- Australia

- /

- Oil and Gas

- /

- ASX:VEA

Did a Half-Year Loss and Dividend Cut Just Shift Viva Energy Group's (ASX:VEA) Investment Narrative?

Reviewed by Simply Wall St

- Viva Energy Group Limited recently reported half-year results showing sales of A$14.96 billion and a net loss of A$195.4 million, alongside a reduced fully franked cash dividend of A$0.0283 per share for the period ended June 30, 2025.

- This reversal from profit to loss, paired with a dividend decrease, reflects a significant shift in the company's financial position compared to the previous year.

- We'll now explore how the swing to a half-year net loss may influence Viva Energy Group's investment outlook and future prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Viva Energy Group Investment Narrative Recap

To be a Viva Energy Group shareholder today, you need to believe in the company’s ability to return to profitability through operational efficiencies and margin improvements, while managing industry headwinds such as regulatory change and shifting fuel demand. The recent swing to a net loss and reduced dividend could moderate near-term optimism, but it does not fundamentally alter the timeline or importance of delivery on major network conversion and refining projects, which remain the primary catalyst for future growth. The key risk now is the company’s continued exposure to refining margin volatility, especially given ongoing losses.

The announcement of a reduced fully franked dividend of A$0.0283 per share directly relates to the company’s reported loss, reflecting more cautious capital management. This move is pragmatic given profitability pressures and is relevant to investors tracking whether free cash flow can sustainably support future distributions, especially as Viva Energy invests heavily in retail and refining upgrades.

However, with persistently high refinery dependency, investors should be aware that...

Read the full narrative on Viva Energy Group (it's free!)

Viva Energy Group is projected to reach A$30.9 billion in revenue and A$405.0 million in earnings by 2028. This outlook assumes a slight annual revenue decline of 0.1% and an earnings increase of A$756.7 million from current earnings of A$-351.7 million.

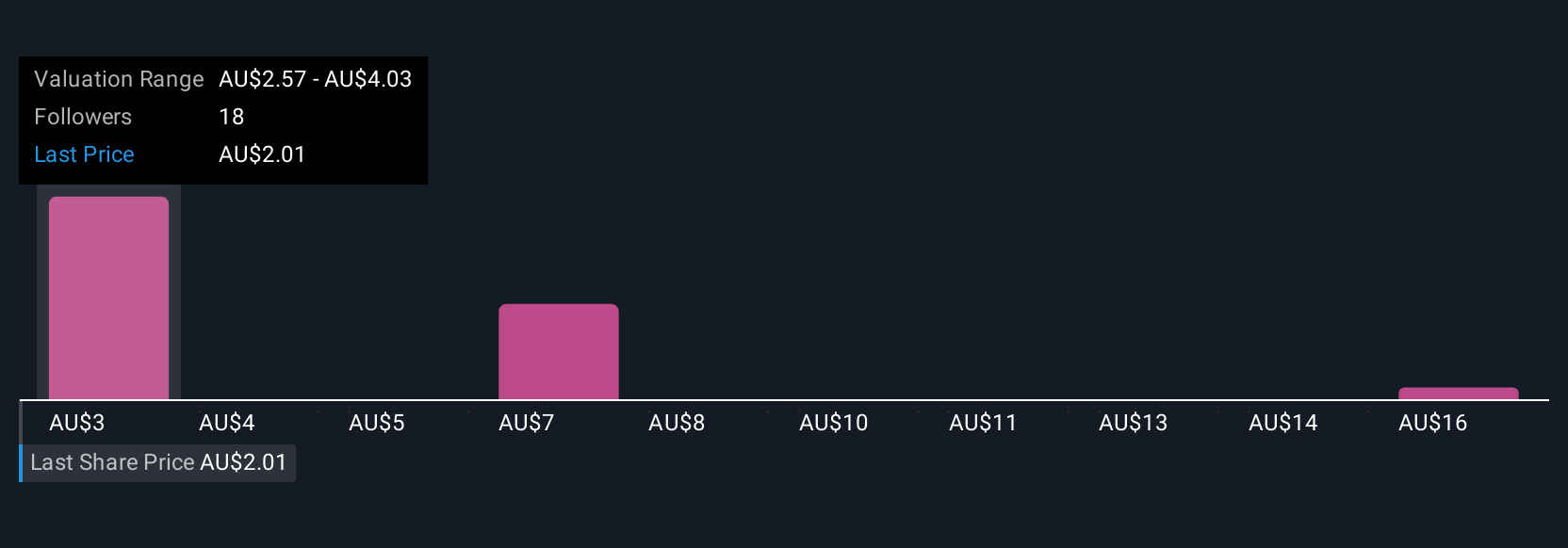

Uncover how Viva Energy Group's forecasts yield a A$2.57 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Six private investors in the Simply Wall St Community estimate Viva Energy’s fair value from A$2.57 up to A$17.19 per share. These sharply different viewpoints reflect how concerns about core refining risks could significantly shape expectations for the company’s future recovery and returns.

Explore 6 other fair value estimates on Viva Energy Group - why the stock might be worth over 8x more than the current price!

Build Your Own Viva Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viva Energy Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Viva Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viva Energy Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VEA

Viva Energy Group

Operates as an energy company in Australia, Singapore, and Papua New Guinea.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives