We Think Costa Group Holdings (ASX:CGC) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Costa Group Holdings Limited (ASX:CGC) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Costa Group Holdings

What Is Costa Group Holdings's Debt?

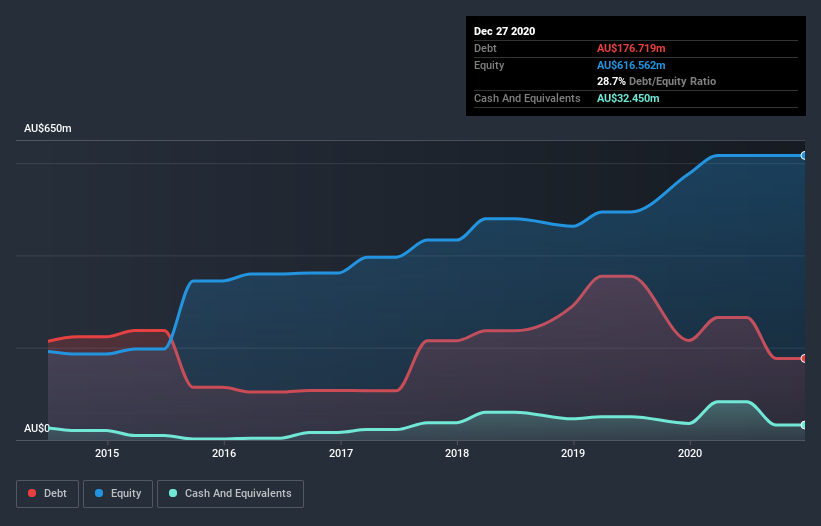

The image below, which you can click on for greater detail, shows that Costa Group Holdings had debt of AU$176.7m at the end of December 2020, a reduction from AU$215.8m over a year. However, because it has a cash reserve of AU$32.5m, its net debt is less, at about AU$144.3m.

How Strong Is Costa Group Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Costa Group Holdings had liabilities of AU$217.1m due within 12 months and liabilities of AU$471.7m due beyond that. Offsetting these obligations, it had cash of AU$32.5m as well as receivables valued at AU$96.9m due within 12 months. So it has liabilities totalling AU$559.4m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Costa Group Holdings has a market capitalization of AU$1.88b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Costa Group Holdings's low debt to EBITDA ratio of 0.94 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.9 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Pleasingly, Costa Group Holdings is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 150% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Costa Group Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Costa Group Holdings reported free cash flow worth 8.7% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

When it comes to the balance sheet, the standout positive for Costa Group Holdings was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. For example, its conversion of EBIT to free cash flow makes us a little nervous about its debt. When we consider all the elements mentioned above, it seems to us that Costa Group Holdings is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Costa Group Holdings insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Costa Group Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CGC

Costa Group Holdings

Costa Group Holdings Limited produces, packs, and markets fruits and vegetables to food retailers.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives