- Australia

- /

- Diversified Financial

- /

- ASX:HLI

Undiscovered Gems In Australia Featuring 3 Promising Small Cap Stocks

Reviewed by Simply Wall St

The Australian market has shown resilience, with the index climbing back over 8,800 points amid positive sentiment from tech investors and robust consumer spending data. While financials and IT sectors lead the charge, energy lags behind; this dynamic environment presents an opportunity to explore promising small-cap stocks that may thrive under these conditions. Identifying a good stock often involves looking for companies with strong growth potential or unique advantages in their sector, especially as market sentiment shifts and economic indicators fluctuate.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$807.55 million, focusing on ethical and sustainable investment strategies.

Operations: Australian Ethical Investment generates revenue primarily through its funds management segment, reporting A$119.38 million in revenue.

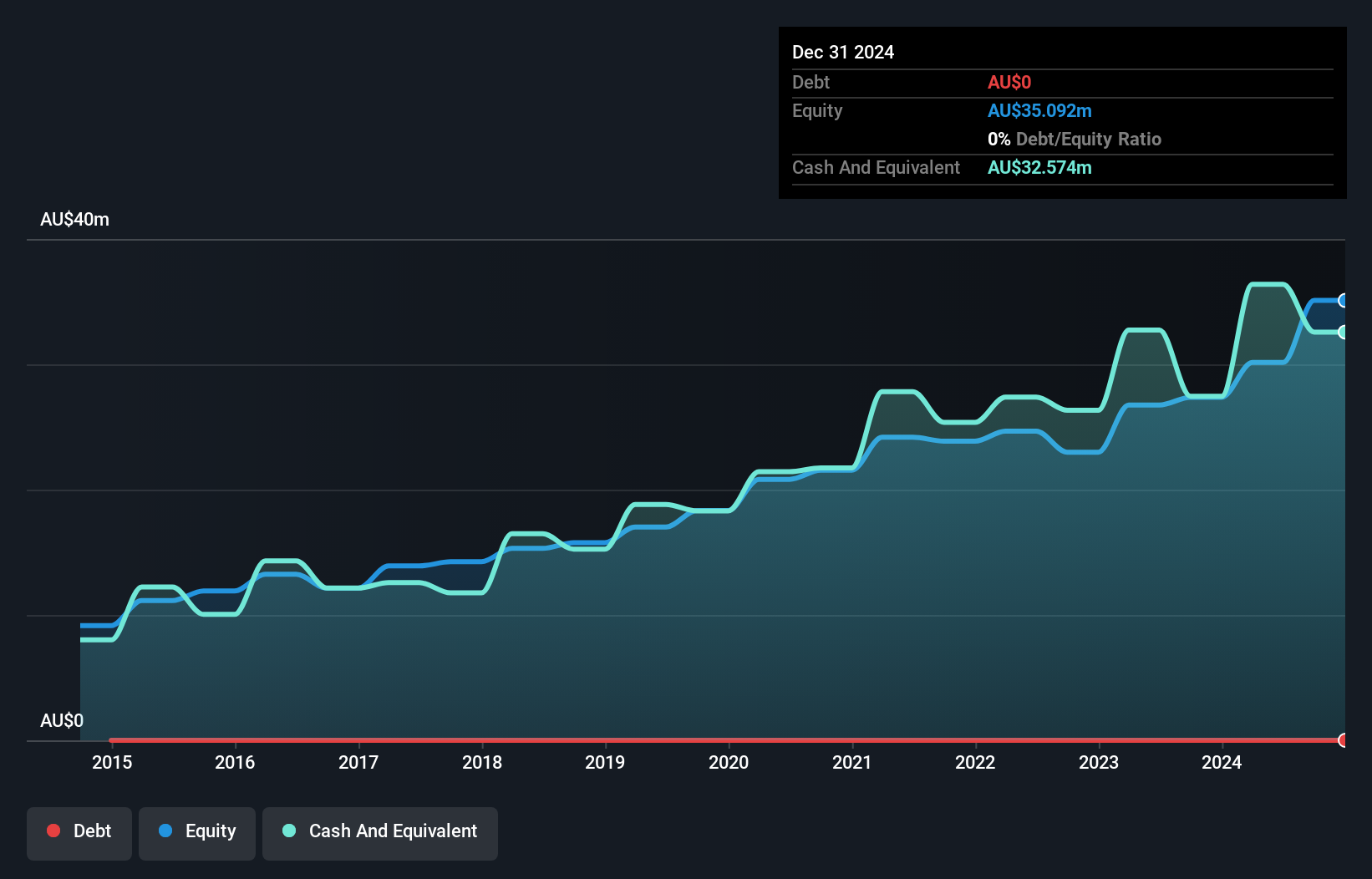

Australian Ethical Investment, a notable player in the ethical investment space, has demonstrated impressive growth. Over the past year, earnings soared by 75%, significantly outpacing the Capital Markets industry average of 5.8%. The company reported net income of A$20.2 million for the fiscal year ending June 2025, up from A$11.53 million previously. With no debt on its books and positive free cash flow standing at A$24 million as of September 2024, it appears well-positioned financially. Despite a recent dividend increase to A$0.09 per share, potential risks include integration challenges and increased operating expenses impacting future margins.

Helia Group (ASX:HLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Helia Group Limited operates in the loan mortgage insurance industry primarily in Australia and has a market cap of A$1.56 billion.

Operations: Helia Group Limited generates revenue of A$559.63 million from its loan mortgage insurance business in Australia.

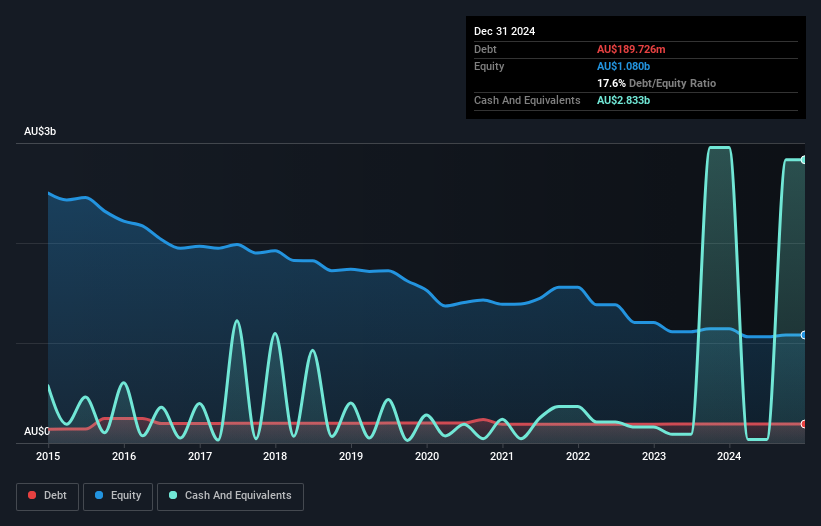

Helia Group, a notable player in the Australian financial landscape, faces headwinds with significant client losses and policy shifts. The exit of major clients like Commonwealth Bank signals potential revenue volatility, while the government's Home Guarantee Scheme could limit premium growth. Despite these challenges, Helia's earnings grew 19% last year, outpacing the industry's -3%. However, its debt to equity ratio rose from 14% to 19% over five years. Recent executive changes include CFO Michael Cant stepping in as interim CEO. With a share price at A$5.93 against a target of A$3.87, market sentiment remains cautious amid forecasted revenue declines.

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations spanning Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America; it has a market capitalization of approximately A$1.01 billion.

Operations: Ricegrowers Limited generates revenue primarily from its International Rice segment, contributing A$860.96 million, and the Rice Pool segment with A$481.87 million. The Cop Rice and Riviana segments add A$250.64 million and A$231.14 million, respectively, while the Rice Food segment brings in A$132.53 million.

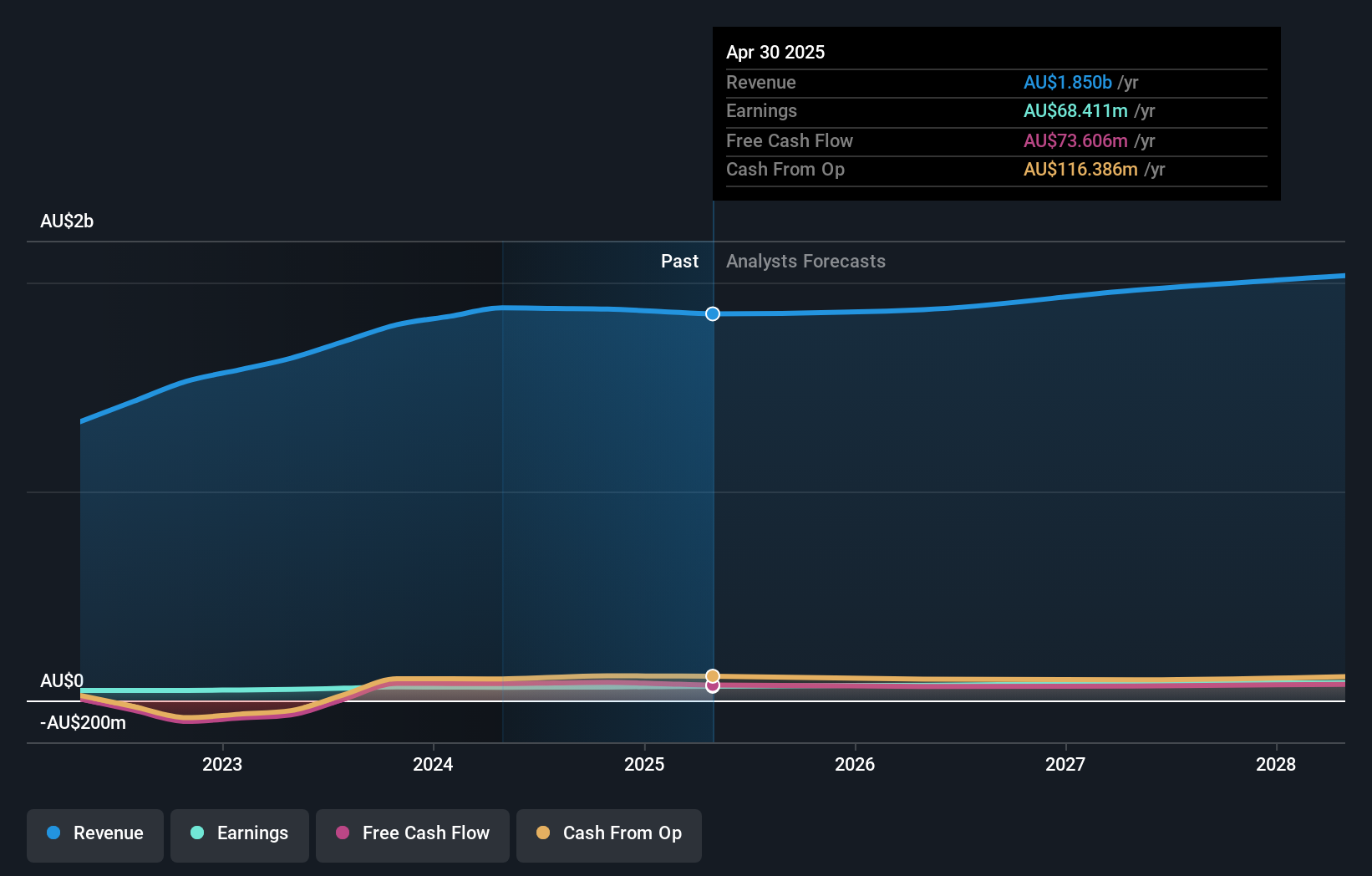

Ricegrowers, a dynamic player in the food industry, is leveraging its position through strategic international expansions and product diversification. With earnings growing at 23% annually over five years and trading 47% below estimated fair value, the company seems undervalued. Its net debt to equity ratio of 31% is satisfactory, ensuring financial stability while covering interest payments effectively with a 6.8x EBIT coverage. Despite facing competition and operational hurdles like yield fluctuations and cost inflation, Ricegrowers' focus on agritech investments aims to boost efficiency and quality. The stock's current trading price of A$14.16 aligns closely with analysts' target of A$14.00.

Where To Now?

- Navigate through the entire inventory of 54 ASX Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLI

Helia Group

Helia Group Limited, together with its subsidiaries, is involved in the loan mortgage insurance business primarily in Australia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives