- Australia

- /

- Medical Equipment

- /

- ASX:EMV

EMVision Medical Devices Ltd's (ASX:EMV) CEO Compensation Is Looking A Bit Stretched At The Moment

CEO Ron Weinberger has done a decent job of delivering relatively good performance at EMVision Medical Devices Ltd (ASX:EMV) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 16 November 2022. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for EMVision Medical Devices

How Does Total Compensation For Ron Weinberger Compare With Other Companies In The Industry?

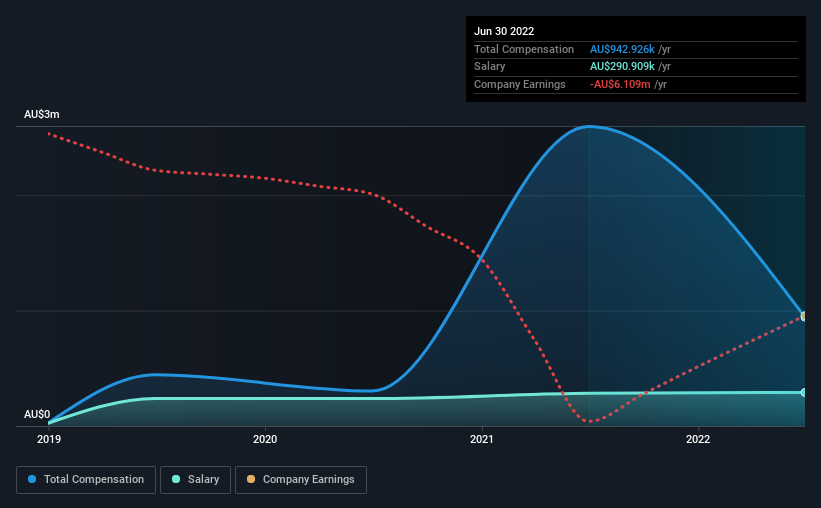

At the time of writing, our data shows that EMVision Medical Devices Ltd has a market capitalization of AU$115m, and reported total annual CEO compensation of AU$943k for the year to June 2022. Notably, that's a decrease of 64% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$291k.

On comparing similar-sized companies in the industry with market capitalizations below AU$306m, we found that the median total CEO compensation was AU$531k. This suggests that Ron Weinberger is paid more than the median for the industry. Moreover, Ron Weinberger also holds AU$2.8m worth of EMVision Medical Devices stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$291k | AU$283k | 31% |

| Other | AU$652k | AU$2.3m | 69% |

| Total Compensation | AU$943k | AU$2.6m | 100% |

Speaking on an industry level, nearly 61% of total compensation represents salary, while the remainder of 39% is other remuneration. EMVision Medical Devices sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at EMVision Medical Devices Ltd's Growth Numbers

Over the last three years, EMVision Medical Devices Ltd has shrunk its earnings per share by 22% per year. It achieved revenue growth of 157% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has EMVision Medical Devices Ltd Been A Good Investment?

We think that the total shareholder return of 93%, over three years, would leave most EMVision Medical Devices Ltd shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. EPS growth is still weak, and until that picks up, shareholders may find it hard to approve a pay rise for the CEO, since they are already paid above the average in their industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for EMVision Medical Devices (of which 1 is a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if EMVision Medical Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EMV

EMVision Medical Devices

Engages in the research, development, and commercialization of neurodiagnostic technology for stroke diagnosis and monitoring, and other medical imaging needs in Australia.

Excellent balance sheet with low risk.

Market Insights

Community Narratives