- Australia

- /

- Metals and Mining

- /

- ASX:ETM

AMCIL Leads The Pack Of 3 ASX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Australian market shows signs of resilience with a positive start to the week, investors are keeping a close eye on global economic developments and their potential impacts on local indices. In this context, penny stocks—often representing smaller or newer companies—continue to capture interest for their affordability and growth potential. Despite being considered an outdated term by some, these stocks remain relevant as they can offer unique opportunities when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$249.92M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.38M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$324.01M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.615 | A$791.48M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.95 | A$488.39M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

AMCIL (ASX:AMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amcil Limited is a publicly owned investment manager with a market cap of A$375.74 million.

Operations: The company's revenue is derived entirely from its investments, totaling A$10.13 million.

Market Cap: A$375.74M

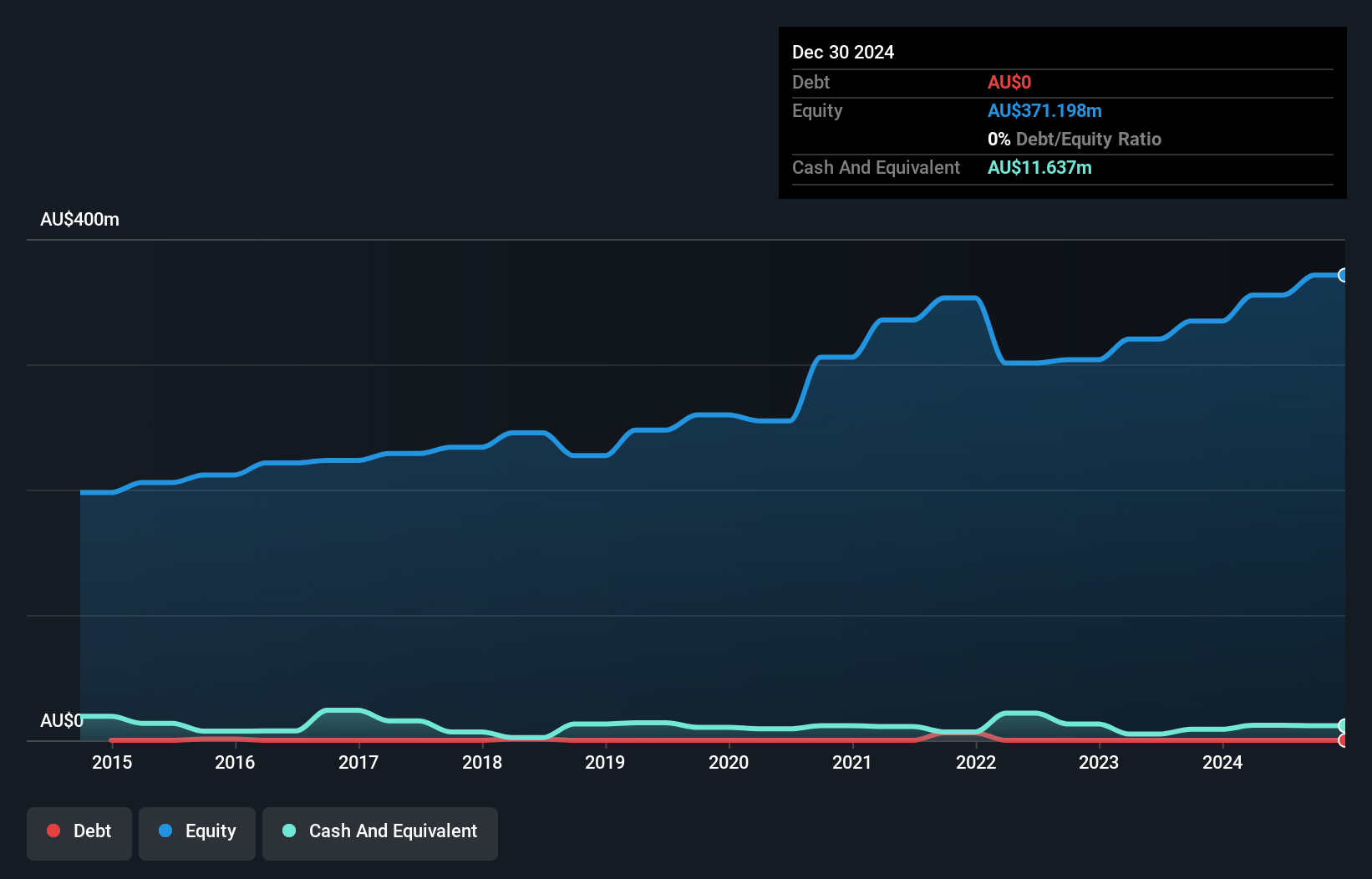

AMCIL, with a market cap of A$375.74 million, is debt-free and boasts high-quality earnings, though recent negative earnings growth presents challenges. Its seasoned management team and stable weekly volatility are positives for investors seeking stability in penny stocks. However, the company's dividend yield of 3.38% is not well covered by earnings or free cash flows, posing sustainability concerns. Short-term assets cover short-term liabilities but fall short against long-term obligations. The firm's net profit margin has improved slightly to 73.8%, yet its return on equity remains low at 2.1%, indicating limited profitability enhancement potential.

- Navigate through the intricacies of AMCIL with our comprehensive balance sheet health report here.

- Evaluate AMCIL's historical performance by accessing our past performance report.

Energy Transition Minerals (ASX:ETM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Energy Transition Minerals Ltd is engaged in mineral exploration and evaluation activities in Australia with a market cap of A$101.43 million.

Operations: The company's revenue segment is derived from Mineral Exploration and Evaluation, amounting to A$0.049 million.

Market Cap: A$101.43M

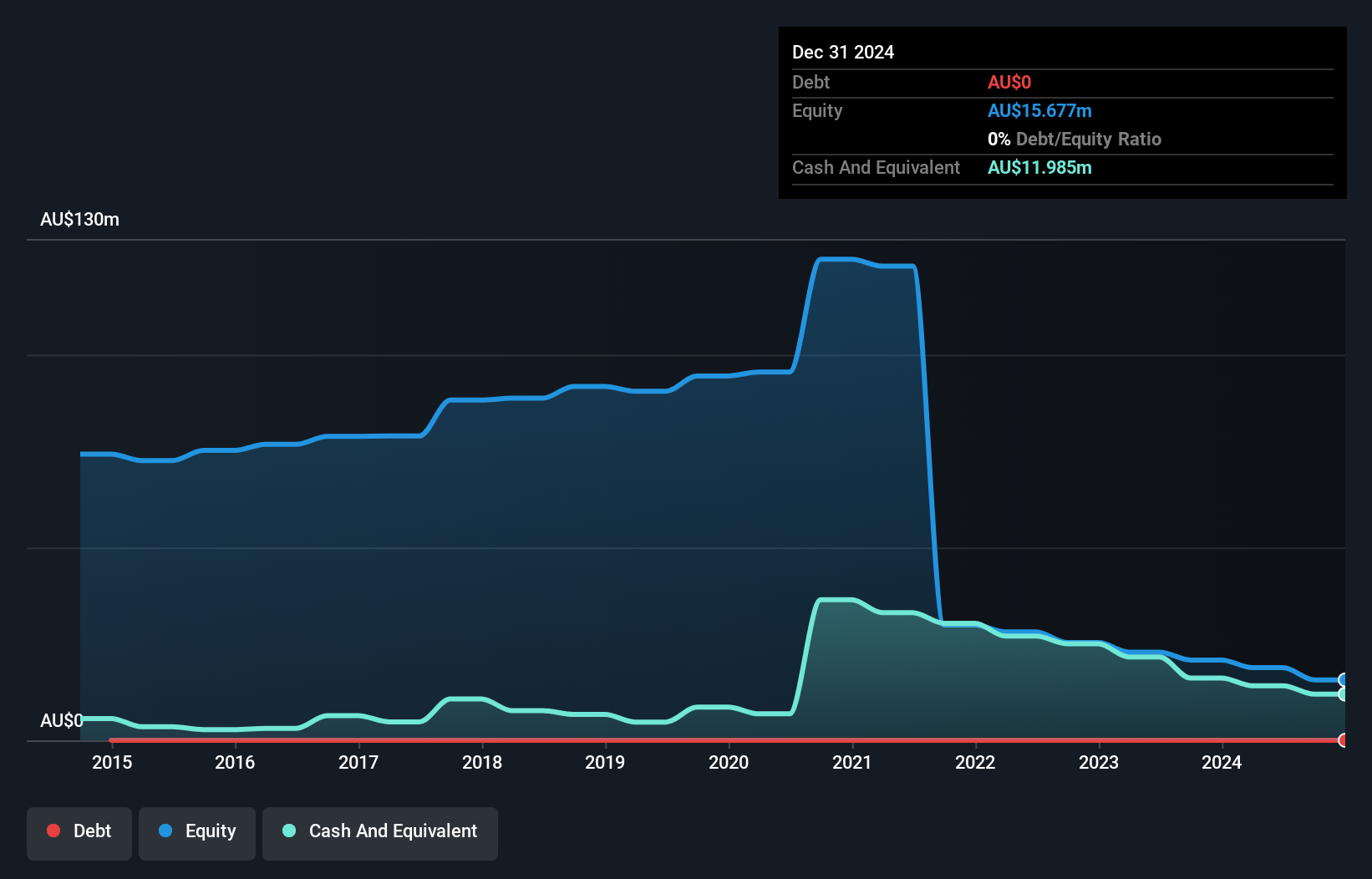

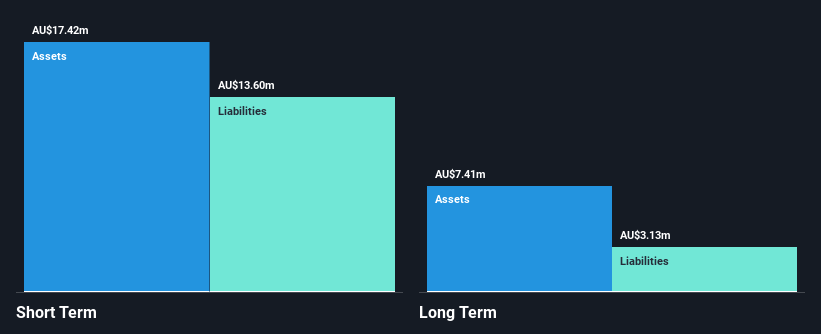

Energy Transition Minerals Ltd, with a market cap of A$101.43 million, is pre-revenue, generating only A$0.049 million from mineral exploration and evaluation. Despite being debt-free and having short-term assets of A$16.3M that cover both short- and long-term liabilities, the company faces challenges with increased volatility in its share price over the past year and a negative return on equity of -31.9%. The management team and board are relatively new, which might affect strategic stability. However, ETM has a cash runway sufficient for over two years if free cash flow trends continue to decline at historical rates.

- Dive into the specifics of Energy Transition Minerals here with our thorough balance sheet health report.

- Assess Energy Transition Minerals' previous results with our detailed historical performance reports.

Prophecy International Holdings (ASX:PRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prophecy International Holdings Limited designs, develops, and markets computer software applications and services across various regions including Australia, New Zealand, the Middle East, North America, Europe, Africa, and Asia with a market cap of A$40.86 million.

Operations: The company's revenue is primarily generated from its eMite segment at A$14.24 million, followed by SNARE at A$8.25 million, and Legacy at A$0.70 million.

Market Cap: A$40.86M

Prophecy International Holdings, with a market cap of A$40.86 million, is unprofitable but has reduced losses by 2.2% annually over the past five years. It generates revenue primarily from its eMite segment (A$14.24 million) and SNARE (A$8.25 million). The company is debt-free and possesses sufficient cash runway for over three years, even if free cash flow decreases by 14.8% annually. Its seasoned management team and board have average tenures of 7.9 and 14.4 years respectively, contributing to strategic stability despite recent delisting from OTC Equity due to inactivity concerns.

- Jump into the full analysis health report here for a deeper understanding of Prophecy International Holdings.

- Review our historical performance report to gain insights into Prophecy International Holdings' track record.

Make It Happen

- Dive into all 1,051 of the ASX Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transition Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ETM

Energy Transition Minerals

Energy Transition Minerals Ltd involves in the mineral exploration and evaluation activities in Australia.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives