- Australia

- /

- Medical Equipment

- /

- ASX:IBX

Here's Why We're Watching Imagion Biosystems' (ASX:IBX) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Imagion Biosystems (ASX:IBX) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Imagion Biosystems

Does Imagion Biosystems Have A Long Cash Runway?

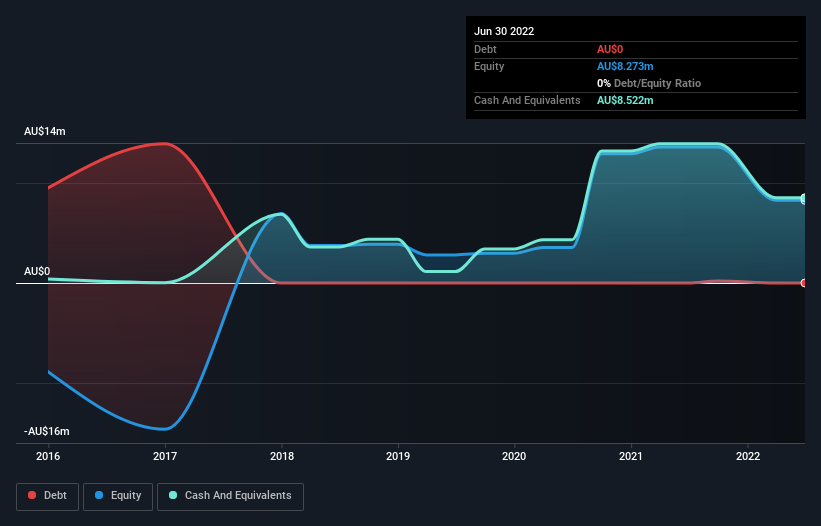

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2022, Imagion Biosystems had AU$8.5m in cash, and was debt-free. Looking at the last year, the company burnt through AU$9.6m. So it had a cash runway of approximately 11 months from June 2022. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Is Imagion Biosystems' Cash Burn Changing Over Time?

Whilst it's great to see that Imagion Biosystems has already begun generating revenue from operations, last year it only produced AU$341k, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. In fact, it ramped its spending strongly over the last year, increasing cash burn by 137%. That sort of spending growth rate can't continue for very long before it causes balance sheet weakness, generally speaking. Admittedly, we're a bit cautious of Imagion Biosystems due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Imagion Biosystems To Raise More Cash For Growth?

Since its cash burn is moving in the wrong direction, Imagion Biosystems shareholders may wish to think ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Imagion Biosystems has a market capitalisation of AU$31m and burnt through AU$9.6m last year, which is 30% of the company's market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Imagion Biosystems' Cash Burn A Worry?

We must admit that we don't think Imagion Biosystems is in a very strong position, when it comes to its cash burn. Although we can understand if some shareholders find its cash runway acceptable, we can't ignore the fact that we consider its increasing cash burn to be downright troublesome. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Imagion Biosystems (2 can't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IBX

Imagion Biosystems

Provides medical imaging technologies using magnetic resonance.

Moderate risk with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026