As Asian markets navigate a complex landscape shaped by global trade tensions and economic uncertainties, small-cap stocks in the region are capturing attention for their potential resilience and growth opportunities. In this context, understanding the dynamics of insider activity can provide valuable insights into company prospects, especially as investors seek to identify stocks that may be well-positioned amid current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.9x | 1.1x | 30.83% | ★★★★★☆ |

| Puregold Price Club | 9.1x | 0.4x | 26.00% | ★★★★★☆ |

| Hansen Technologies | 293.3x | 2.8x | 25.68% | ★★★★★☆ |

| Abacus Group | NA | 4.4x | 27.05% | ★★★★★☆ |

| Hong Leong Asia | 9.4x | 0.2x | 43.95% | ★★★★☆☆ |

| Cettire | 159.0x | 0.5x | 40.45% | ★★★★☆☆ |

| Champion Iron | 19.3x | 1.6x | 42.49% | ★★★★☆☆ |

| Viva Energy Group | NA | 0.1x | 10.36% | ★★★★☆☆ |

| China XLX Fertiliser | 4.0x | 0.2x | -147.62% | ★★★☆☆☆ |

| Dicker Data | 20.0x | 0.7x | -25.75% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★★☆

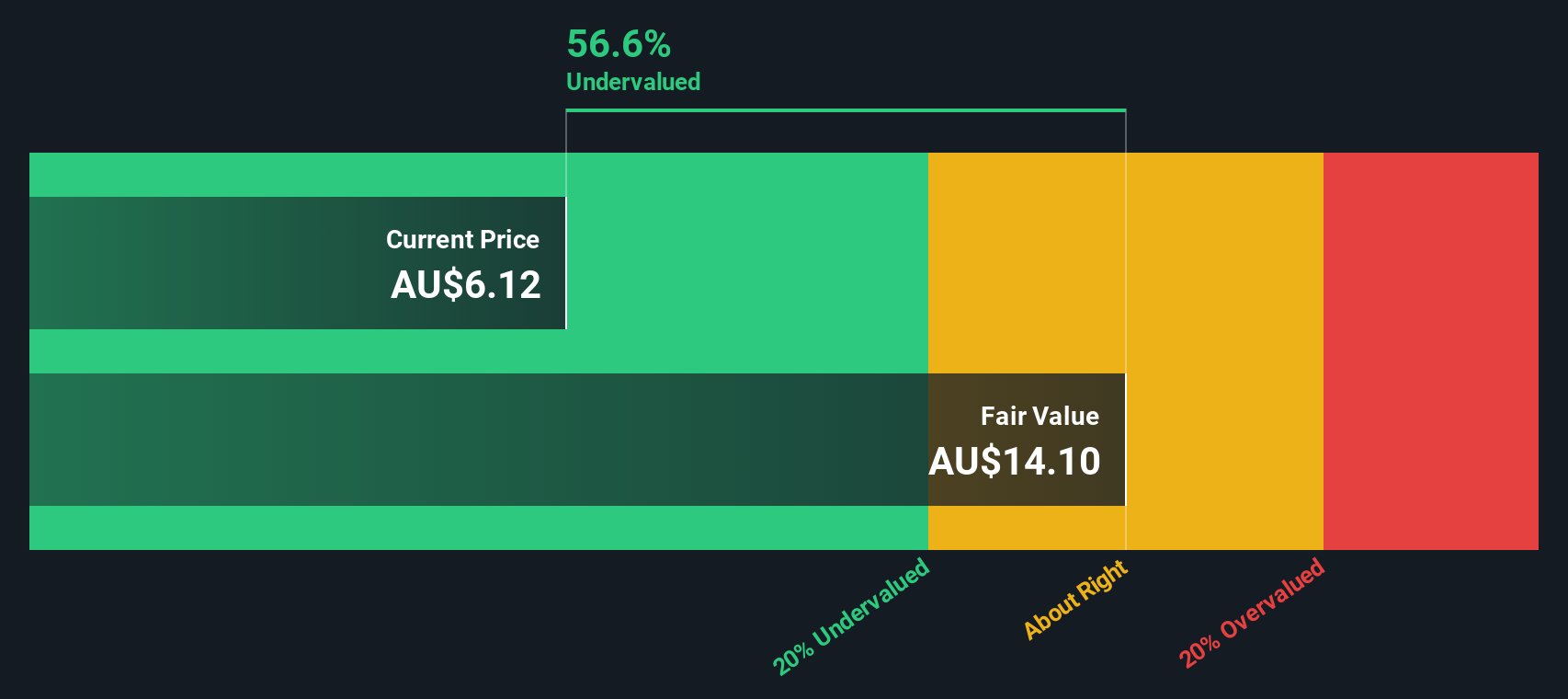

Overview: Elders operates as an agribusiness providing agricultural products and services through its branch network, wholesale products, and feed and processing services, with a market capitalization of A$1.54 billion.

Operations: Branch Network is the primary revenue stream, generating A$2.63 billion, followed by Wholesale Products with A$360.81 million and Feed and Processing Services at A$138.22 million. Over recent periods, the gross profit margin has shown fluctuations, reaching 19.90% in September 2024 from a low of 17.29% in March 2023. Operating expenses are significant, with Sales & Marketing consistently being a major component, impacting overall profitability alongside varying non-operating expenses.

PE: 29.2x

Elders, a key player in the agriculture sector, recently completed a follow-on equity offering raising A$245.76 million, reflecting insider confidence in its potential. Despite facing challenges with lower profit margins of 1.4% from last year's 3%, the company is forecasted to grow earnings by 24.71% annually. While debt coverage by operating cash flow remains an issue, Elders' strategic board changes and anticipated growth suggest promising prospects for those eyeing undervalued opportunities in Asia's market landscape.

- Click here to discover the nuances of Elders with our detailed analytical valuation report.

Gain insights into Elders' historical performance by reviewing our past performance report.

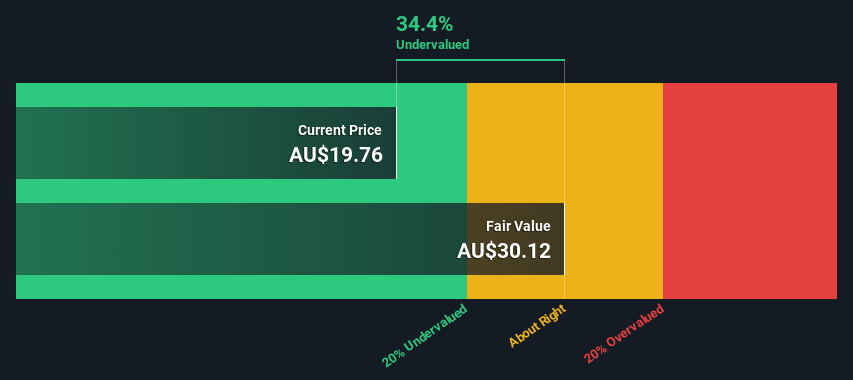

Perpetual (ASX:PPT)

Simply Wall St Value Rating: ★★★★★★

Overview: Perpetual is a diversified financial services company primarily engaged in asset management and wealth management, with a market cap of A$1.91 billion.

Operations: The company's revenue is primarily driven by Asset Management and Wealth Management, with significant contributions from Group Support Service. Over recent periods, the net income margin has shown a declining trend, reaching -35.87% in December 2024. Operating expenses have consistently increased alongside non-operating expenses, impacting overall profitability.

PE: -4.4x

Perpetual, a player in the financial services sector, is drawing attention as an undervalued stock with insider confidence highlighted by recent share purchases. Despite a dip in net income to A$12 million for H1 2025 from A$34.5 million the previous year, its earnings are projected to grow significantly at 62% annually. The company faces challenges with higher-risk funding due to reliance on external borrowing and has decreased its dividend payout. M&A rumors suggest potential interest in its Wealth Management arm, indicating possible strategic shifts ahead.

- Click to explore a detailed breakdown of our findings in Perpetual's valuation report.

Understand Perpetual's track record by examining our Past report.

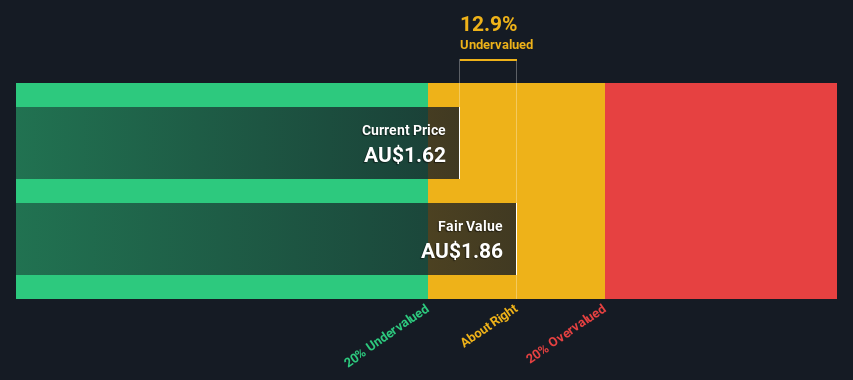

Viva Energy Group (ASX:VEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Viva Energy Group is an Australian company engaged in the supply, distribution, and marketing of fuel and convenience products with a market capitalization of A$4.49 billion.

Operations: The company derives its revenue primarily from the Commercial & Industrial segment, followed by Convenience & Mobility and Energy & Infrastructure. Over recent periods, the gross profit margin has shown variability, with a notable figure of 9.62% as of December 2024. Operating expenses have consistently increased over time, impacting profitability.

PE: -35.1x

Viva Energy Group, a key player in Asia's energy sector, has seen insider confidence with share purchases over the past year. Despite a challenging financial position with earnings not covering interest payments and reliance on external borrowing for funding, Viva's sales surged to A$30.14 billion in 2024 from A$26.74 billion the previous year. However, they reported a net loss of A$76.3 million versus a profit last year, affecting their dividend payout to 3.9 cents per share for December 2024 end period. Earnings are projected to grow by over 41% annually, highlighting potential future growth despite current challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Viva Energy Group.

Explore historical data to track Viva Energy Group's performance over time in our Past section.

Make It Happen

- Delve into our full catalog of 44 Undervalued Asian Small Caps With Insider Buying here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elders might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELD

Elders

Provides agricultural products and services to rural and regional customers primarily in Australia.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives