- Australia

- /

- Auto Components

- /

- ASX:PWH

Top ASX Stocks Estimated as Undervalued for Investment Opportunities in July 2024

Reviewed by Simply Wall St

As the Australian market navigates through varied sector performances with the ASX200 recently closing down slightly, opportunities for investment can emerge from analyzing undervalued stocks. Given current conditions, such as the recovery in iron ore prices and specific sector movements, identifying stocks that are priced below their intrinsic value could offer potential growth prospects for investors.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MaxiPARTS (ASX:MXI) | A$1.97 | A$3.91 | 49.6% |

| GTN (ASX:GTN) | A$0.445 | A$0.85 | 47.5% |

| ReadyTech Holdings (ASX:RDY) | A$3.21 | A$6.25 | 48.6% |

| hipages Group Holdings (ASX:HPG) | A$1.055 | A$2.09 | 49.5% |

| IPH (ASX:IPH) | A$6.20 | A$11.98 | 48.3% |

| Regal Partners (ASX:RPL) | A$3.22 | A$6.18 | 47.9% |

| Australian Clinical Labs (ASX:ACL) | A$2.51 | A$4.74 | 47% |

| Strike Energy (ASX:STX) | A$0.235 | A$0.44 | 46.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| SiteMinder (ASX:SDR) | A$5.09 | A$10.01 | 49.2% |

Let's uncover some gems from our specialized screener

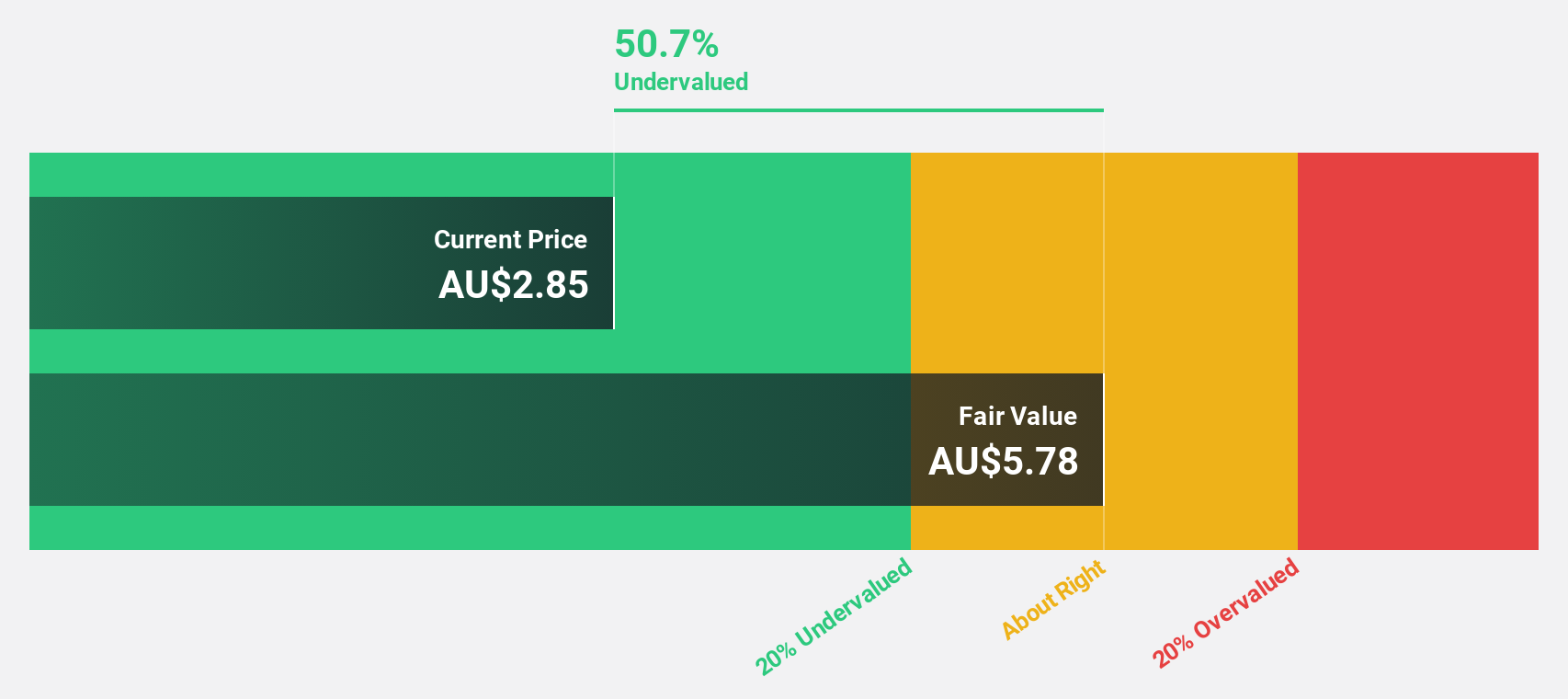

Australian Clinical Labs (ASX:ACL)

Overview: Australian Clinical Labs Limited operates in the pathology services sector within Australia and has a market capitalization of approximately A$503.26 million.

Operations: The company generates its revenue primarily from medical labs and research, totaling approximately A$674.03 million.

Estimated Discount To Fair Value: 47%

Australian Clinical Labs is trading at A$2.51, significantly below the estimated fair value of A$4.74, highlighting its undervaluation based on discounted cash flow analysis. Despite slower revenue growth forecasts at 4.6% annually compared to the market, ACL's earnings are expected to surge by 20.99% per year over the next three years, outpacing the Australian market's forecast of 13%. However, current profit margins have dipped to 2.3%, a decrease from last year's 9%, and financial results have been affected by large one-off items.

- The analysis detailed in our Australian Clinical Labs growth report hints at robust future financial performance.

- Click here to discover the nuances of Australian Clinical Labs with our detailed financial health report.

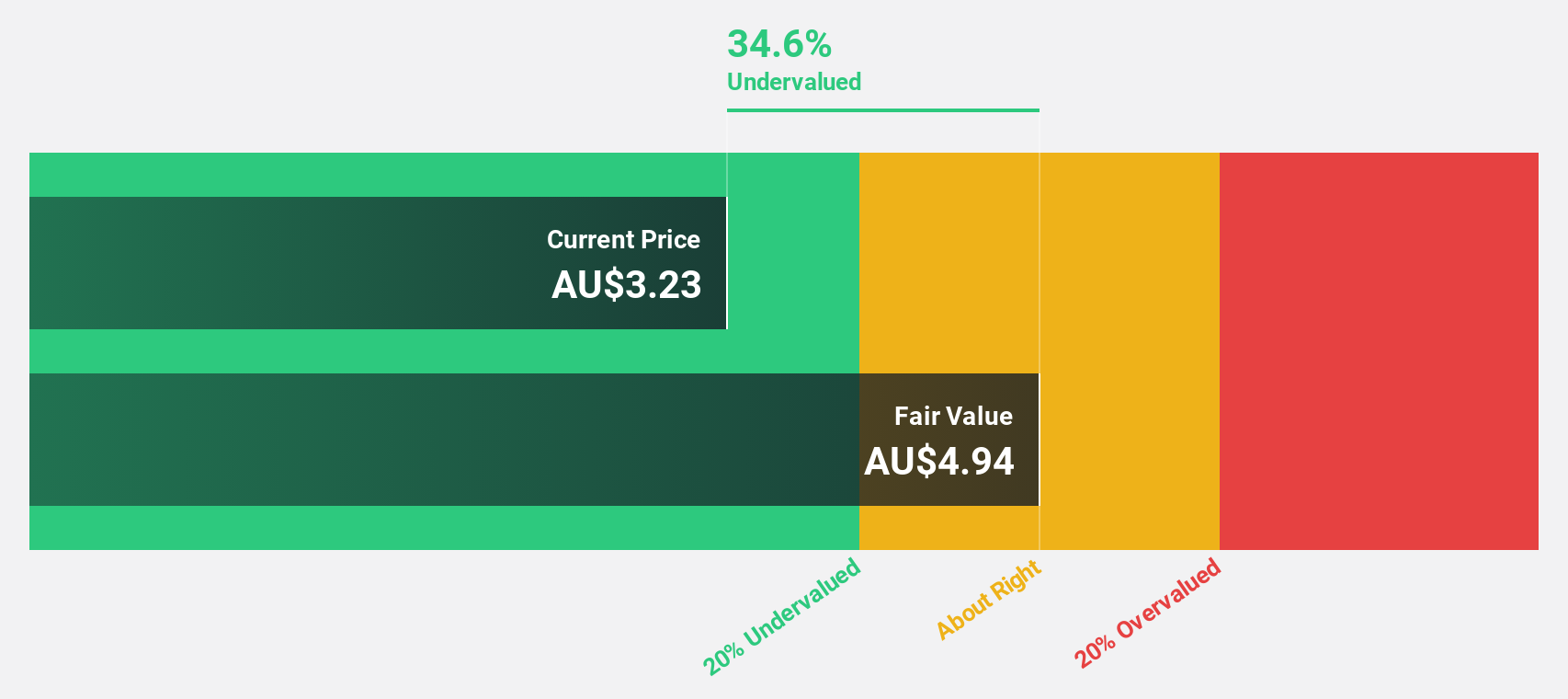

IPD Group (ASX:IPG)

Overview: IPD Group Limited, operating in Australia, specializes in the distribution of electrical equipment and has a market capitalization of approximately A$485.89 million.

Operations: The company generates revenue through its Products Division, which brought in A$215.98 million, and its Services Division, which contributed A$20.79 million.

Estimated Discount To Fair Value: 14.6%

IPD Group is currently priced at A$4.70, under the calculated fair value of A$5.50, suggesting a modest undervaluation based on cash flow analysis. The company's earnings have increased by 22.4% over the past year and are expected to grow by 25.88% annually for the next three years, significantly outstripping the Australian market's growth rate of 13%. However, there has been considerable insider selling recently, and shareholder dilution occurred over the past year, tempering its investment appeal.

- According our earnings growth report, there's an indication that IPD Group might be ready to expand.

- Take a closer look at IPD Group's balance sheet health here in our report.

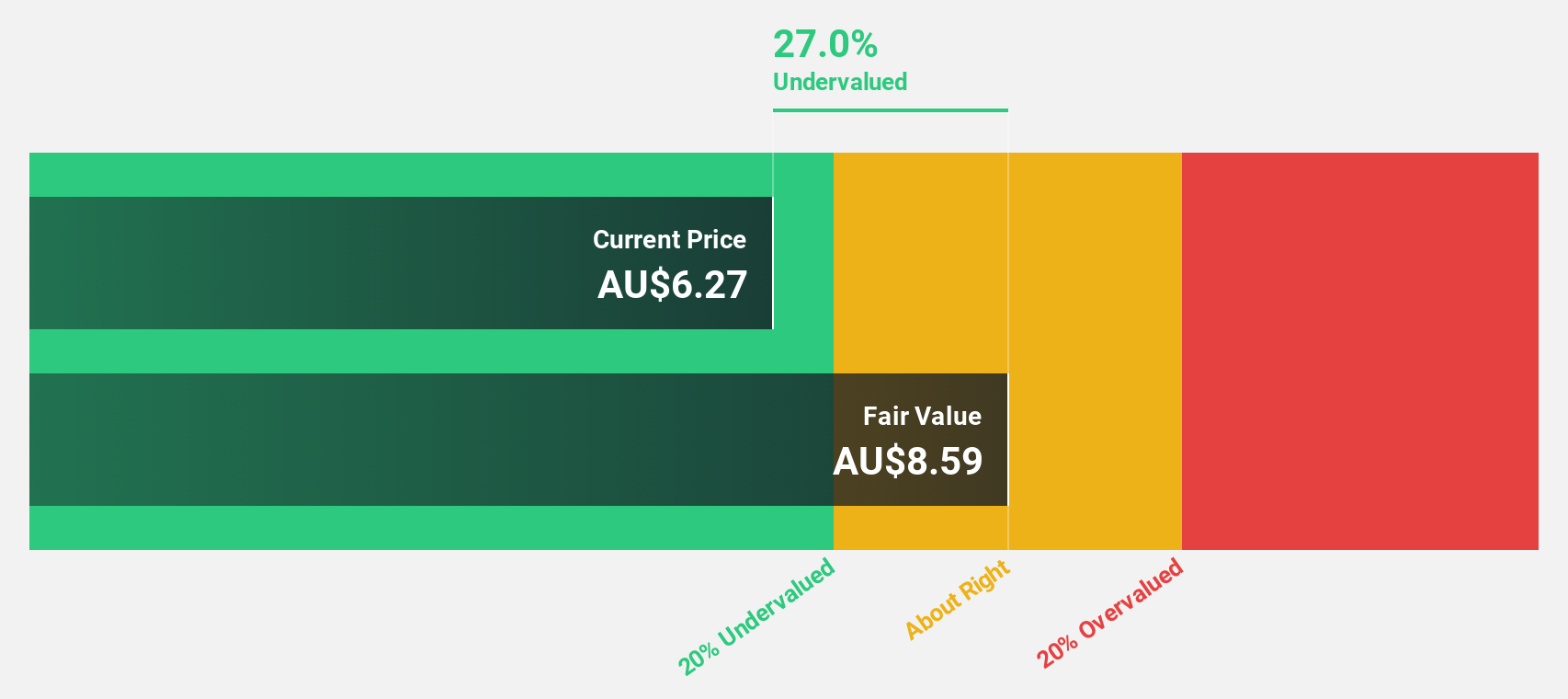

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in designing, prototyping, producing, testing, validating, and selling cooling products and solutions across Australia, the United States, the United Kingdom, Italy, Germany and other international markets with a market capitalization of approximately A$1.10 billion.

Operations: The company's revenue is primarily generated through two segments: PWR C&R, which contributed A$37.35 million, and PWR Performance Products, which added A$104.44 million.

Estimated Discount To Fair Value: 20.3%

PWR Holdings is trading at A$10.94, below the estimated fair value of A$13.73, indicating a 20.3% undervaluation based on discounted cash flow analysis. While its earnings have grown by 12.3% over the past year, they are expected to increase by 15.36% annually, outpacing the Australian market's forecast growth of 13%. However, revenue growth projections are less robust at 12.9% per year compared to more aggressive market averages.

- The growth report we've compiled suggests that PWR Holdings' future prospects could be on the up.

- Dive into the specifics of PWR Holdings here with our thorough financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 46 Undervalued ASX Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives