- Australia

- /

- Metals and Mining

- /

- ASX:LM8

Discover 3 Promising ASX Penny Stocks Under A$400M Market Cap

Reviewed by Simply Wall St

The Australian share market is showing signs of an upswing, with ASX 200 futures indicating a modest gain as investors react to potential shifts in inflation data and interest rate expectations. Amid these broader market dynamics, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. Despite their vintage name, penny stocks can offer surprising value when backed by strong financials, and this article explores three such promising candidates on the ASX that may hold long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$322.38M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.89 | A$104.55M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.53 | A$104.08M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.14 | A$331.46M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$4.98 | A$491.43M | ★★★★☆☆ |

| Nickel Industries (ASX:NIC) | A$0.795 | A$3.41B | ★★★★★☆ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

4DMedical (ASX:4DX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 4DMedical Limited is a medical technology company operating in the United States and Australia, with a market cap of A$240.57 million.

Operations: The company generates revenue from its Medical Technology R&D of Lung Function Analysis segment, amounting to A$3.75 million.

Market Cap: A$240.57M

4DMedical Limited, with a market cap of A$240.57 million, operates in the medical technology sector focusing on lung function analysis. Despite generating A$3.75 million in revenue from its R&D segment, it remains pre-revenue and unprofitable. The company has no debt and short-term assets exceed both its long-term (A$27.2M) and short-term liabilities (A$21.9M). However, it faces challenges with a negative return on equity (-50.73%) and less than one year of cash runway based on current free cash flow trends. Recent board changes include Director John Livingston transitioning to a Non-Executive Director role starting January 2025.

- Click to explore a detailed breakdown of our findings in 4DMedical's financial health report.

- Understand 4DMedical's earnings outlook by examining our growth report.

Lunnon Metals (ASX:LM8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lunnon Metals Limited is an Australian company engaged in the exploration and development of nickel and gold, with a market cap of A$47.95 million.

Operations: The company generates revenue from its mineral exploration activities, amounting to A$0.001551 million.

Market Cap: A$47.95M

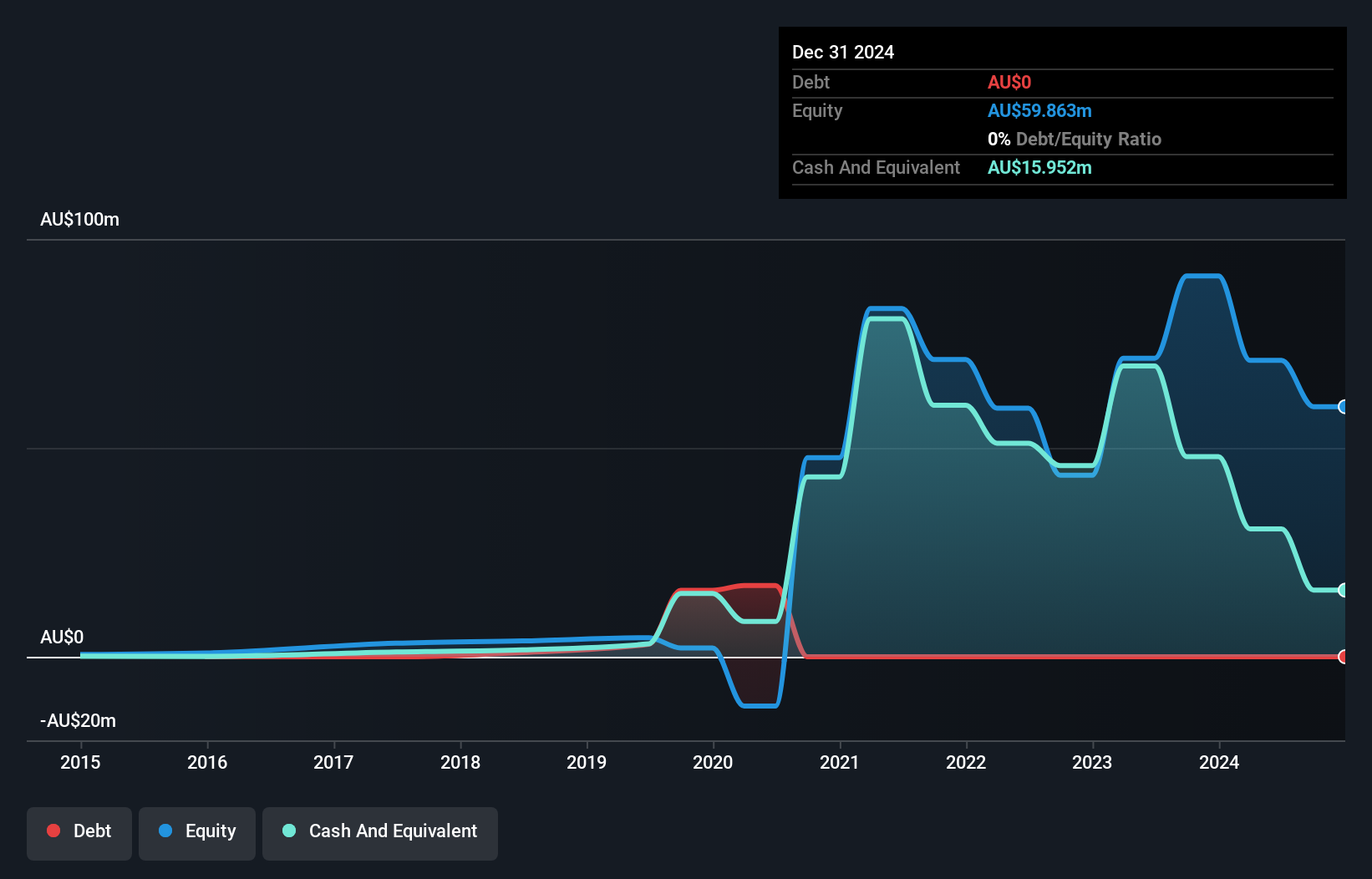

Lunnon Metals Limited, with a market cap of A$47.95 million, is pre-revenue and unprofitable, facing increased losses over the past five years. Despite this, it remains debt-free and has sufficient cash runway for over a year. The company’s short-term assets (A$22.6M) comfortably cover its liabilities, both short-term (A$733K) and long-term (A$57.2K). Trading significantly below estimated fair value suggests potential for upside if operational milestones are met. However, recent delisting due to inactivity may raise concerns about liquidity or strategic direction despite management's experience and stable shareholder structure without significant dilution recently.

- Dive into the specifics of Lunnon Metals here with our thorough balance sheet health report.

- Learn about Lunnon Metals' future growth trajectory here.

PointsBet Holdings (ASX:PBH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PointsBet Holdings Limited operates a cloud-based platform offering sports, racing, and iGaming betting products and services in Australia, with a market cap of A$315.14 million.

Operations: The company's revenue segments include Australian Trading generating A$211.54 million, Canada Trading with A$33.95 million, and Technology contributing A$21.37 million.

Market Cap: A$315.14M

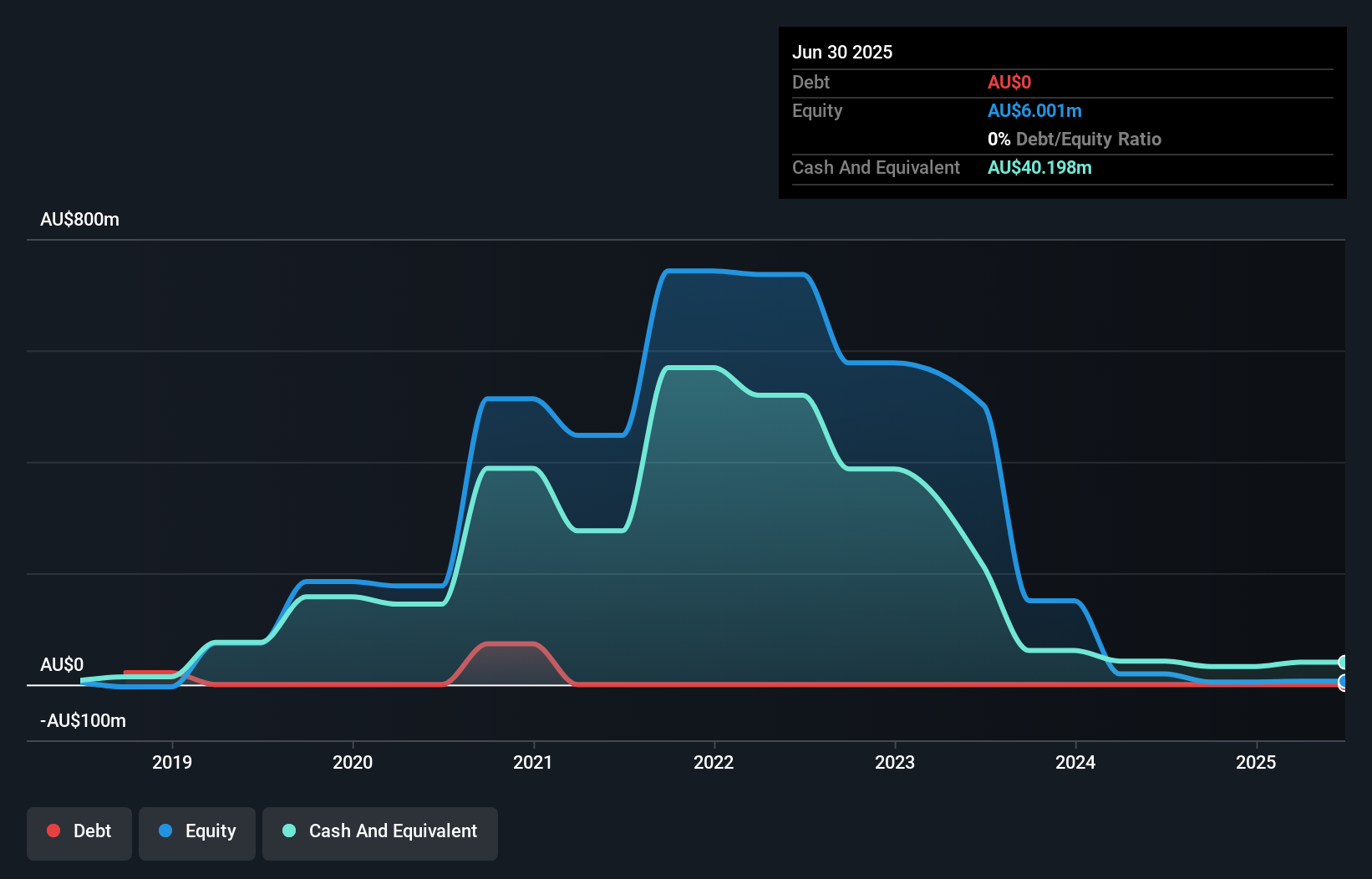

PointsBet Holdings Limited, with a market cap of A$315.14 million, is currently unprofitable but has reduced its losses over the past five years by 7.9% annually. The company is debt-free and maintains a cash runway exceeding three years based on current free cash flow. Recent merger and acquisition discussions hint at a potential takeover bid exceeding A$300 million, which could offer shareholders value above current trading levels. Despite trading significantly below estimated fair value, PointsBet's short-term assets (A$48.7M) fall short of covering its short-term liabilities (A$60.3M), posing a liquidity challenge amidst ongoing profitability concerns.

- Take a closer look at PointsBet Holdings' potential here in our financial health report.

- Explore PointsBet Holdings' analyst forecasts in our growth report.

Next Steps

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,028 more companies for you to explore.Click here to unveil our expertly curated list of 1,031 ASX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LM8

Lunnon Metals

Focuses on the exploration and development of nickel and gold in Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives