- Australia

- /

- Healthcare Services

- /

- ASX:ACL

Top ASX Stocks Estimated To Be Undervalued In July 2024

Reviewed by Simply Wall St

The Australian stock market has shown robust growth, climbing 3.1% over the past week and achieving a 10% increase over the last year, with earnings expected to grow by 13% annually. In this context, identifying stocks that are potentially undervalued could offer investors an opportunity to capitalize on this positive momentum.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GTN (ASX:GTN) | A$0.435 | A$0.85 | 48.7% |

| Ansell (ASX:ANN) | A$25.52 | A$49.46 | 48.4% |

| VEEM (ASX:VEE) | A$1.78 | A$3.54 | 49.7% |

| hipages Group Holdings (ASX:HPG) | A$1.04 | A$2.06 | 49.4% |

| Australian Clinical Labs (ASX:ACL) | A$2.37 | A$4.66 | 49.1% |

| ReadyTech Holdings (ASX:RDY) | A$3.20 | A$6.20 | 48.4% |

| IPH (ASX:IPH) | A$6.15 | A$11.83 | 48% |

| Strike Energy (ASX:STX) | A$0.21 | A$0.40 | 48% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| MedAdvisor (ASX:MDR) | A$0.56 | A$1.07 | 47.8% |

Let's explore several standout options from the results in the screener.

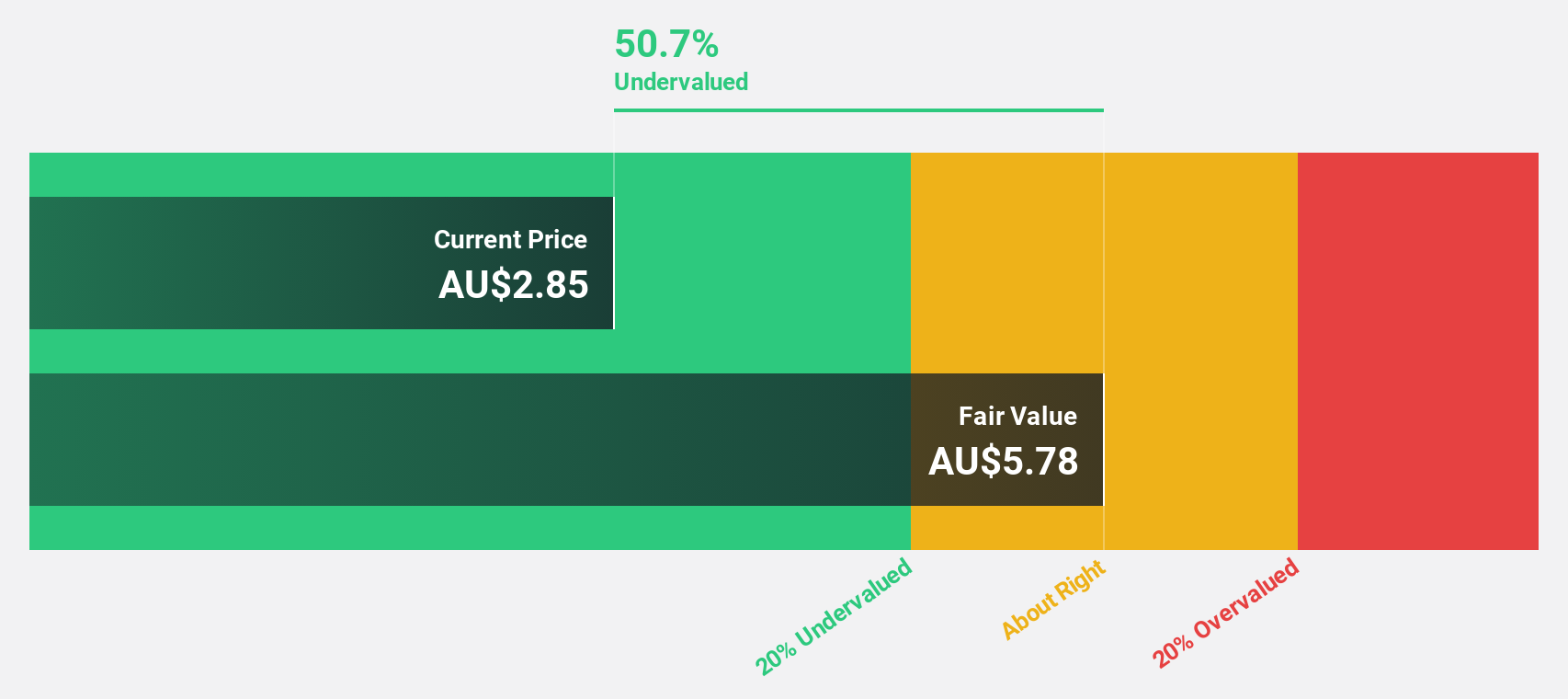

Australian Clinical Labs (ASX:ACL)

Overview: Australian Clinical Labs Limited operates in Australia, offering pathology services with a market capitalization of approximately A$475.19 million.

Operations: The company generates revenue primarily through its medical labs and research segment, totaling A$674.03 million.

Estimated Discount To Fair Value: 49.1%

Australian Clinical Labs (ACL) appears undervalued based on discounted cash flow analysis, trading at A$2.37 against a fair value of A$4.66, indicating a significant potential upside. Despite this, ACL's revenue growth is modest at 4.6% per year and lags behind the broader Australian market forecast of 5.3%. Profit margins have declined from last year's 9% to 2.3%, reflecting challenges despite earnings projected to grow by approximately 21% annually, outpacing the market expectation of 13.3%. Analyst consensus suggests a potential price increase of around 30.6%.

- In light of our recent growth report, it seems possible that Australian Clinical Labs' financial performance will exceed current levels.

- Dive into the specifics of Australian Clinical Labs here with our thorough financial health report.

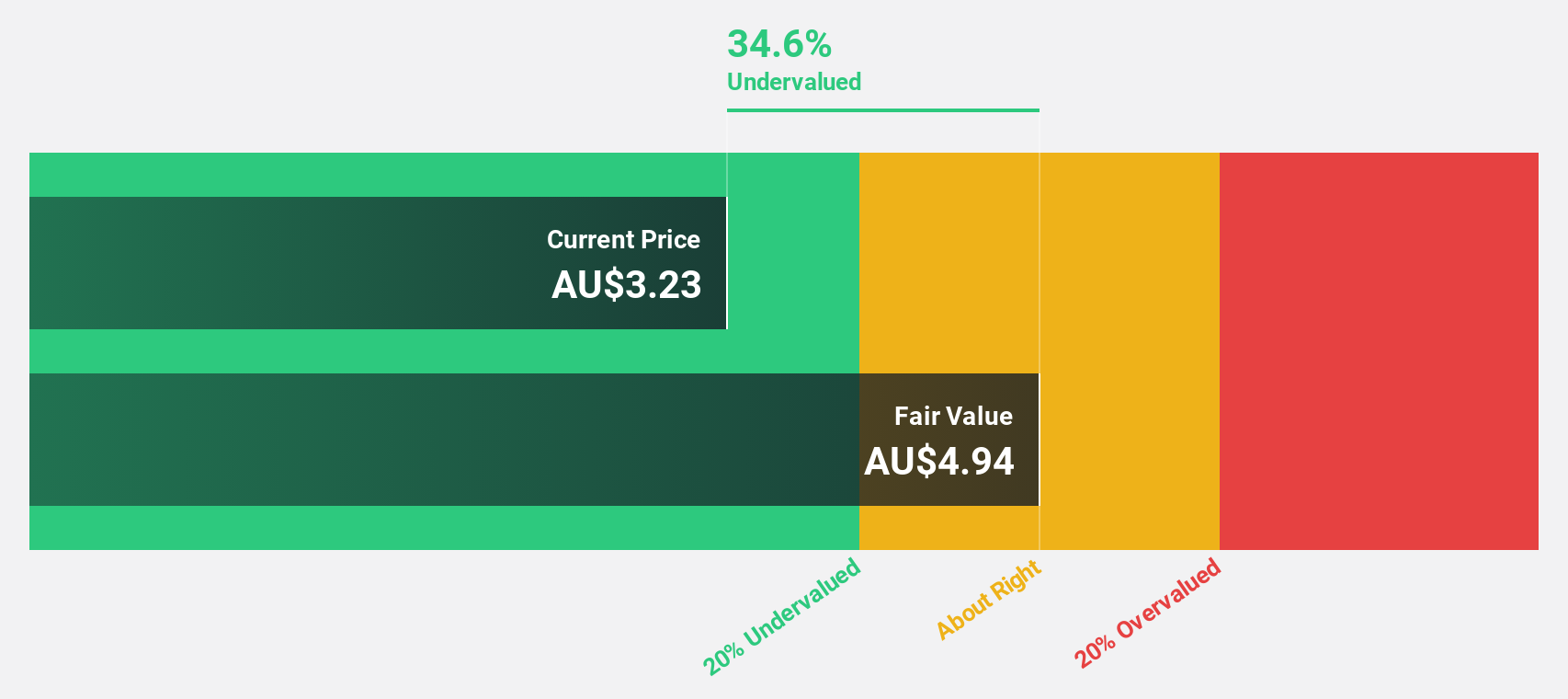

IPD Group (ASX:IPG)

Overview: IPD Group Limited, operating in Australia, specializes in the distribution of electrical equipment and has a market capitalization of approximately A$497.26 million.

Operations: The company generates revenue through its Products Division, which brought in A$215.98 million, and its Services Division, which contributed A$20.79 million.

Estimated Discount To Fair Value: 12.5%

IPD Group, trading at A$4.81, is considered undervalued with a fair value of A$5.50, reflecting a 12.5% discount based on discounted cash flow analysis. Despite some shareholder dilution over the past year and significant insider selling in the last three months, IPD's financial outlook remains robust with earnings growth forecasted at 25.88% annually and revenue expected to increase by 23.6% each year—both metrics substantially outpacing broader market projections. However, its Return on Equity is anticipated to remain low at 19%.

- The growth report we've compiled suggests that IPD Group's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of IPD Group.

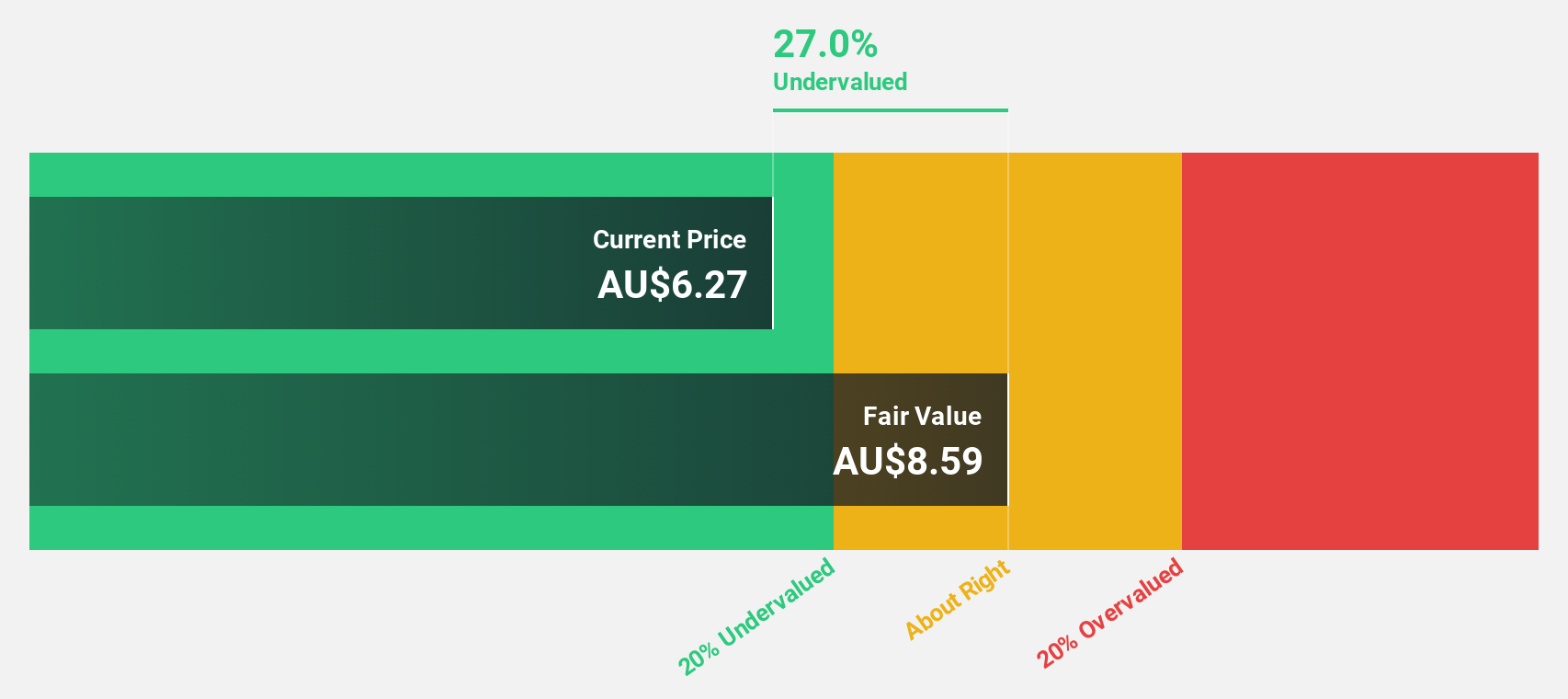

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in the design, production, and sale of cooling products and solutions across multiple countries, with a market capitalization of approximately A$1.21 billion.

Operations: The company generates revenue through two primary segments: PWR C&R, which contributed A$37.35 million, and PWR Performance Products, which accounted for A$104.44 million.

Estimated Discount To Fair Value: 13.3%

PWR Holdings, currently priced at A$12.05, is trading 13.3% below our calculated fair value of A$13.89, suggesting undervaluation based on discounted cash flow analysis. The company's earnings and revenue are both expected to outperform the Australian market with forecasts of 15.4% and 12.9% annual growth respectively, although these figures do not exceed the high-growth threshold of 20%. Additionally, a projected Return on Equity of 30.6% significantly surpasses benchmarks, highlighting potential for efficient capital management.

- Our earnings growth report unveils the potential for significant increases in PWR Holdings' future results.

- Get an in-depth perspective on PWR Holdings' balance sheet by reading our health report here.

Next Steps

- Gain an insight into the universe of 50 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ACL

Australian Clinical Labs

Provides pathology diagnostic services in Australia.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives