- Australia

- /

- Metals and Mining

- /

- ASX:MLX

Discover 3 ASX Penny Stocks With Market Caps Under A$2B

Reviewed by Simply Wall St

As the Australian market experiences a modest uptick, bolstered by renewed investor confidence following recent developments in U.S.-China trade tensions, attention turns to opportunities within smaller cap stocks. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies with potential for growth. By focusing on those with strong financial health and clear growth prospects, investors can uncover promising opportunities in this niche area of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.945 | A$58.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Wiseway Group (ASX:WWG) | A$0.21 | A$35.88M | ✅ 2 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.10 | A$228.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.043 | A$50.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.069 | A$36.34M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.82 | A$391.73M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 425 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Iron Road (ASX:IRD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iron Road Limited is an Australian company focused on exploring and evaluating iron ore properties, with a market cap of A$39.04 million.

Operations: The company's revenue is derived entirely from its Metals & Mining - Iron & Steel segment, amounting to A$7.69 million.

Market Cap: A$39.04M

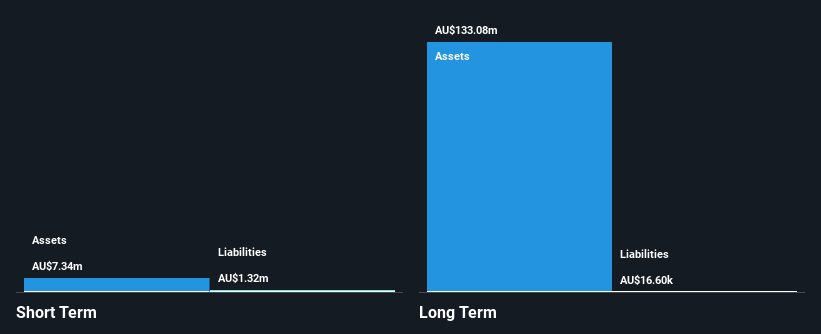

Iron Road Limited, with a market cap of A$39.04 million, has recently turned profitable, reporting net income of A$5.05 million for the year ending June 30, 2025. Despite this positive development and its debt-free status, the company faces challenges including high share price volatility and an auditor's going concern doubt due to financial stability concerns. The management team is experienced with an average tenure of 8.8 years and has not diluted shareholders over the past year. Iron Road also completed a minor share buyback but trades significantly below its estimated fair value.

- Navigate through the intricacies of Iron Road with our comprehensive balance sheet health report here.

- Gain insights into Iron Road's historical outcomes by reviewing our past performance report.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market capitalization of A$788.89 million.

Operations: The company generates revenue from its 50% ownership in the Renison Tin Operation, amounting to A$271.38 million.

Market Cap: A$788.89M

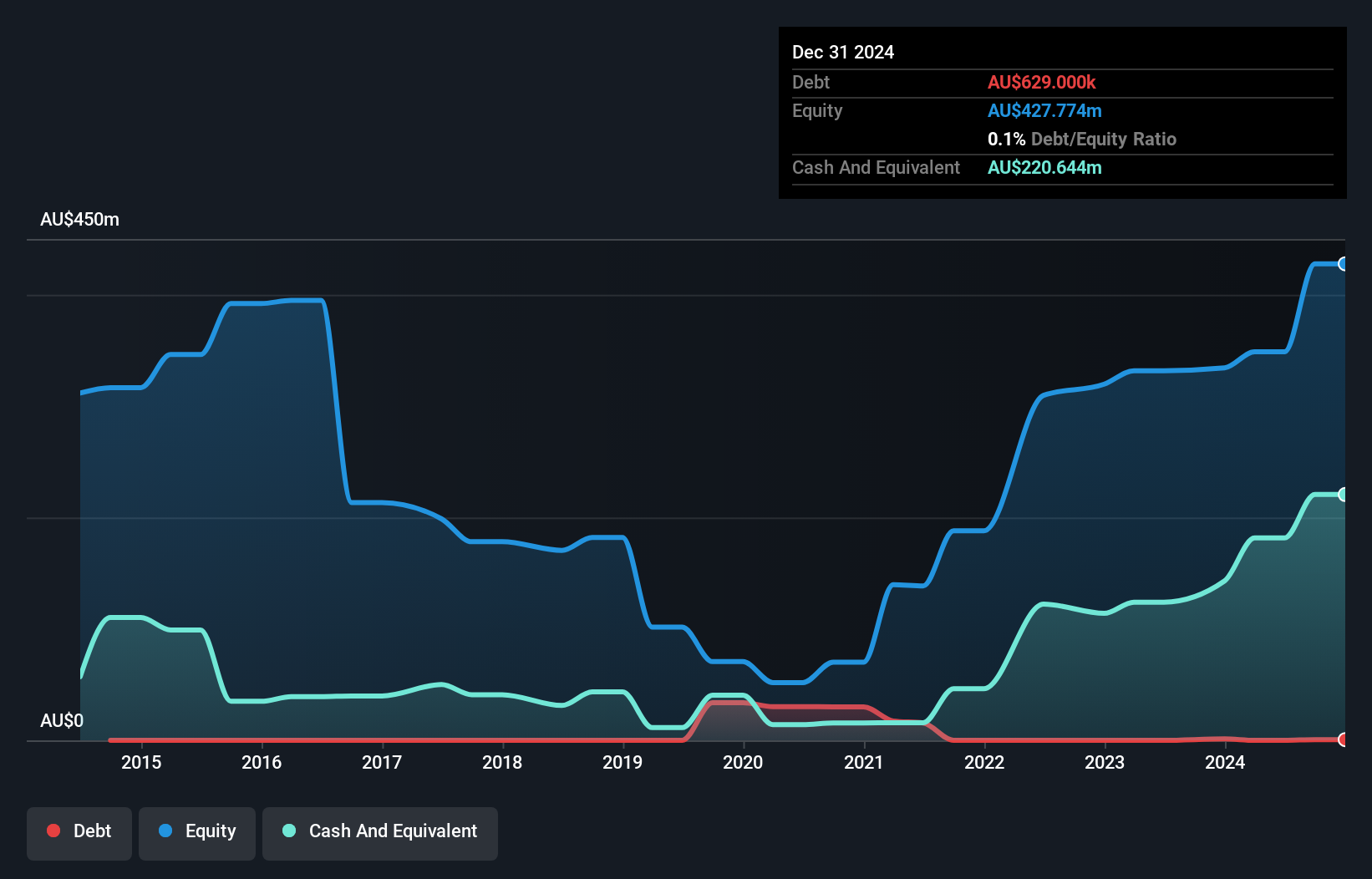

Metals X Limited, with a market cap of A$788.89 million, has demonstrated significant financial growth, reporting A$147.54 million in sales for the first half of 2025, up from A$94.98 million the previous year. The company boasts high-quality earnings with a notable one-off gain impacting recent results and maintains a strong balance sheet with no debt and substantial short-term assets exceeding liabilities. Despite its impressive 708.2% earnings growth last year and favorable price-to-earnings ratio compared to the market, future earnings are expected to decline by an average of 33.1% annually over the next three years according to forecasts.

- Get an in-depth perspective on Metals X's performance by reading our balance sheet health report here.

- Explore Metals X's analyst forecasts in our growth report.

Nanosonics (ASX:NAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanosonics Limited is an infection prevention company with operations across Australia, North America, Europe, the United Kingdom, the Middle East, and Asia Pacific; it has a market cap of A$1.38 billion.

Operations: The company generates A$198.63 million in revenue from its healthcare equipment segment.

Market Cap: A$1.38B

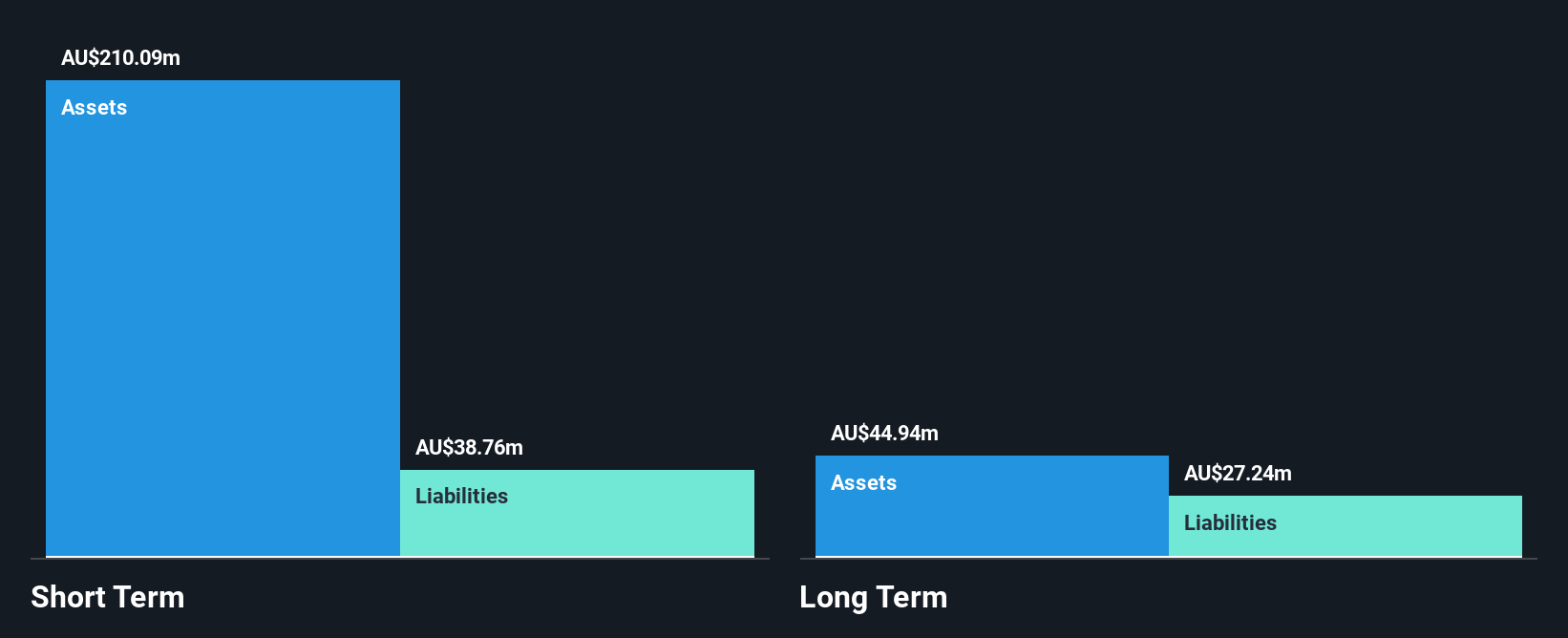

Nanosonics Limited, with a market cap of A$1.38 billion, has shown robust financial performance with revenue reaching A$198.63 million for the fiscal year ending June 2025 and net income rising to A$20.68 million from the previous year. The company maintains a strong balance sheet, being debt-free and having short-term assets of A$225.3 million surpassing both its long-term liabilities (A$22.8M) and short-term liabilities (A$39.8M). Earnings growth of 59.4% last year outpaced the industry average, while future earnings are projected to grow at nearly 20% annually according to analyst estimates.

- Click here and access our complete financial health analysis report to understand the dynamics of Nanosonics.

- Examine Nanosonics' earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Gain an insight into the universe of 425 ASX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MLX

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.