Top 3 ASX Stocks Estimated To Be Undervalued In September 2024

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat, with notable gains in the Real Estate sector at 3.3%. While the market is up 11% over the past year and earnings are forecast to grow by 12% annually, identifying undervalued stocks can offer significant opportunities for investors looking to capitalize on current conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hansen Technologies (ASX:HSN) | A$4.39 | A$8.21 | 46.5% |

| Westgold Resources (ASX:WGX) | A$2.80 | A$5.60 | 50% |

| Duratec (ASX:DUR) | A$1.40 | A$2.61 | 46.4% |

| MLG Oz (ASX:MLG) | A$0.65 | A$1.19 | 45.3% |

| HMC Capital (ASX:HMC) | A$8.04 | A$15.46 | 48% |

| Ansell (ASX:ANN) | A$30.13 | A$57.24 | 47.4% |

| Genesis Minerals (ASX:GMD) | A$2.15 | A$4.03 | 46.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Superloop (ASX:SLC) | A$1.75 | A$3.31 | 47.2% |

| Ai-Media Technologies (ASX:AIM) | A$0.77 | A$1.42 | 45.8% |

Let's review some notable picks from our screened stocks.

Infomedia (ASX:IFM)

Overview: Infomedia Ltd, with a market cap of A$646.46 million, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Operations: Infomedia's revenue segments include Publishing - Periodicals, which generated A$140.83 million.

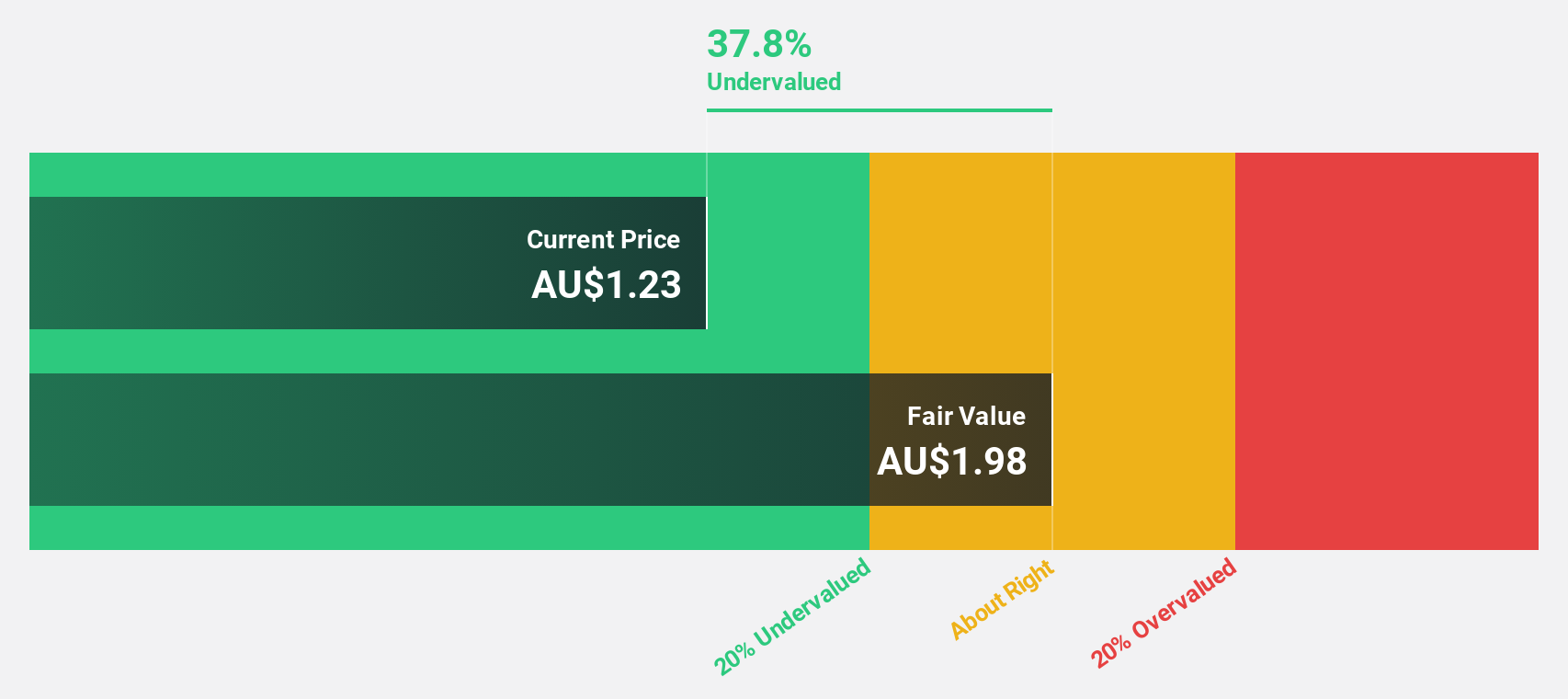

Estimated Discount To Fair Value: 29.4%

Infomedia is trading at A$1.73, significantly below its estimated fair value of A$2.44, representing a 29.4% discount. The company's earnings grew by 32.4% over the past year, with forecasts indicating continued high growth of 22% annually over the next three years, outpacing the Australian market's expected growth rate of 12.2%. Recent financial results show net income increased to A$12.68 million from A$9.58 million last year, reflecting strong underlying cash flows despite large one-off items impacting results.

- Our comprehensive growth report raises the possibility that Infomedia is poised for substantial financial growth.

- Click here to discover the nuances of Infomedia with our detailed financial health report.

Megaport (ASX:MP1)

Overview: Megaport Limited (ASX:MP1) offers on-demand interconnection and internet exchange services to enterprises and service providers across multiple regions including Australia, New Zealand, Hong Kong, Singapore, Japan, North America, and Europe with a market cap of A$1.25 billion.

Operations: Revenue segments for Megaport Limited (ASX:MP1) include A$31.88 million from Europe, A$52.58 million from Asia-Pacific, and A$110.81 million from North America.

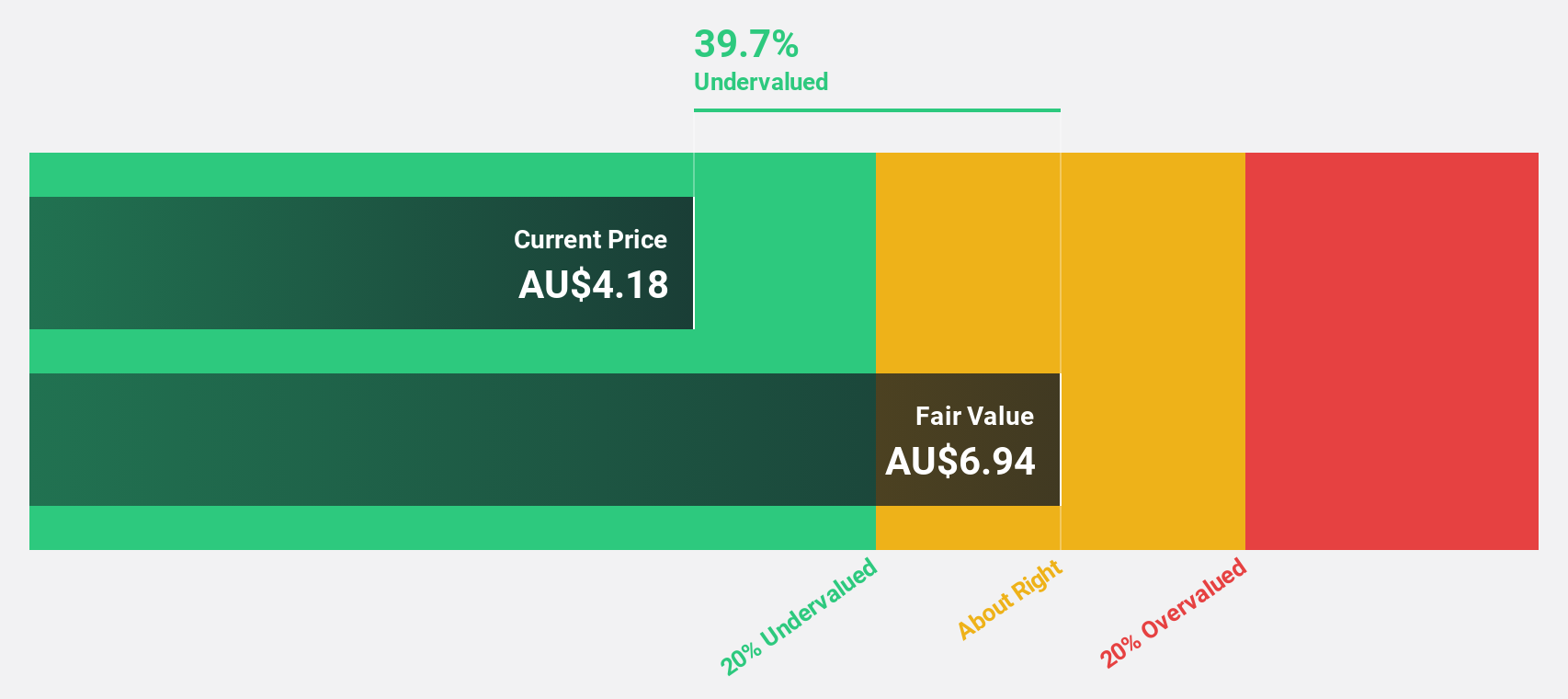

Estimated Discount To Fair Value: 42.8%

Megaport's recent financial results show a significant turnaround, with net income of A$9.61 million for the year ending June 30, 2024, compared to a net loss of A$9.77 million the previous year. The company's revenue is forecasted to grow faster than the Australian market at 13.6% annually and earnings are expected to increase significantly by 32.5% per year over the next three years. Trading at A$7.78, it remains highly undervalued based on discounted cash flow analysis with an estimated fair value of A$13.60.

- Our growth report here indicates Megaport may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Megaport.

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited, with a market cap of A$1.07 billion, operates as a global infection prevention company.

Operations: Nanosonics generates its revenue primarily from the Healthcare Equipment segment, amounting to A$170.01 million.

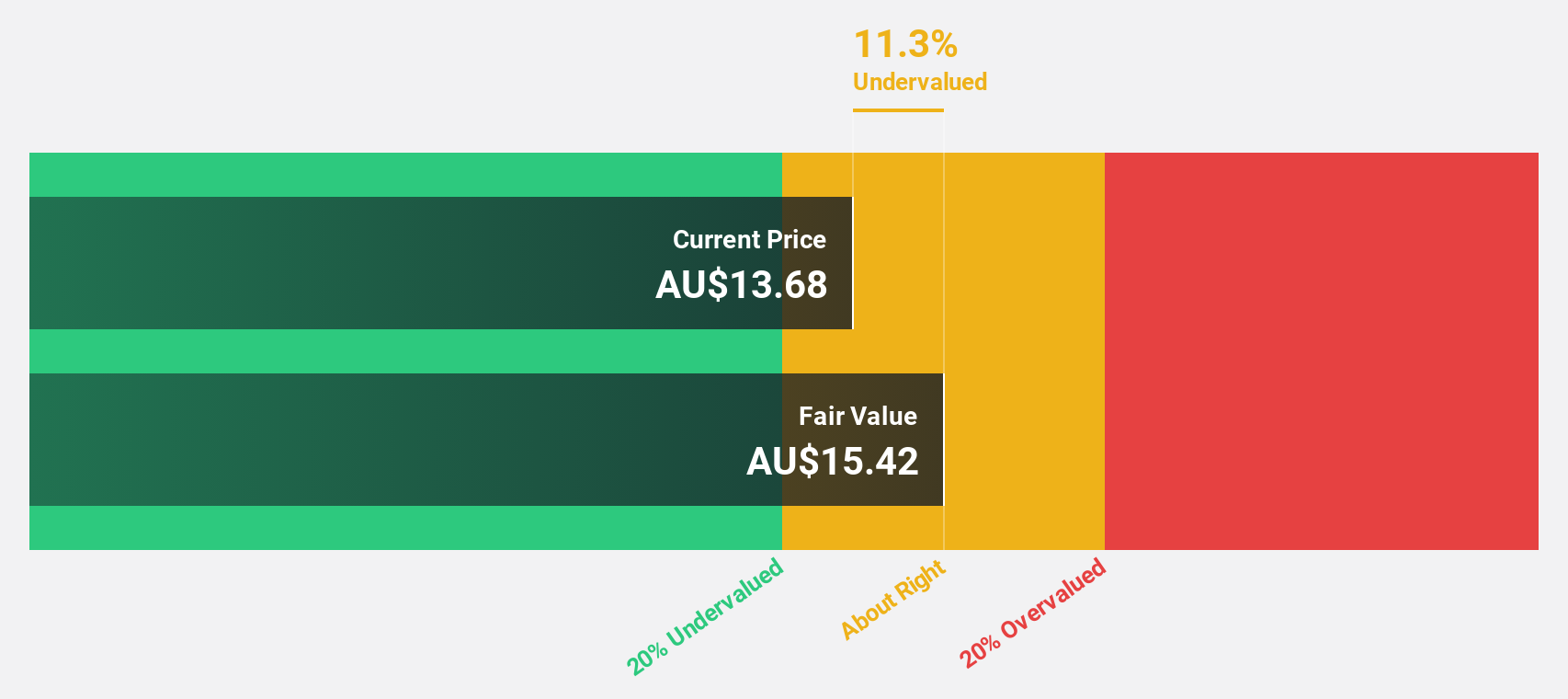

Estimated Discount To Fair Value: 30.3%

Nanosonics is trading at A$3.54, significantly below its estimated fair value of A$5.08, suggesting it may be undervalued based on discounted cash flows. Despite a decline in profit margins from 12% to 7.6% and a drop in net income to A$12.97 million for the fiscal year ending June 30, 2024, earnings are forecasted to grow substantially by 23.15% annually over the next three years, outpacing the broader Australian market's growth rate of 12.2%.

- Upon reviewing our latest growth report, Nanosonics' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Nanosonics with our comprehensive financial health report here.

Summing It All Up

- Unlock our comprehensive list of 42 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Very undervalued with flawless balance sheet.