- Australia

- /

- Construction

- /

- ASX:VNT

ASX Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

The Australian market is experiencing a cautious phase, with ASX 200 futures indicating a slight decline and investors closely monitoring the February reporting season. Despite the broader market's fluctuations, penny stocks continue to capture interest due to their potential for growth at lower price points. While the term "penny stocks" might seem dated, it still represents an intriguing segment where smaller or newer companies offer opportunities for those seeking value with solid financials and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Perenti (ASX:PRN) | A$1.16 | A$1.07B | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.45 | A$279.07M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.34 | A$362.44M | ★★★★☆☆ |

| GTN (ASX:GTN) | A$0.54 | A$106.04M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.05 | A$333.78M | ★★★★★★ |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.745 | A$461.15M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.21 | A$153.77M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.03 | A$64.14M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.00 | A$94.35M | ★★★★★★ |

Click here to see the full list of 1,034 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Genesis Minerals (ASX:GMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia, with a market capitalization of A$3.61 billion.

Operations: The company generates revenue of A$561.40 million from its mineral production, exploration, and development activities.

Market Cap: A$3.61B

Genesis Minerals has demonstrated significant growth, becoming profitable this year with earnings increasing by 22.6% annually over the past five years. The company reported a substantial rise in gold production and sales for the half-year ending December 2024, with net income reaching A$59.8 million from A$24.05 million a year ago. Despite having low Return on Equity at 11%, Genesis trades below its estimated fair value and maintains strong financial health, with short-term assets exceeding liabilities and debt well-covered by cash flow. Management is experienced, though the board is relatively new in tenure.

- Take a closer look at Genesis Minerals' potential here in our financial health report.

- Assess Genesis Minerals' future earnings estimates with our detailed growth reports.

Red Sky Energy (ASX:ROG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Red Sky Energy Limited (ASX:ROG) is an oil and gas exploration and development company focused on acquiring, drilling, and developing resources in the United States and Australia, with a market cap of A$32.53 million.

Operations: Currently, there are no reported revenue segments for Red Sky Energy Limited.

Market Cap: A$32.53M

Red Sky Energy, with a market cap of A$32.53 million, remains pre-revenue, focusing on oil and gas exploration in the US and Australia. Despite its unprofitability, the company has reduced losses by 5.1% annually over five years and maintains a stable cash runway for over three years without incurring debt. The management team is experienced, averaging 6.6 years in tenure, which provides stability amidst high share price volatility and industry challenges. Although short-term assets cover both short- and long-term liabilities comfortably, the negative return on equity highlights ongoing profitability hurdles.

- Unlock comprehensive insights into our analysis of Red Sky Energy stock in this financial health report.

- Gain insights into Red Sky Energy's past trends and performance with our report on the company's historical track record.

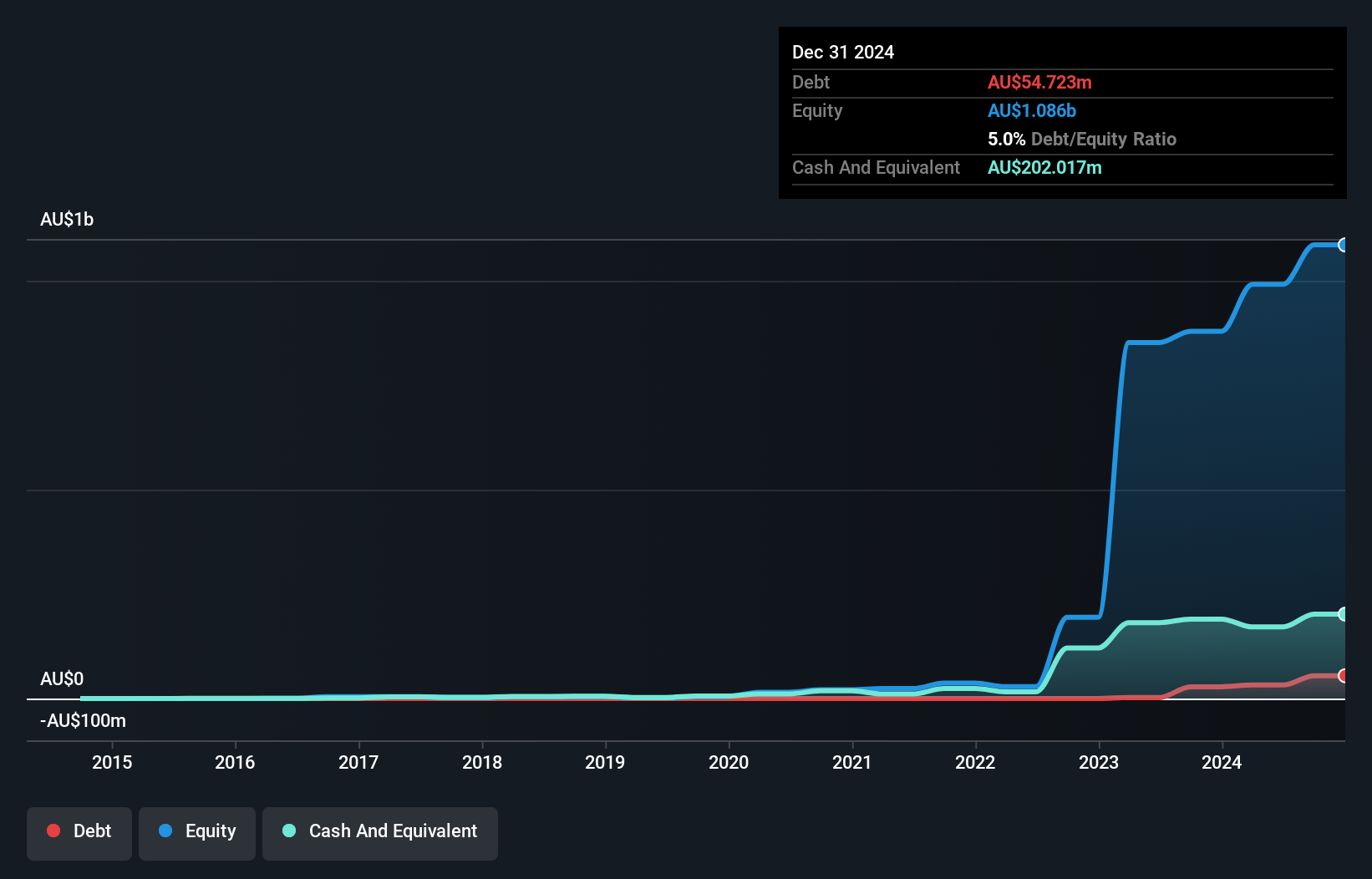

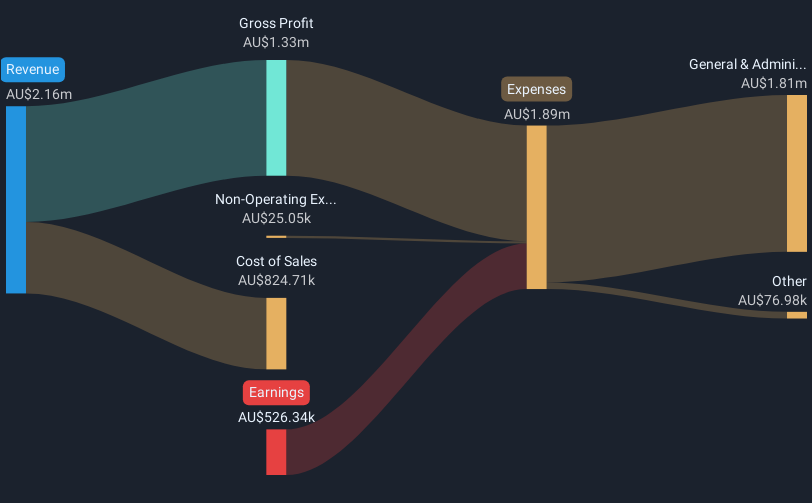

Ventia Services Group (ASX:VNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ventia Services Group Limited offers infrastructure services in Australia and New Zealand, with a market cap of A$3.64 billion.

Operations: The company's revenue is derived from four main segments: Transport (A$632.4 million), Telecommunications (A$1.58 billion), Infrastructure Services (A$1.32 billion), and Defence and Social Infrastructure (A$2.58 billion).

Market Cap: A$3.64B

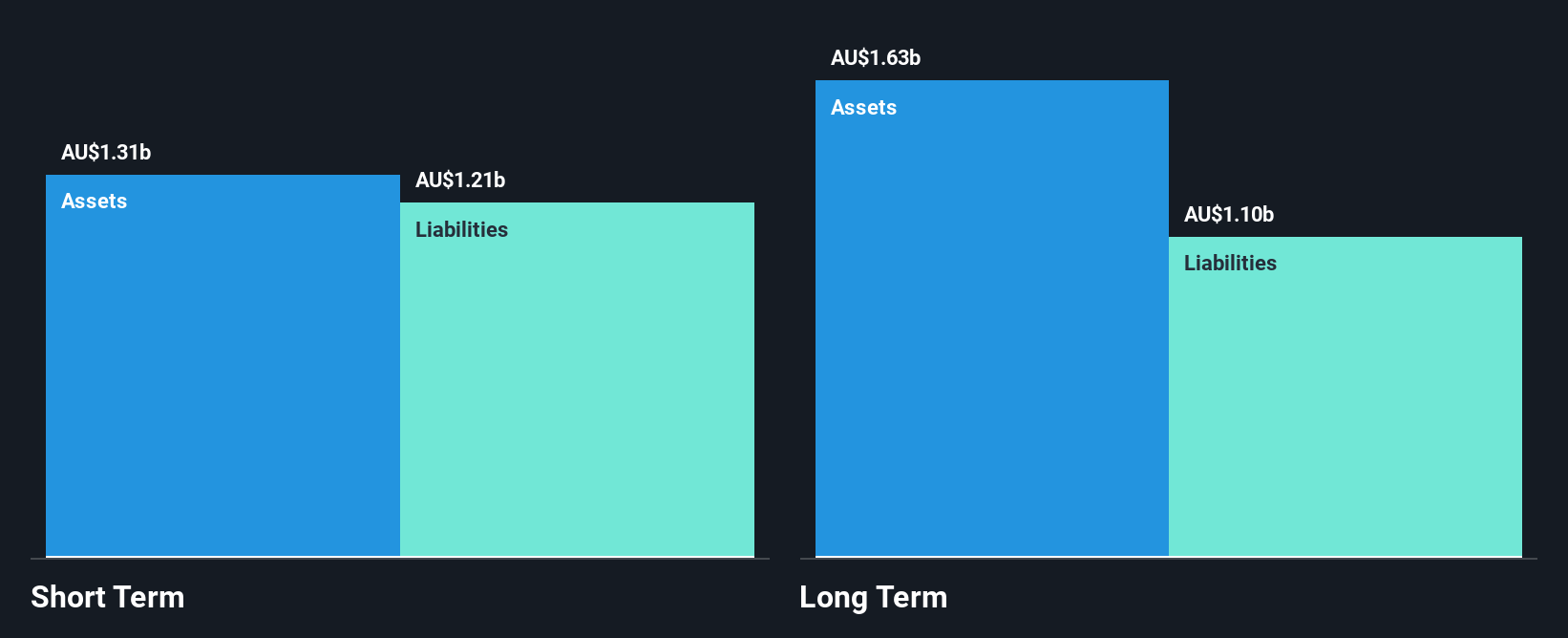

Ventia Services Group, with a market cap of A$3.64 billion, offers infrastructure services across four segments and demonstrates strong financial health. The company trades at 45.7% below its estimated fair value and has well-covered interest payments on debt by EBIT (9x coverage). Although it holds a high net debt to equity ratio of 55.8%, Ventia's short-term assets exceed both short- and long-term liabilities, indicating solid liquidity. Recent earnings showed increased sales (A$6.11 billion) and net income (A$220.2 million), while the company announced a share repurchase program worth A$100 million alongside pursuing bolt-on acquisitions for growth acceleration.

- Get an in-depth perspective on Ventia Services Group's performance by reading our balance sheet health report here.

- Learn about Ventia Services Group's future growth trajectory here.

Where To Now?

- Access the full spectrum of 1,034 ASX Penny Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VNT

Ventia Services Group

Provides infrastructure services in Australia and New Zealand.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives