It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Cochlear (ASX:COH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Cochlear

Cochlear's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Cochlear's EPS has grown 34% each year, compound, over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

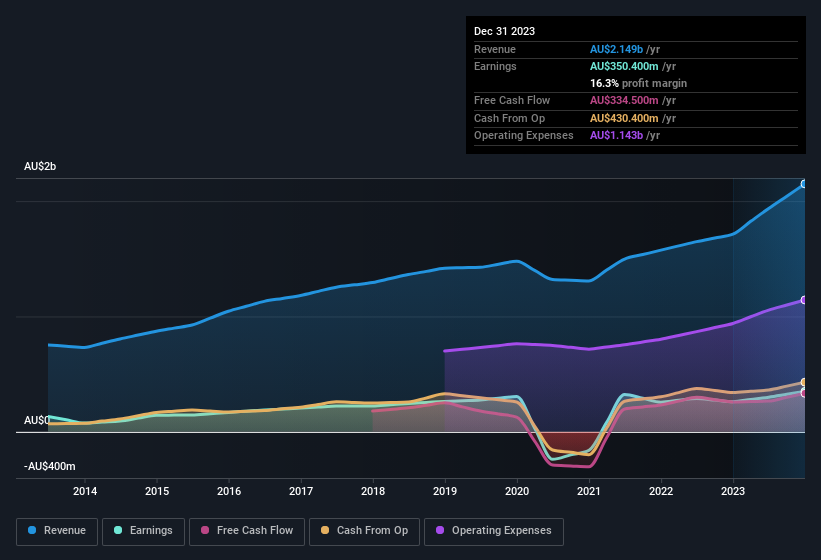

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Cochlear achieved similar EBIT margins to last year, revenue grew by a solid 25% to AU$2.1b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Cochlear?

Are Cochlear Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Cochlear insiders refrain from selling stock during the year, but they also spent AU$256k buying it. That's nice to see, because it suggests insiders are optimistic. It is also worth noting that it was Independent Non-Executive Director Christine McLoughlin who made the biggest single purchase, worth AU$68k, paying AU$271 per share.

The good news, alongside the insider buying, for Cochlear bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping AU$86m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Is Cochlear Worth Keeping An Eye On?

For growth investors, Cochlear's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Of course, profit growth is one thing but it's even better if Cochlear is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Keen growth investors love to see insider activity. Thankfully, Cochlear isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Cochlear, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:COH

Cochlear

Provides implantable hearing solutions for children and adults worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives