Last Update 25 Aug 25

Fair value Increased 9.95%Despite a worsening revenue growth outlook, a significant increase in Helia Group's future P/E multiple has driven the consensus analyst price target up from A$3.52 to A$3.87.

What's in the News

- Announced fully franked ordinary dividend of AUD 0.16 per share and unfranked special dividend of AUD 0.27 per share for six months ended June 30, 2025.

- Raised FY2025 insurance revenue guidance to $350–390 million from earlier $310–390 million range.

- Extended share buyback program duration to December 31, 2025.

- CEO Pauline Blight-Johnston to step down; CFO Michael Cant appointed interim CEO effective July 1, 2025, with Craig Ward as Interim CFO.

Valuation Changes

Summary of Valuation Changes for Helia Group

- The Consensus Analyst Price Target has risen from A$3.52 to A$3.87.

- The Future P/E for Helia Group has significantly risen from 9.54x to 12.44x.

- The Consensus Revenue Growth forecasts for Helia Group has significantly fallen from -15.5% per annum to -18.9% per annum.

Key Takeaways

- Loss of major clients and government policy changes will sharply shrink Helia's core market and pressure future revenue growth.

- Heavy capital returns risk undermining strategic reinvestment, threatening competitive positioning and future profitability.

- Strong capital management, resilient historical earnings, and adaption to client shifts support Helia's robust market position and profitability amid near-term sector and client pressures.

Catalysts

About Helia Group- Helia Group Limited, together with its subsidiaries, is involved in the loan mortgage insurance business primarily in Australia.

- The loss of two major lender clients (Commonwealth Bank and ING), who represented 61% of recent gross written premium, is expected to sharply reduce Helia's new business volumes from 2026 onward, putting future revenue at risk and increasing earnings volatility.

- The government's expanded Home Guarantee Scheme (removal of caps, higher property price thresholds, and relaxed eligibility) will further displace private mortgage insurance in the first homebuyer segment, removing a market that contributed 25–30% of GWP, which is likely to materially depress premium growth and future revenue.

- Increased prevalence of government-backed and self-insured home loan solutions, combined with waivers by lenders, is set to shrink Helia's addressable market, limiting the runway for long-term top-line growth and amplifying revenue pressures.

- Reliance on exceptionally low claims and favorable investment returns is currently elevating net margins and profits, but these are cyclical and non-sustainable; normalization of claims ratios and investment returns could quickly compress margins and lower future earnings.

- The company's focus on returning excess capital via special dividends and buybacks, while positive for short-term shareholder returns, may inhibit Helia's ability to strategically reinvest in technology and innovation, causing potential long-term erosion in competitive positioning and return on equity.

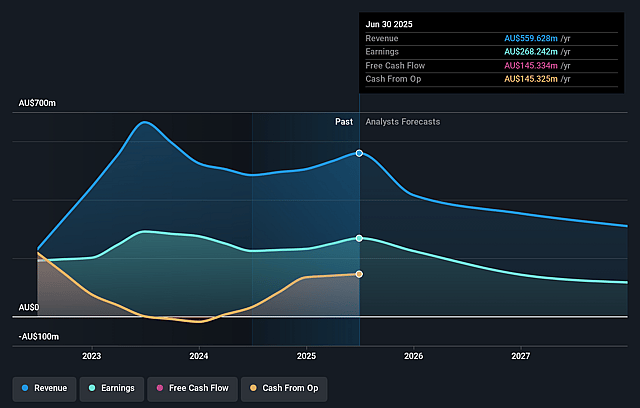

Helia Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Helia Group's revenue will decrease by 18.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 47.9% today to 34.7% in 3 years time.

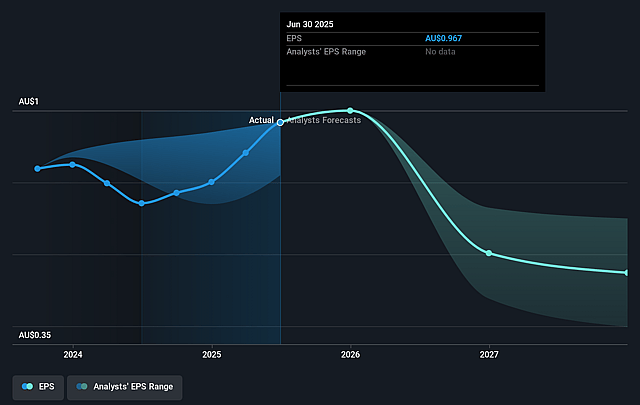

- Analysts expect earnings to reach A$103.7 million (and earnings per share of A$0.55) by about September 2028, down from A$268.2 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as A$136.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, up from 5.6x today. This future PE is lower than the current PE for the AU Diversified Financial industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.33%, as per the Simply Wall St company report.

Helia Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Helia maintains a dominant 50% market share in its in-force LMI portfolio, which provides a substantial buffer of unearned revenue (via LRC and CSM) to underpin future revenues and earnings even as new business volumes face short-term pressure.

- The company's exceptionally strong capital position and capital management discipline, evidenced by ongoing dividends, special dividends, and share buybacks, offer significant financial flexibility for shareholder returns and smoothing of EPS and ROE, mitigating revenue volatility in the near-term.

- Despite the loss of major clients (CBA and ING) and government scheme pressures, Helia has achieved a 28% YoY increase in gross written premium from new and renewed customer activity, demonstrating an ability to grow market share among regional/second-tier lenders and adapt its client risk settings, which may partially offset top-line declines.

- The long duration and seasoning of Helia's back book-with revenue recognition extending up to 15 years-means historical premium earnings will continue to support reported revenues and profit generation, providing a multi-year runway for strategic business adjustment and cost transformation.

- Current favorable macro trends-such as low unemployment, rising house prices nationwide, persistent low claims, and resilience in household balance sheets-support continued low loss ratios and strong bottom-line profitability, insulating Helia's margins and NPAT against immediate sector headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.867 for Helia Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$298.8 million, earnings will come to A$103.7 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$5.56, the analyst price target of A$3.87 is 43.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Helia Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.