- Australia

- /

- Healthcare Services

- /

- ASX:AHX

With EPS Growth And More, Apiam Animal Health (ASX:AHX) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Apiam Animal Health (ASX:AHX). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Apiam Animal Health

How Fast Is Apiam Animal Health Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Apiam Animal Health managed to grow EPS by 6.8% per year, over three years. While that sort of growth rate isn't amazing, it does show the business is growing.

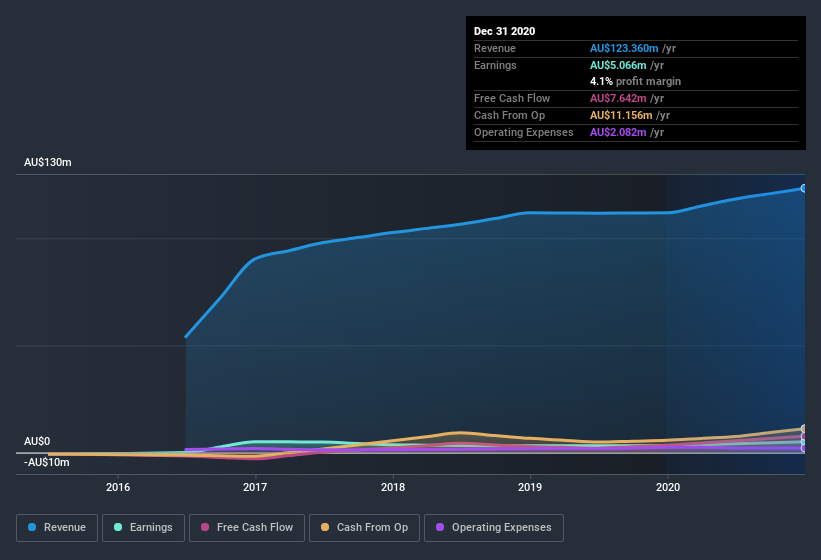

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Apiam Animal Health's EBIT margins were flat over the last year, revenue grew by a solid 10% to AU$123m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Apiam Animal Health?

Are Apiam Animal Health Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Apiam Animal Health, is that company insiders paid AU$36k for shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. It is also worth noting that it was MD & Executive Director Christopher Richards who made the biggest single purchase, worth AU$13k, paying AU$0.47 per share.

The good news, alongside the insider buying, for Apiam Animal Health bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$31m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 31% of the company; visible skin in the game.

Does Apiam Animal Health Deserve A Spot On Your Watchlist?

One positive for Apiam Animal Health is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. You should always think about risks though. Case in point, we've spotted 5 warning signs for Apiam Animal Health you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Apiam Animal Health, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Apiam Animal Health, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AHX

Apiam Animal Health

A vertically integrated animal health company, provides veterinary products and services to production and companion animals, and equine in Australia.

Moderate and good value.

Market Insights

Community Narratives