- Australia

- /

- Medical Equipment

- /

- ASX:IBX

Here's Why We're Watching Imagion Biosystems' (ASX:IBX) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Imagion Biosystems (ASX:IBX) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Imagion Biosystems

How Long Is Imagion Biosystems' Cash Runway?

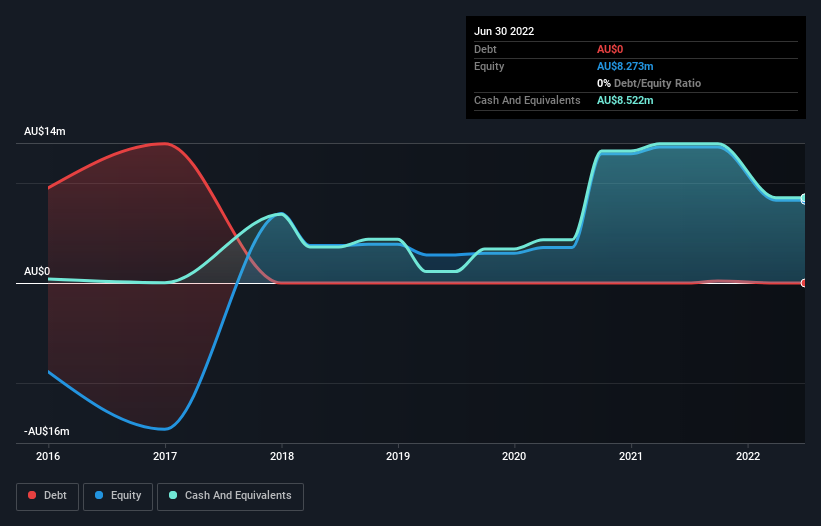

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at June 2022, Imagion Biosystems had cash of AU$8.5m and no debt. Importantly, its cash burn was AU$9.6m over the trailing twelve months. Therefore, from June 2022 it had roughly 11 months of cash runway. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Is Imagion Biosystems' Cash Burn Changing Over Time?

In our view, Imagion Biosystems doesn't yet produce significant amounts of operating revenue, since it reported just AU$341k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. The skyrocketing cash burn up 137% year on year certainly tests our nerves. It's fair to say that sort of rate of increase cannot be maintained for very long, without putting pressure on the balance sheet. Imagion Biosystems makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Imagion Biosystems Raise More Cash Easily?

Given its cash burn trajectory, Imagion Biosystems shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Imagion Biosystems has a market capitalisation of AU$43m and burnt through AU$9.6m last year, which is 22% of the company's market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Imagion Biosystems' Cash Burn A Worry?

Imagion Biosystems is not in a great position when it comes to its cash burn situation. While its cash burn relative to its market cap wasn't too bad, its increasing cash burn does leave us rather nervous. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Imagion Biosystems (2 are significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Imagion Biosystems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IBX

Imagion Biosystems

Provides medical imaging technologies using magnetic resonance.

Medium-low and slightly overvalued.

Market Insights

Community Narratives