- Australia

- /

- Electrical

- /

- ASX:LIS

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the ASX 200 futures point to a positive start, buoyed by a general January rally, Australian investors are closely monitoring market developments both locally and internationally. In such fluctuating conditions, penny stocks—often representing smaller or newer companies—can present intriguing opportunities for those willing to explore beyond the established names. Despite their somewhat outdated moniker, these stocks can uncover hidden value when supported by strong financials and offer potential stability alongside growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$249.92M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.38M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$324.01M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$105.1M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.27 | A$108.43M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.95 | A$488.39M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Li-S Energy (ASX:LIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-S Energy Limited is an Australian company focused on developing and commercializing lithium sulphur and metal batteries, with a market cap of A$85.89 million.

Operations: Li-S Energy Limited has not reported any revenue segments.

Market Cap: A$85.89M

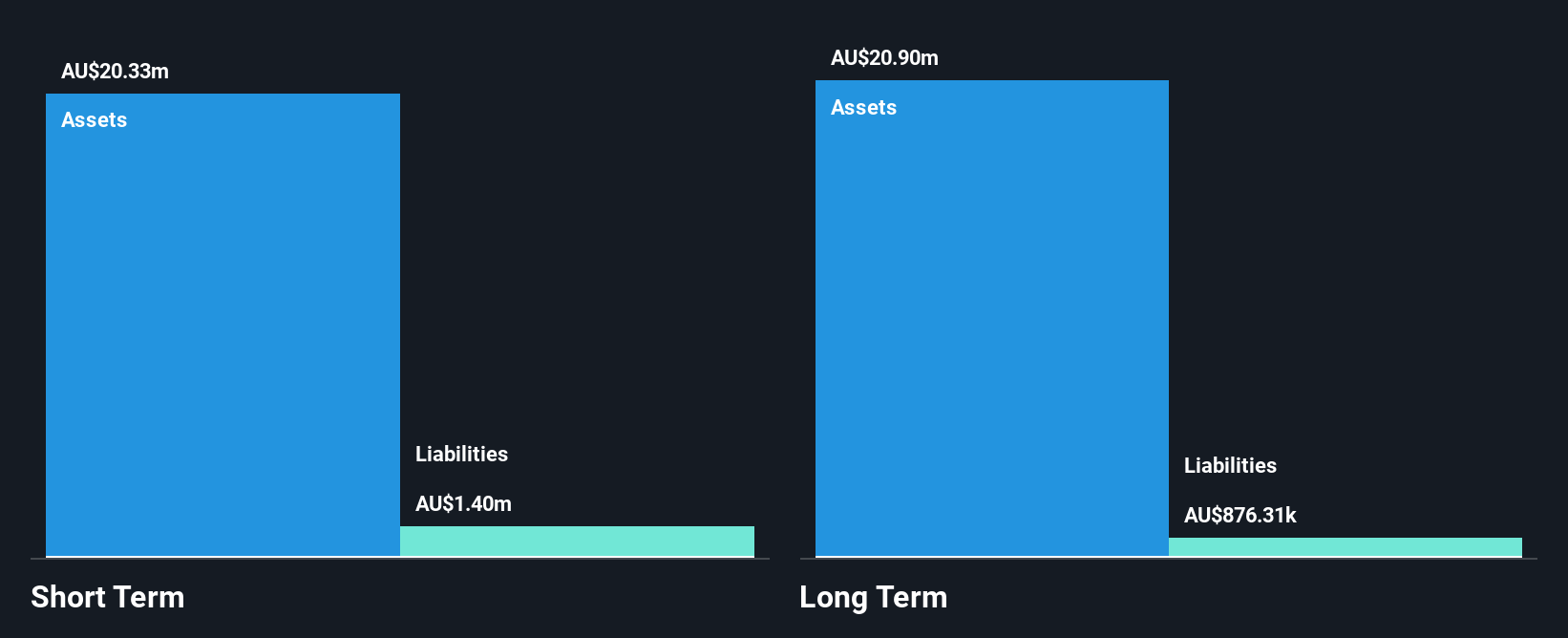

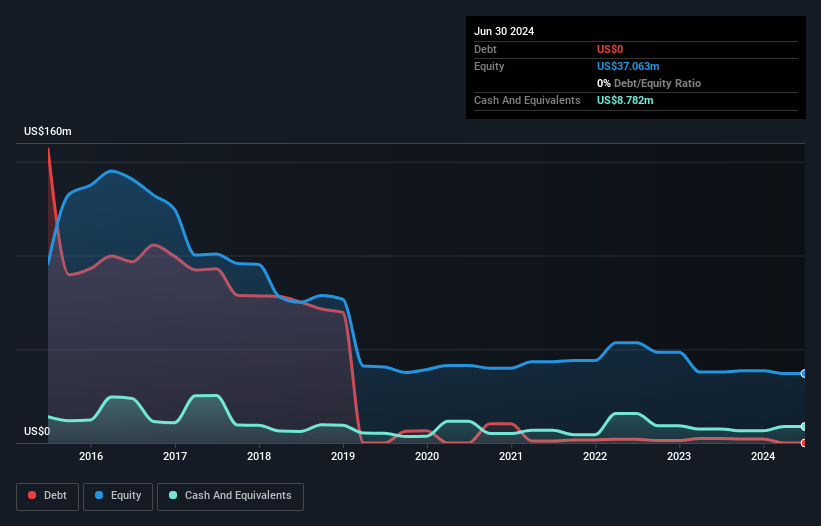

Li-S Energy Limited, with a market cap of A$85.89 million, is pre-revenue and currently unprofitable, facing increased share price volatility over the past three months. The company has no debt and maintains a strong liquidity position with short-term assets of A$25.0 million exceeding its liabilities. Despite having an experienced management team, the board is relatively new with an average tenure of 1.5 years. Recent changes include the election of Mr. Marc Fenton as a director in November 2024, which may influence future strategic directions amid ongoing challenges in profitability and earnings growth stability.

- Click to explore a detailed breakdown of our findings in Li-S Energy's financial health report.

- Learn about Li-S Energy's historical performance here.

VHM (ASX:VHM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: VHM Limited is involved in the exploration and development of mineral properties in Australia, with a market capitalization of A$90.91 million.

Operations: The company generates revenue from its Metals & Mining - Miscellaneous segment, amounting to A$0.023 million.

Market Cap: A$90.91M

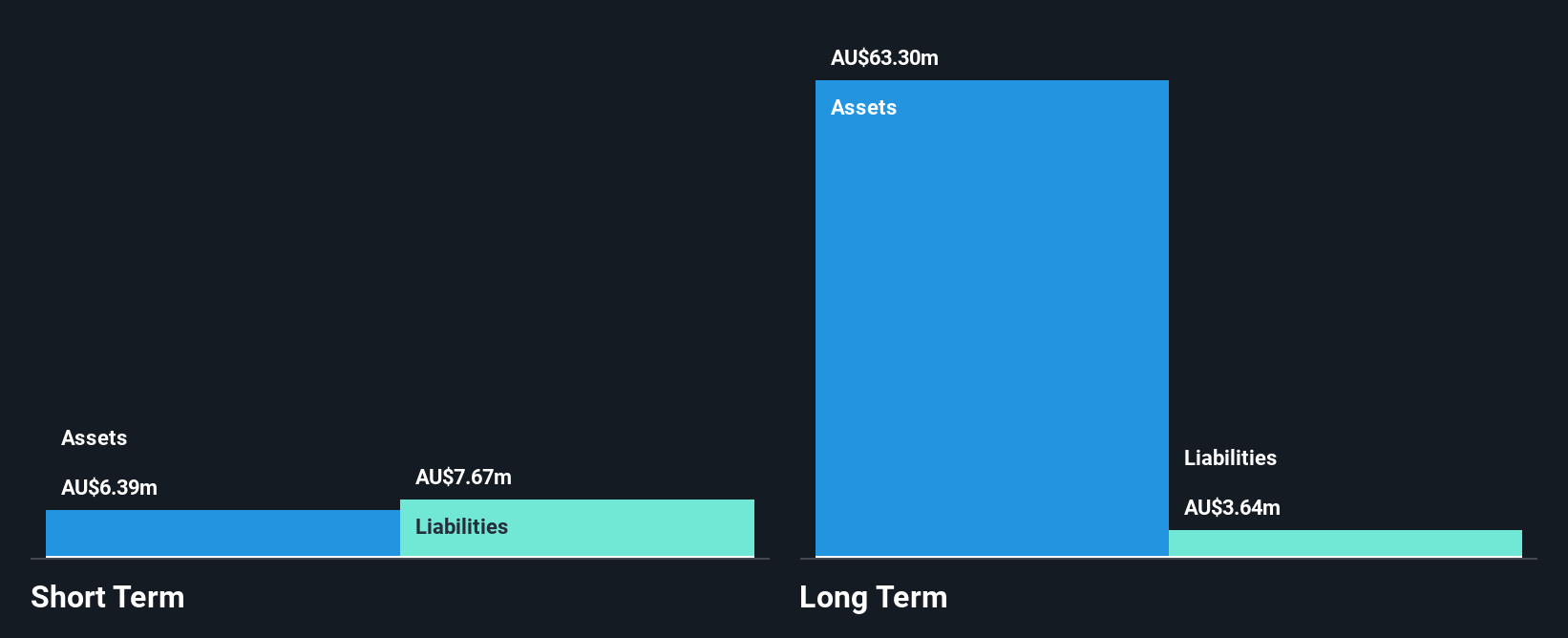

VHM Limited, with a market capitalization of A$90.91 million, is pre-revenue and unprofitable, generating minimal income from its Metals & Mining segment. The company has experienced shareholder dilution over the past year and faces declining earnings forecasts for the next three years. Despite being debt-free, VHM's short-term assets of A$6.4 million surpass its short-term liabilities but fall short of covering long-term liabilities of A$8.2 million. The management team and board are relatively inexperienced with average tenures under two years, which may impact strategic execution amid limited cash runway despite recent capital raises.

- Unlock comprehensive insights into our analysis of VHM stock in this financial health report.

- Gain insights into VHM's outlook and expected performance with our report on the company's earnings estimates.

Wellard (ASX:WLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wellard Limited operates in the supply of livestock and livestock vessels across Australia, Singapore, Brazil, and internationally with a market cap of A$36.66 million.

Operations: The company generates revenue primarily from its Chartering segment, amounting to $34.92 million.

Market Cap: A$36.66M

Wellard Limited, with a market cap of A$36.66 million, operates primarily through its Chartering segment, generating A$34.92 million in revenue. The company is unprofitable but has managed to reduce losses by 39.4% annually over the past five years and remains debt-free, with short-term assets of A$23.1 million covering both short and long-term liabilities comfortably. Despite negative return on equity at -2.2%, Wellard benefits from an experienced management team averaging 5.8 years tenure and a seasoned board with 7.9 years average tenure, alongside a stable cash runway exceeding three years even as free cash flow shrinks modestly.

- Jump into the full analysis health report here for a deeper understanding of Wellard.

- Explore historical data to track Wellard's performance over time in our past results report.

Seize The Opportunity

- Jump into our full catalog of 1,051 ASX Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Li-S Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LIS

Li-S Energy

Engages in the development and commercialization of lithium sulphur and metal batteries in Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives