It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Elders (ASX:ELD), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out the opportunities and risks within the AU Food industry.

How Fast Is Elders Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Elders' EPS has grown 18% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

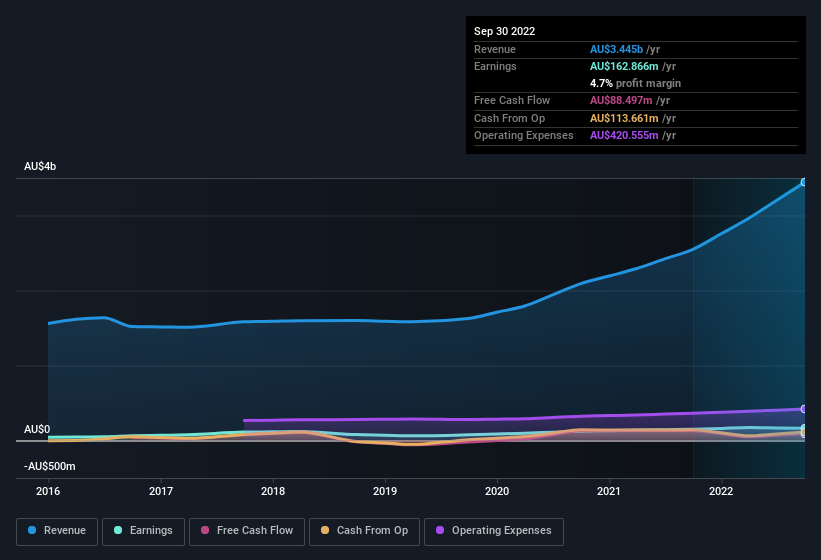

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Elders remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 35% to AU$3.4b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Elders?

Are Elders Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Elders insiders spent AU$83k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

The good news, alongside the insider buying, for Elders bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$27m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add Elders To Your Watchlist?

You can't deny that Elders has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. We should say that we've discovered 2 warning signs for Elders (1 is a bit unpleasant!) that you should be aware of before investing here.

The good news is that Elders is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Elders might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ELD

Elders

Provides agricultural products and services to rural and regional customers primarily in Australia.

Moderate and good value.

Similar Companies

Market Insights

Community Narratives