- Australia

- /

- Consumer Finance

- /

- ASX:CCV

Top ASX Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the ASX200 climbs back above 9,000 points with a notable annual return of 10%, optimism surrounding potential US-China trade talks has buoyed investor sentiment in Australia. In this context of market resilience and sectoral gains, dividend stocks remain an attractive option for investors seeking steady income streams amidst fluctuating global economic conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.43% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.78% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.94% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.08% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.30% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.84% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.18% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.79% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.80% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.75% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Cash Converters International (ASX:CCV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cash Converters International Limited operates in unsecured lending and second-hand retail services across Australia, New Zealand, the United Kingdom, and internationally, with a market cap of A$217.27 million.

Operations: Cash Converters International Limited generates revenue through several segments, including Store Operations (A$157.12 million), Personal Finance (A$78.53 million), the United Kingdom (A$83.49 million), New Zealand (A$22.19 million), and Vehicle Finance (A$12.02 million).

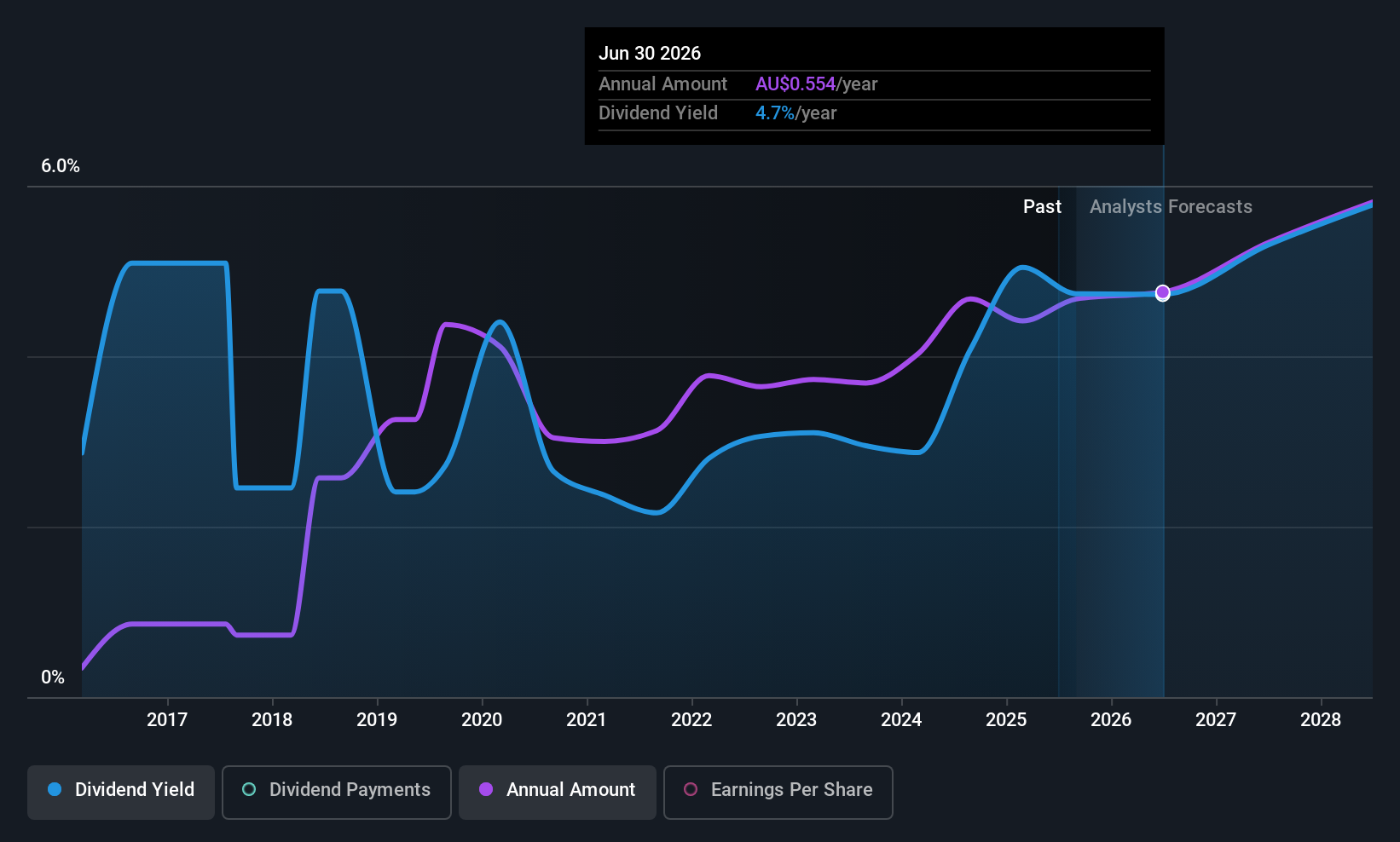

Dividend Yield: 5.7%

Cash Converters International offers a dividend yield of 5.71%, placing it in the top 25% of Australian dividend payers. Despite this, its dividend history is marked by volatility and unreliability, with past payments declining over the last decade. However, dividends are well-covered by earnings and cash flows, with payout ratios at 51% and 16.4%, respectively. Recent financials show revenue at A$385.27 million and net income at A$24.48 million for FY2025 amidst ongoing strategic changes including a recent equity offering worth A$25 million.

- Take a closer look at Cash Converters International's potential here in our dividend report.

- The valuation report we've compiled suggests that Cash Converters International's current price could be quite moderate.

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates in the online retail of lottery tickets across Australia, the United Kingdom, Canada, Fiji, and other international markets with a market capitalization of A$799.65 million.

Operations: Jumbo Interactive Limited generates revenue through three main segments: Managed Services (A$26.72 million), Lottery Retailing (A$108.05 million), and Software-As-A-Service (SaaS) (A$44.25 million).

Dividend Yield: 4.3%

Jumbo Interactive's dividend yield of 4.32% lags behind the top 25% of Australian dividend payers. While dividends are covered by earnings and cash flows with payout ratios at 85% and 83%, respectively, their track record is unstable, showing volatility over the past decade. The recent acquisition of Dream Car Giveaways could influence future payouts. Despite trading below estimated fair value, investors should note its inconsistent dividend history amidst solid financial coverage.

- Get an in-depth perspective on Jumbo Interactive's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Jumbo Interactive's share price might be too pessimistic.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, with a market cap of A$1.21 billion, operates as a rice food company across various regions including Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia and North America.

Operations: Ricegrowers Limited generates revenue from several segments, including Riviana (A$231.14 million), Cop Rice (A$250.64 million), Rice Food (A$132.53 million), Rice Pool (A$481.87 million), Corporate Segment (A$26.93 million) and International Rice (A$860.96 million).

Dividend Yield: 3.6%

Ricegrowers' dividend yield of 3.64% falls short compared to top Australian payers, yet its dividends are covered by earnings and cash flows with payout ratios of 63.2% and 59.6%. Despite a volatile dividend history, recent inclusion in the S&P/ASX Small Ordinaries and ASX 300 indices may enhance visibility. Earnings growth at 23.4% annually over five years supports financial stability, though investors should consider its inconsistent dividend track record amidst solid coverage metrics.

- Click here and access our complete dividend analysis report to understand the dynamics of Ricegrowers.

- Our valuation report unveils the possibility Ricegrowers' shares may be trading at a discount.

Make It Happen

- Discover the full array of 28 Top ASX Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCV

Cash Converters International

Provides unsecured lending and second-hand retail services in Australia, New Zealand, the United Kingdom, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives