- Australia

- /

- Diversified Financial

- /

- ASX:SOL

Is Now The Time To Put Washington H. Soul Pattinson (ASX:SOL) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Washington H. Soul Pattinson (ASX:SOL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Washington H. Soul Pattinson

Washington H. Soul Pattinson's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Washington H. Soul Pattinson has grown EPS by 42% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. To cut to the chase Washington H. Soul Pattinson's EBIT margins dropped last year, and so did its revenue. That will not make it easy to grow profits, to say the least.

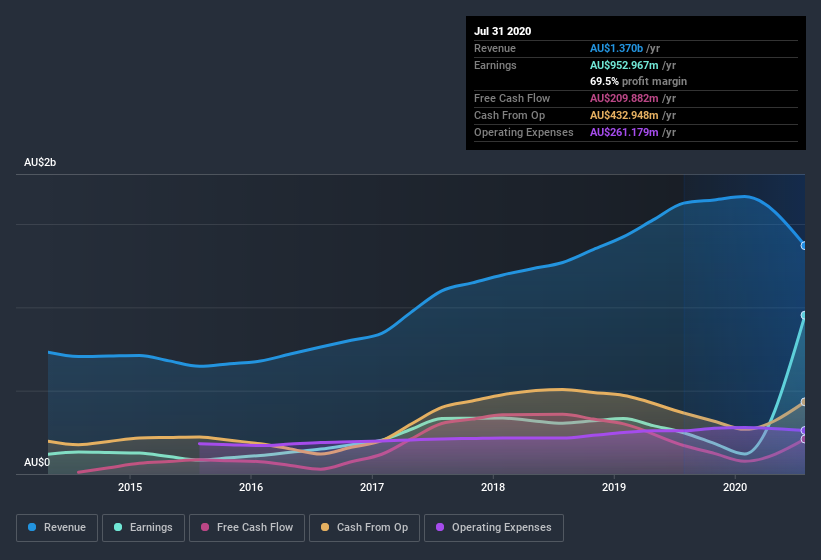

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Washington H. Soul Pattinson EPS 100% free.

Are Washington H. Soul Pattinson Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -AU$425k worth of shares. But that's far less than the AU$11m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Washington H. Soul Pattinson's future. We also note that it was the MD, CEO & Executive Director, Todd Barlow, who made the biggest single acquisition, paying AU$3.0m for shares at about AU$28.98 each.

The good news, alongside the insider buying, for Washington H. Soul Pattinson bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at AU$467m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Washington H. Soul Pattinson Worth Keeping An Eye On?

Washington H. Soul Pattinson's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Washington H. Soul Pattinson deserves timely attention. However, before you get too excited we've discovered 3 warning signs for Washington H. Soul Pattinson (1 is potentially serious!) that you should be aware of.

As a growth investor I do like to see insider buying. But Washington H. Soul Pattinson isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Washington H. Soul Pattinson, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Washington H. Soul Pattinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SOL

Washington H. Soul Pattinson

An investment company, engages in investing various industries and asset classes in Australia.

Flawless balance sheet average dividend payer.