Why Investors Shouldn't Be Surprised By Select Harvests Limited's (ASX:SHV) 28% Share Price Surge

Select Harvests Limited (ASX:SHV) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.4% over the last year.

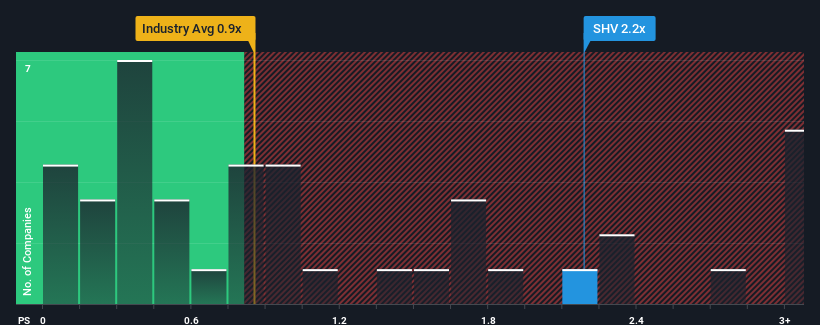

Since its price has surged higher, when almost half of the companies in Australia's Food industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Select Harvests as a stock probably not worth researching with its 2.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Select Harvests

How Has Select Harvests Performed Recently?

Select Harvests could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Select Harvests' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Select Harvests?

In order to justify its P/S ratio, Select Harvests would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 10% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 13% per year during the coming three years according to the six analysts following the company. With the industry only predicted to deliver 5.7% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Select Harvests is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The large bounce in Select Harvests' shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Select Harvests shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Select Harvests that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SHV

Select Harvests

Engages in the growing, processing, packaging, and selling of almonds and its by-products in Australia.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026