- Australia

- /

- Medical Equipment

- /

- ASX:NXS

Next Science Limited (ASX:NXS) Might Not Be As Mispriced As It Looks After Plunging 29%

The Next Science Limited (ASX:NXS) share price has fared very poorly over the last month, falling by a substantial 29%. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

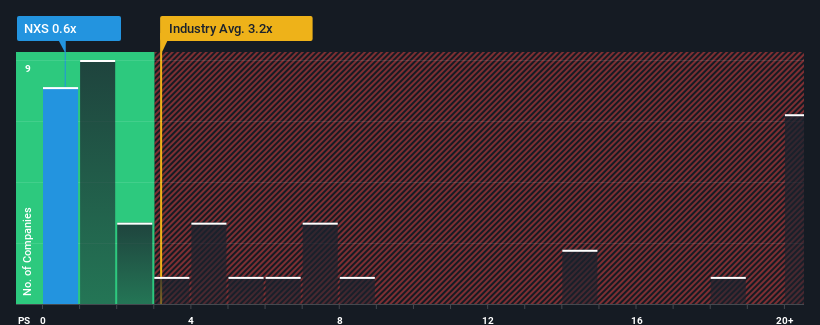

Following the heavy fall in price, Next Science's price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the wider Medical Equipment industry in Australia, where around half of the companies have P/S ratios above 3.2x and even P/S above 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Next Science

How Has Next Science Performed Recently?

The recent revenue growth at Next Science would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Next Science will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Next Science would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.9% last year. This was backed up an excellent period prior to see revenue up by 155% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 17% shows it's noticeably more attractive.

With this information, we find it odd that Next Science is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Shares in Next Science have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Next Science currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You need to take note of risks, for example - Next Science has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Next Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXS

Next Science

Engages in the research, development, and commercialization of technologies that resolve the issues in human health caused by biofilms, incumbent bacteria, fungus, viruses, and infections in North America, Australia, and New Zealand.

Slight risk and slightly overvalued.

Market Insights

Community Narratives