- Australia

- /

- Metals and Mining

- /

- ASX:CTM

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The ASX 200 is showing resilience, climbing over 37.9 points to around 8,417, even as global markets face turbulence from a tech sell-off sparked by developments in AI technology. In such a fluctuating market landscape, understanding what makes a good stock is crucial—particularly when considering the unique opportunities presented by penny stocks. Although the term 'penny stock' may seem outdated, these smaller or newer companies can still offer significant potential for growth when they are built on strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.945 | A$316.68M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$240.95M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.985 | A$110.44M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Centaurus Metals (ASX:CTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaurus Metals Limited is involved in the exploration and evaluation of mineral resource properties in Brazil, with a market cap of A$208.61 million.

Operations: Currently, there are no reported revenue segments for Centaurus Metals Limited.

Market Cap: A$208.61M

Centaurus Metals Limited, with a market cap of A$208.61 million, is a pre-revenue company involved in mineral exploration in Brazil. Despite being debt-free and having short-term assets (A$27.8M) that exceed its liabilities, the company faces financial challenges due to its unprofitability and negative return on equity (-56.73%). It has less than a year of cash runway based on current free cash flow trends, although it can extend this to 1.1 years if cost reductions continue at historical rates. The management team is experienced with an average tenure of 5.2 years, offering some stability amidst financial uncertainties.

- Take a closer look at Centaurus Metals' potential here in our financial health report.

- Learn about Centaurus Metals' future growth trajectory here.

Catalyst Metals (ASX:CYL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catalyst Metals Limited is an Australian company focused on exploring and evaluating mineral properties, with a market cap of A$804.50 million.

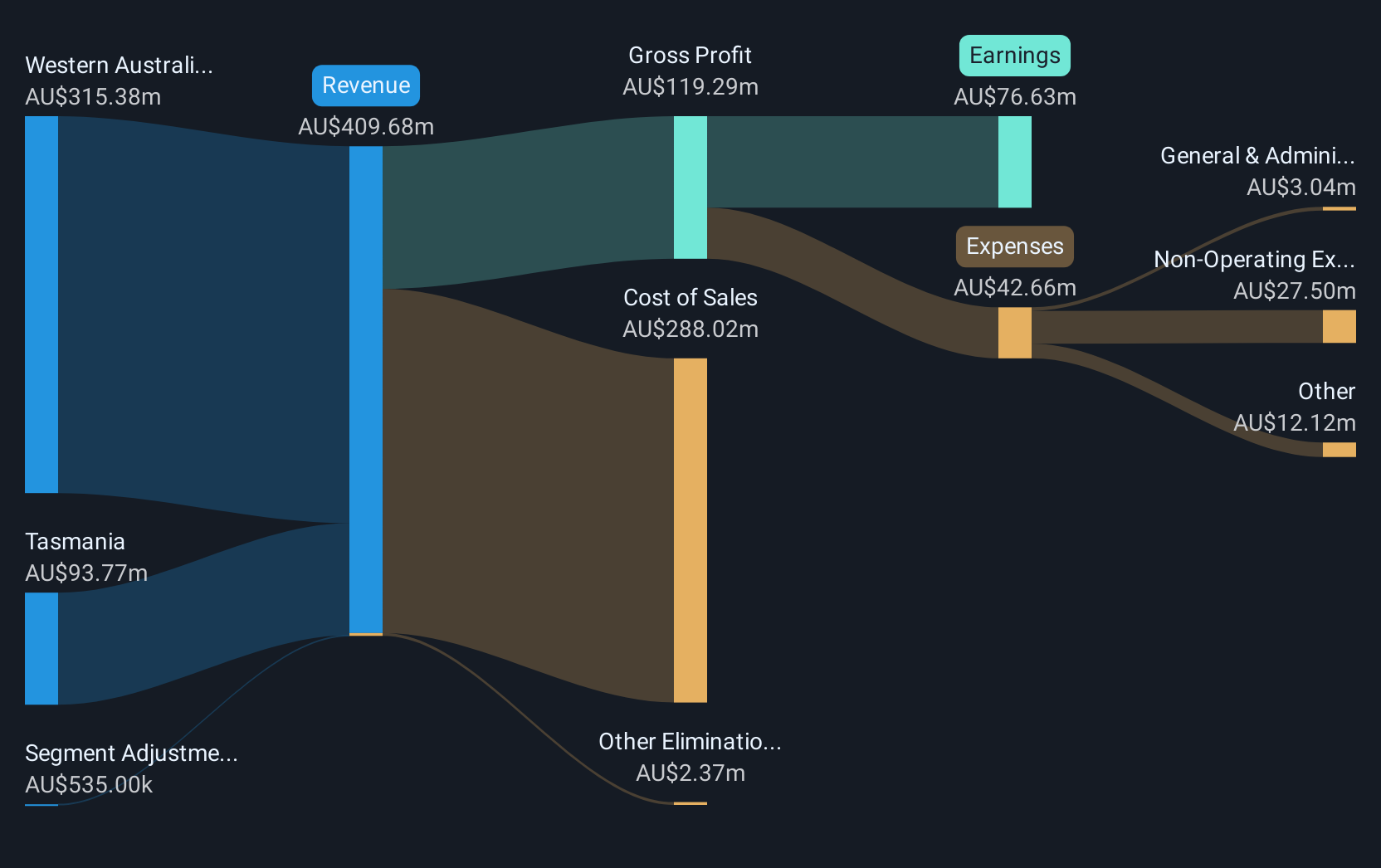

Operations: Catalyst Metals generates revenue primarily from its operations in Western Australia (A$243.77 million) and Tasmania (A$75.08 million).

Market Cap: A$804.5M

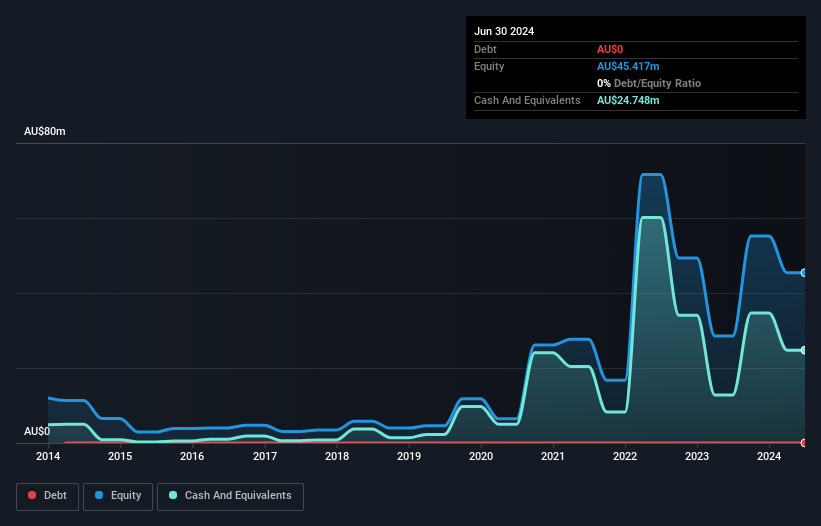

Catalyst Metals Limited, with a market cap of A$804.50 million, has transitioned to profitability recently, distinguishing it within the metals and mining sector. The company's debt is well-covered by operating cash flow, indicating strong financial management. However, its short-term assets (A$76.3M) do not fully cover short-term liabilities (A$89.9M), posing some liquidity concerns despite long-term liabilities being covered by assets. Earnings are forecasted to grow significantly at 28.4% annually, reflecting potential upside for investors seeking growth in penny stocks. Additionally, Catalyst's experienced management and board provide strategic stability as the company navigates its financial landscape.

- Click here and access our complete financial health analysis report to understand the dynamics of Catalyst Metals.

- Explore Catalyst Metals' analyst forecasts in our growth report.

Strike Energy (ASX:STX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Strike Energy Limited is an independent gas producer focused on exploring and developing oil and gas resources in Australia, with a market cap of A$673.72 million.

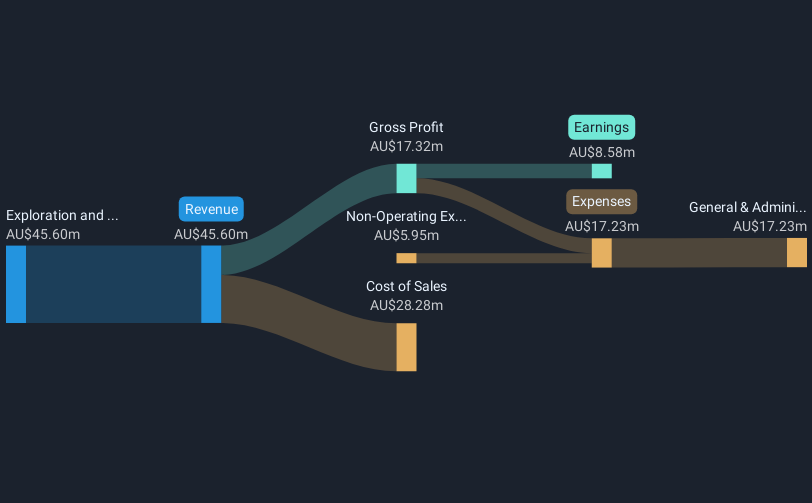

Operations: The company's revenue segment includes Exploration and Corporate activities, generating A$45.60 million.

Market Cap: A$673.72M

Strike Energy Limited, with a market cap of A$673.72 million, has recently achieved profitability, marking a significant milestone in its financial journey. The company’s short-term assets (A$62.8M) comfortably cover both short-term (A$45.1M) and long-term liabilities (A$29.6M), indicating robust liquidity management. Recent developments include the Walyering East-1 exploration well reaching total depth and securing A$60 million in debt financing from Macquarie Bank for the South Erregulla project, enhancing its Perth Basin Gas Acceleration Strategy. Despite low return on equity at 1.9%, Strike's earnings are forecast to grow substantially at 38.85% annually, suggesting potential growth prospects for investors interested in penny stocks within the oil and gas sector.

- Click to explore a detailed breakdown of our findings in Strike Energy's financial health report.

- Assess Strike Energy's future earnings estimates with our detailed growth reports.

Key Takeaways

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,023 more companies for you to explore.Click here to unveil our expertly curated list of 1,026 ASX Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTM

Centaurus Metals

Engages in the exploration and evaluation of mineral resource properties Brazil.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives