Investors Give Wellnex Life Limited (ASX:WNX) Shares A 35% Hiding

To the annoyance of some shareholders, Wellnex Life Limited (ASX:WNX) shares are down a considerable 35% in the last month, which continues a horrid run for the company. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

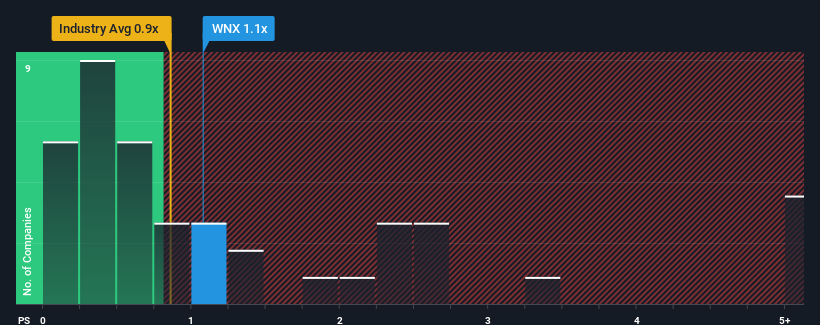

Although its price has dipped substantially, it's still not a stretch to say that Wellnex Life's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Food industry in Australia, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Wellnex Life

How Wellnex Life Has Been Performing

For example, consider that Wellnex Life's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wellnex Life's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Wellnex Life's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that to the industry, which is only predicted to deliver 8.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Wellnex Life's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Wellnex Life's P/S Mean For Investors?

Wellnex Life's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't quite envision Wellnex Life's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware Wellnex Life is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If you're unsure about the strength of Wellnex Life's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wellnex Life might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WNX

Wellnex Life

Develops, markets, and sells health and wellness solutions in Australia and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives