- Australia

- /

- Oil and Gas

- /

- ASX:PDN

Even though Paladin Energy (ASX:PDN) has lost AU$477m market cap in last 7 days, shareholders are still up 375% over 3 years

Paladin Energy Ltd (ASX:PDN) shareholders might be concerned after seeing the share price drop 25% in the last quarter. But that doesn't displace its brilliant performance over three years. Over that time, we've been excited to watch the share price climb an impressive 365%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The share price action could signify that the business itself is dramatically improved, in that time.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Paladin Energy

SWOT Analysis for Paladin Energy

- Debt is well covered by earnings.

- No major weaknesses identified for PDN.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Trading below our estimate of fair value by more than 20%.

- Debt is not well covered by operating cash flow.

Paladin Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Paladin Energy's revenue trended up 82% each year over three years. That's much better than most loss-making companies. And it's not just the revenue that is taking off. The share price is up 67% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Paladin Energy can sometimes sustain strong growth for many years. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

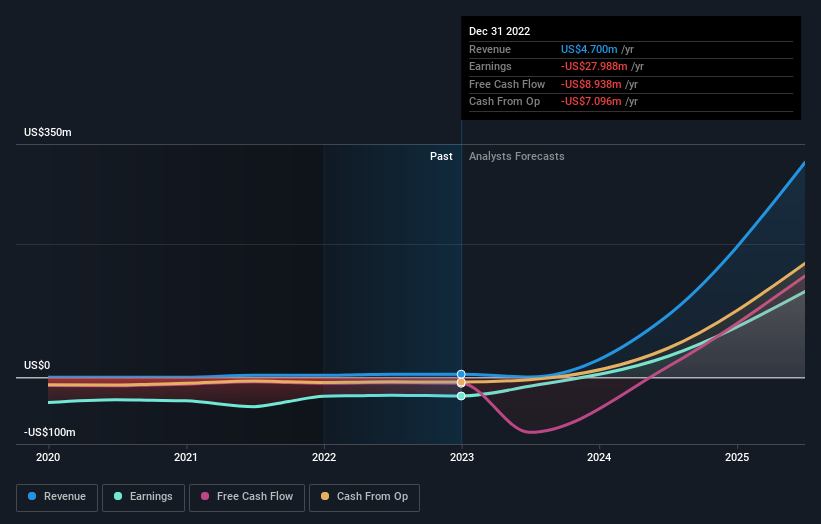

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Paladin Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Paladin Energy's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Paladin Energy's TSR, at 375% is higher than its share price return of 365%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Paladin Energy shareholders are down 33% for the year, but the market itself is up 2.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 26%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Paladin Energy , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PDN

Paladin Energy

Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives