- Australia

- /

- Medical Equipment

- /

- ASX:IPD

Further weakness as ImpediMed (ASX:IPD) drops 11% this week, taking five-year losses to 60%

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. Zooming in on an example, the ImpediMed Limited (ASX:IPD) share price dropped 60% in the last half decade. That's not a lot of fun for true believers. And we doubt long term believers are the only worried holders, since the stock price has declined 57% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

Since ImpediMed has shed AU$20m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for ImpediMed

Given that ImpediMed didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, ImpediMed saw its revenue increase by 21% per year. That's better than most loss-making companies. In contrast, the share price is has averaged a loss of 10% per year - that's quite disappointing. It's safe to say investor expectations are more grounded now. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

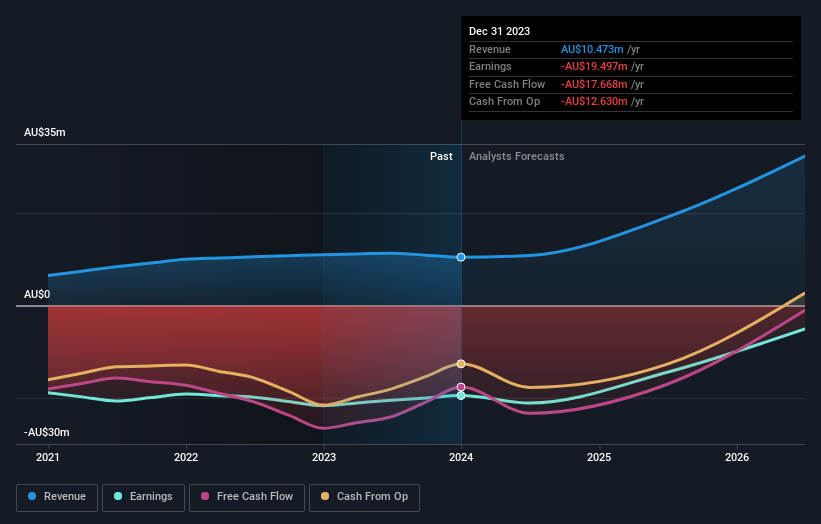

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for ImpediMed in this interactive graph of future profit estimates.

A Different Perspective

ImpediMed shareholders are down 57% for the year, but the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand ImpediMed better, we need to consider many other factors. Take risks, for example - ImpediMed has 2 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IPD

ImpediMed

A medical technology company, develops, manufactures and sells bioimpedance spectroscopy (BIS) technology medical devices and software services in Australia, Europe, the United States, and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026