- Australia

- /

- Consumer Finance

- /

- ASX:CCV

ASX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The Australian market is experiencing a positive upswing, with shares set to rise following a temporary ceasefire between Israel and Iran, which has alleviated some geopolitical tensions. In this context of renewed investor confidence, penny stocks—often representing smaller or newer companies—remain an intriguing segment for those looking beyond the major players. Despite being considered an outdated term by some, penny stocks continue to offer potential opportunities when backed by strong financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.47 | A$116.52M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.34M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.68 | A$413.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.735 | A$458.75M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.26 | A$768.13M | ✅ 3 ⚠️ 2 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.86 | A$1.31B | ✅ 5 ⚠️ 1 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.555 | A$762.07M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.685 | A$217.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.25 | A$154.21M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.84 | A$148.2M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 477 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cash Converters International (ASX:CCV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cash Converters International Limited operates as a franchisor and retailer of second-hand goods and financial services under the Cash Converters brand in Australia, New Zealand, the United Kingdom, and internationally, with a market cap of A$174.40 million.

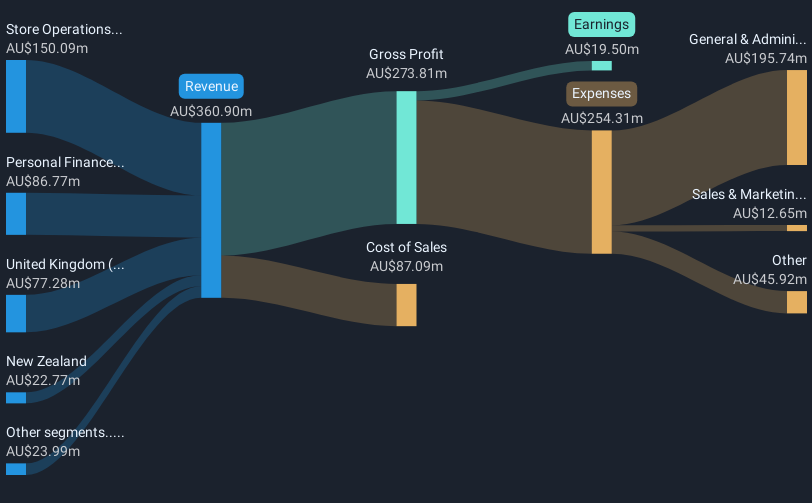

Operations: Cash Converters International generates revenue from several segments, including Store Operations (A$150.09 million), Personal Finance (A$86.77 million), the United Kingdom (A$77.28 million), New Zealand (A$22.77 million), and Vehicle Finance (A$14.20 million).

Market Cap: A$174.4M

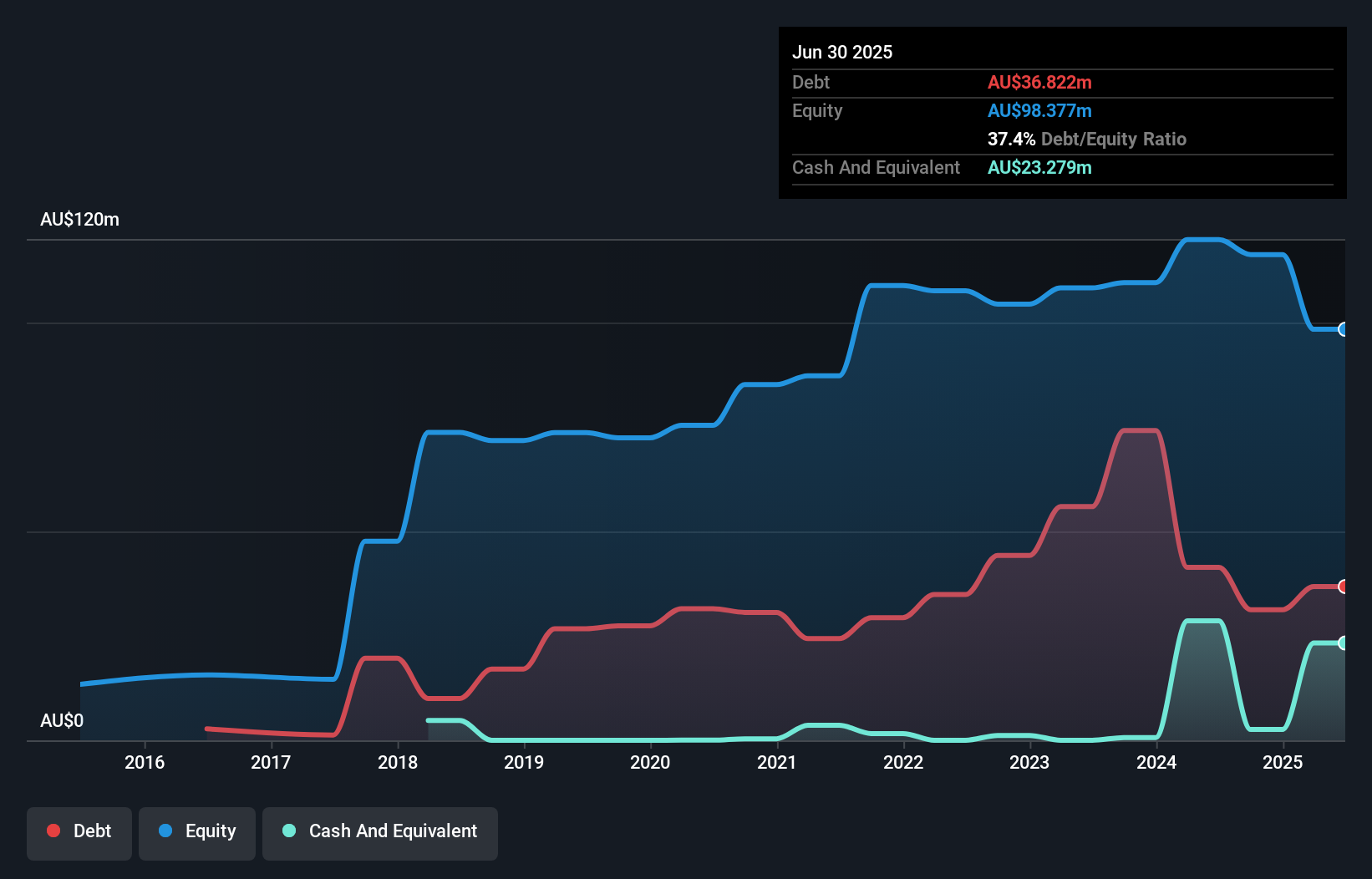

Cash Converters International, with a market cap of A$174.40 million, has demonstrated financial resilience by maintaining short-term assets (A$328.3M) that exceed both its short-term (A$145.4M) and long-term liabilities (A$102.2M). The company has become profitable over the past five years despite a slight decline in profit margins from 5.6% to 5.4%. Its Price-To-Earnings ratio of 8.9x suggests it is trading at good value compared to the broader Australian market average of 17.9x, although debt levels have increased over time with a satisfactory net debt to equity ratio of 35.1%.

- Navigate through the intricacies of Cash Converters International with our comprehensive balance sheet health report here.

- Learn about Cash Converters International's future growth trajectory here.

Duxton Farms (ASX:DBF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duxton Farms Limited focuses on the sowing and harvesting of dryland and irrigated crops in Australia, with a market cap of A$58.03 million.

Operations: The company's revenue segment is derived from Agriculture, totaling A$25.95 million.

Market Cap: A$58.03M

Duxton Farms, with a market cap of A$58.03 million, has recently turned profitable, though its earnings were significantly influenced by a large one-off gain of A$11.2 million in 2024. The company's short-term assets (A$58.2M) comfortably cover both its short-term (A$5M) and long-term liabilities (A$48.1M), reflecting sound financial management despite negative operating cash flow indicating debt is not well covered by cash generation. While the net debt to equity ratio is satisfactory at 24.7%, the Return on Equity remains low at 0.6%. The dividend yield of 7.09% lacks coverage from current earnings or free cash flows.

- Jump into the full analysis health report here for a deeper understanding of Duxton Farms.

- Review our historical performance report to gain insights into Duxton Farms' track record.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining services, mining support, and civil infrastructure solutions to clients in Australia and Southeast Asia, with a market cap of A$654.56 million.

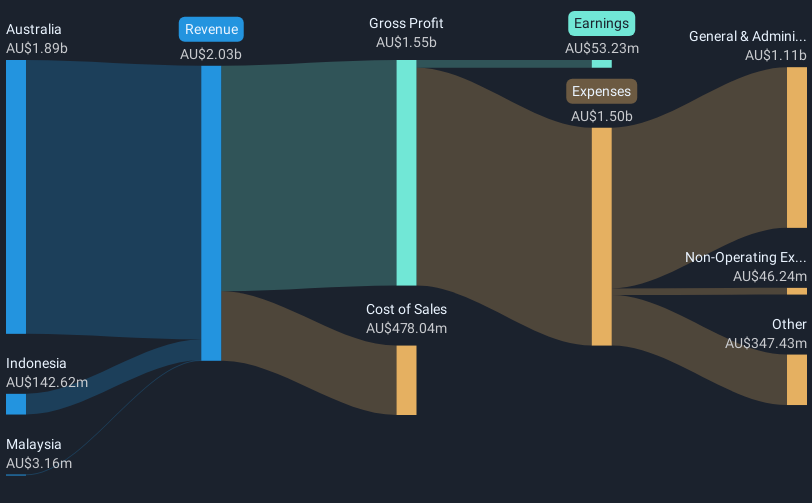

Operations: The company's revenue segments include surface and underground mining services, mining support, and civil infrastructure solutions across Australia and Southeast Asia, generating a total of A$2.24 billion.

Market Cap: A$654.56M

Macmahon Holdings, with a market cap of A$654.56 million, recently secured a three-year extension at the Byerwen coking coal mine, adding approximately A$900 million to its order book without requiring new capital expenditure. Despite high-quality earnings and satisfactory debt levels—operating cash flow covers 86.5% of debt and interest is well covered by EBIT—earnings have declined by 4.2% annually over five years. Short-term assets exceed liabilities, but profit margins have decreased from last year and Return on Equity is low at 7%. The stock trades significantly below estimated fair value, though recent earnings growth was negative.

- Get an in-depth perspective on Macmahon Holdings' performance by reading our balance sheet health report here.

- Gain insights into Macmahon Holdings' future direction by reviewing our growth report.

Key Takeaways

- Discover the full array of 477 ASX Penny Stocks right here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCV

Cash Converters International

Provides unsecured lending and second-hand retail services in Australia, New Zealand, the United Kingdom, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives