With just five trading days until Christmas, the Australian Securities Exchange (ASX) closed up 0.78% at 8,314 points, with sectors like Industrials, Real Estate, and IT leading the way. For investors willing to explore beyond the prominent market players, penny stocks—often representing smaller or newer companies—can still offer intriguing opportunities. In this article, we highlight three such stocks that could pair financial resilience with potential long-term growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$316.27M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.915 | A$313.42M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.59 | A$789.03M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$219.66M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.83 | A$103.2M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.92 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,050 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Pure Hydrogen (ASX:PH2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pure Hydrogen Corporation Limited focuses on developing hydrogen fuel and natural gas energy projects in Australia and Botswana, with a market cap of A$41.20 million.

Operations: The company's revenue segment is Energy Development, which generated A$1.36 million.

Market Cap: A$41.2M

Pure Hydrogen Corporation Limited, with a market cap of A$41.20 million, operates in the energy development sector but remains pre-revenue with less than US$1 million in revenue. The company has experienced shareholder dilution over the past year and continues to operate at a loss, reporting a net loss of A$3.92 million for the year ending June 30, 2024. Despite this, it maintains strong liquidity with short-term assets exceeding both short and long-term liabilities significantly. Recent activities include presenting at international conferences and completing an equity offering to raise A$1.5 million for further development initiatives.

- Click to explore a detailed breakdown of our findings in Pure Hydrogen's financial health report.

- Review our growth performance report to gain insights into Pure Hydrogen's future.

Reckon (ASX:RKN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reckon Limited offers software solutions in Australia, the United States, and internationally with a market cap of A$64.01 million.

Operations: The company generates revenue from its Business Group, which accounts for A$41.68 million, and the Practice Management Legal Group, contributing A$11.99 million.

Market Cap: A$64.01M

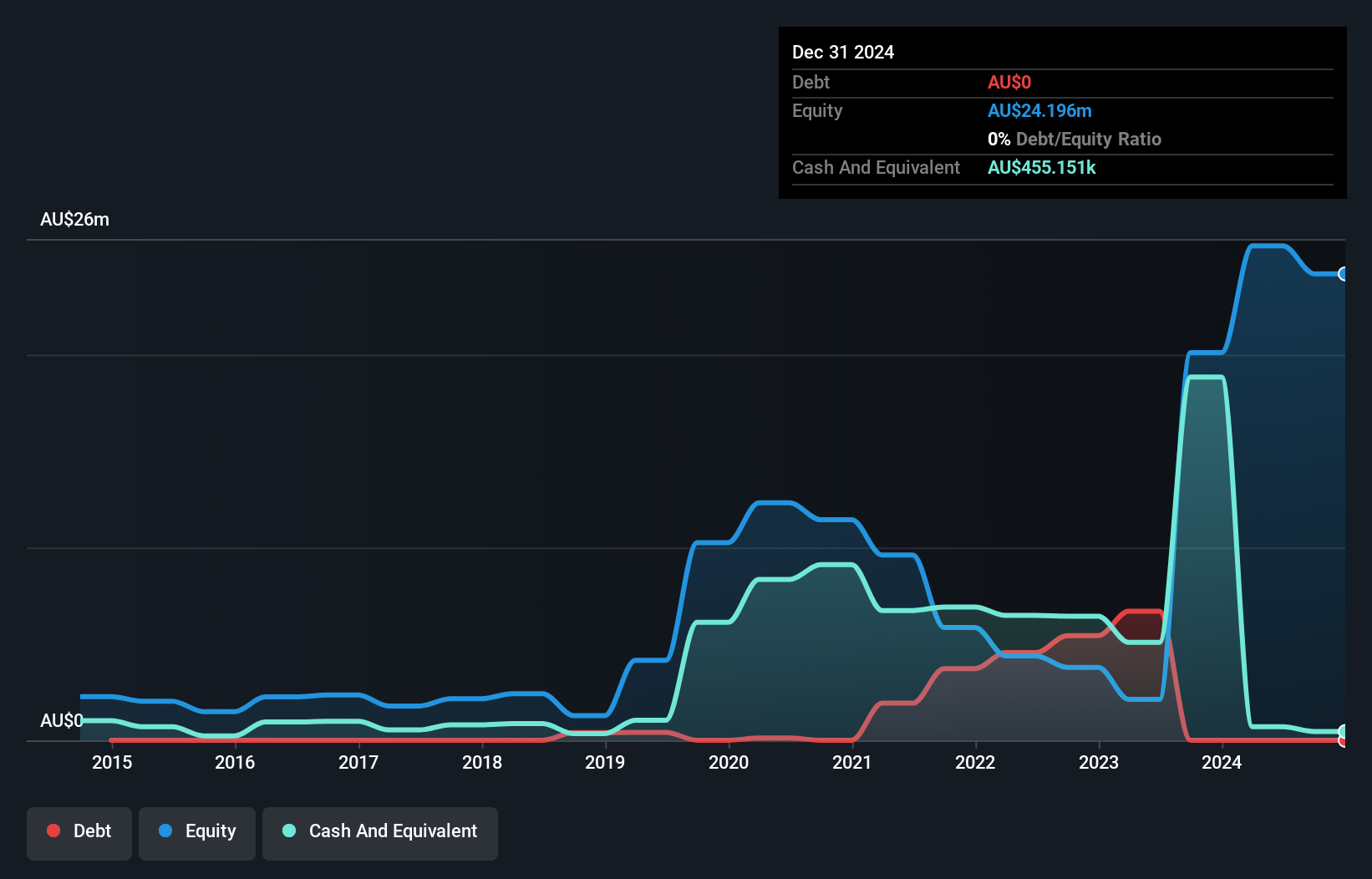

Reckon Limited, with a market cap of A$64.01 million, offers software solutions and generates significant revenue from its Business Group (A$41.68 million) and Practice Management Legal Group (A$11.99 million). The company is debt-free, having reduced its debt to equity ratio from 176% five years ago to zero today. Despite stable weekly volatility at 3%, Reckon's profitability has been challenged by declining earnings over the past five years and negative growth last year (-3.8%). Short-term assets (A$4.8M) fall short in covering both short-term liabilities (A$12.8M) and long-term liabilities (A$5.6M).

- Jump into the full analysis health report here for a deeper understanding of Reckon.

- Assess Reckon's future earnings estimates with our detailed growth reports.

Venus Metals (ASX:VMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Venus Metals Corporation Limited is involved in the exploration of mineral tenements in Western Australia, with a market cap of A$12.75 million.

Operations: The company's revenue is derived from the exploration of minerals, amounting to A$0.03 million.

Market Cap: A$12.75M

Venus Metals Corporation Limited, with a market cap of A$12.75 million, is pre-revenue and has recently become profitable, reporting a net income of A$29.47 million for the year ending June 30, 2024. The company boasts an outstanding return on equity at 114.9% and remains debt-free, enhancing its financial stability despite shareholder dilution over the past year. Its short-term assets (A$1.1M) comfortably cover both short-term (A$397.7K) and long-term liabilities (A$26.3K). Recent activities include a follow-on equity offering raising A$0.416 million to support ongoing operations and growth initiatives amidst increased share price volatility.

- Get an in-depth perspective on Venus Metals' performance by reading our balance sheet health report here.

- Gain insights into Venus Metals' historical outcomes by reviewing our past performance report.

Next Steps

- Investigate our full lineup of 1,050 ASX Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RKN

Reckon

Provides software solutions in Australia, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives