If EPS Growth Is Important To You, Maggie Beer Holdings (ASX:MBH) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Maggie Beer Holdings (ASX:MBH), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Maggie Beer Holdings

Maggie Beer Holdings' Improving Profits

Maggie Beer Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Maggie Beer Holdings' EPS shot from AU$0.012 to AU$0.021, over the last year. It's not often a company can achieve year-on-year growth of 71%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Maggie Beer Holdings' revenue from operations did not account for all of their revenue last year, so our analysis of its margins might not accurately reflect the underlying business. Maggie Beer Holdings shareholders can take confidence from the fact that EBIT margins are up from -1.9% to 8.5%, and revenue is growing. That's great to see, on both counts.

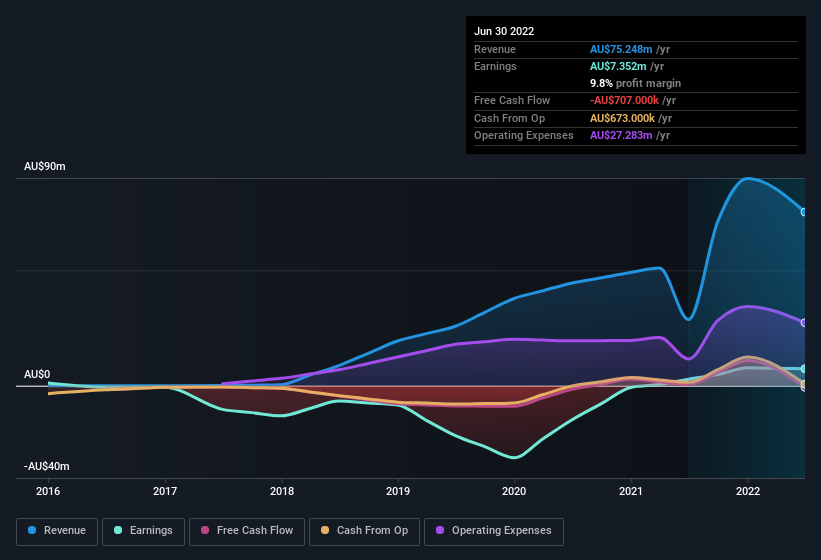

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Maggie Beer Holdings is no giant, with a market capitalisation of AU$74m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Maggie Beer Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite some Maggie Beer Holdings insiders disposing of some shares, we note that there was AU$253k more in buying interest among those who know the company best On balance, that's a good sign. It is also worth noting that it was Independent Non-Executive Director Hugh Robertson who made the biggest single purchase, worth AU$91k, paying AU$0.61 per share.

Along with the insider buying, another encouraging sign for Maggie Beer Holdings is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at AU$25m. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 33% of the company; visible skin in the game.

Does Maggie Beer Holdings Deserve A Spot On Your Watchlist?

Maggie Beer Holdings' earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Maggie Beer Holdings belongs near the top of your watchlist. Even so, be aware that Maggie Beer Holdings is showing 1 warning sign in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Maggie Beer Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Maggie Beer Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MBH

Maggie Beer Holdings

Manufactures and sells food and beverage, and gifting products primarily in Australia.

Flawless balance sheet and good value.