- Australia

- /

- Metals and Mining

- /

- ASX:STK

3 Promising ASX Penny Stocks With Market Caps Under A$500M

Reviewed by Simply Wall St

The Australian market saw a modestly positive day with the ASX 200 finishing slightly in the green, driven by gains in materials while financials lagged. Despite the mixed performance across sectors, investors continue to explore opportunities beyond well-known names. Penny stocks, though an older term, still point to smaller or newer companies that can offer significant value. By focusing on those with strong financial foundations and growth potential, investors can uncover promising opportunities within this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.59 | A$122.18M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.86 | A$53.55M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$415.71M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.18 | A$234.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.066 | A$34.76M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.75 | A$358.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.30 | A$1.41B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 422 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Fenix Resources (ASX:FEX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fenix Resources Limited operates in Western Australia, offering mining, logistics, and port services, with a market cap of A$357.35 million.

Operations: The company generates revenue of A$316.09 million from its mining operations.

Market Cap: A$357.35M

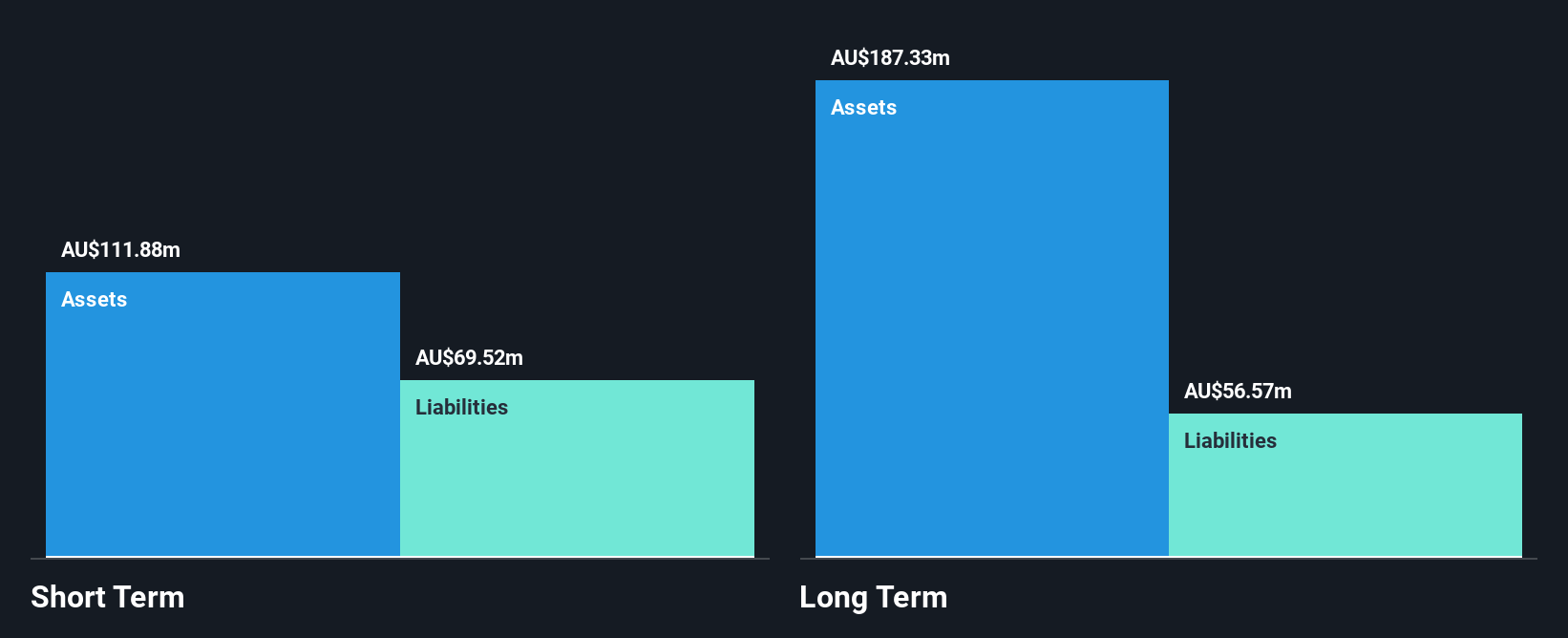

Fenix Resources, with a market cap of A$357.35 million and revenue of A$316.09 million, operates in Western Australia's mining sector. Despite a decline in net profit margins from 13% to 1.7% and negative earnings growth over the past year, the company maintains satisfactory debt levels with strong interest coverage by EBIT (4.3x). Its board is experienced, although management tenure is relatively short at 1.3 years on average. The company's operating cash flow covers its debt well (97.4%), and it trades below estimated fair value by 29%, indicating potential for value investors despite recent volatility stability at 9%.

- Click to explore a detailed breakdown of our findings in Fenix Resources' financial health report.

- Review our growth performance report to gain insights into Fenix Resources' future.

Marmota (ASX:MEU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marmota Limited is an Australian company focused on the exploration of mineral properties, with a market cap of A$84.84 million.

Operations: Marmota Limited does not report any specific revenue segments.

Market Cap: A$84.84M

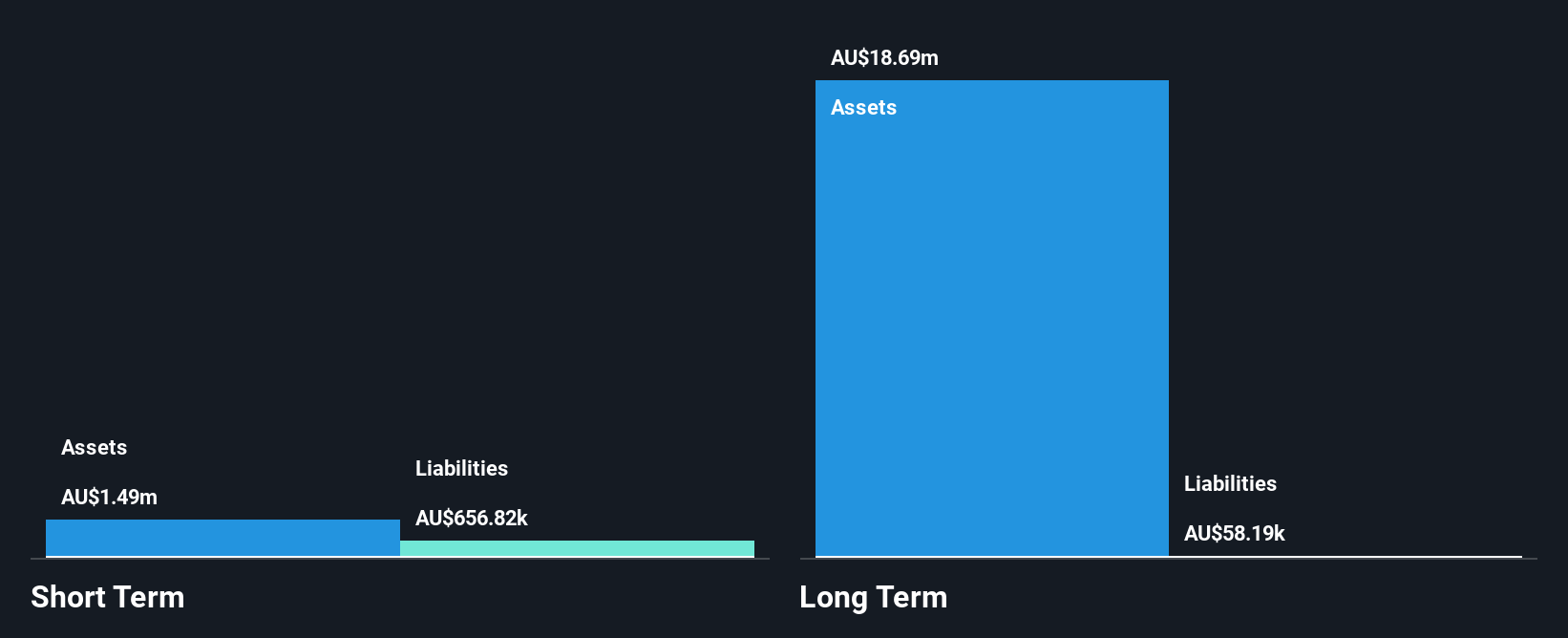

Marmota Limited, with a market cap of A$84.84 million, is pre-revenue and focuses on mineral exploration. The company reported minimal revenue of A$0.13 million for the year ending June 2025, with a net loss increasing to A$1.71 million from the previous year. Marmota operates debt-free and has sufficient cash runway for over a year despite its unprofitability and volatile share price in recent months. Its management team is seasoned, averaging 6.1 years in tenure, while short-term assets significantly exceed liabilities, providing some financial stability amidst its high-risk profile typical of penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Marmota.

- Understand Marmota's track record by examining our performance history report.

Strickland Metals (ASX:STK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Strickland Metals Limited is an Australian company focused on the exploration of mineral resources, with a market cap of A$452.47 million.

Operations: Strickland Metals Limited has not reported any revenue segments.

Market Cap: A$452.47M

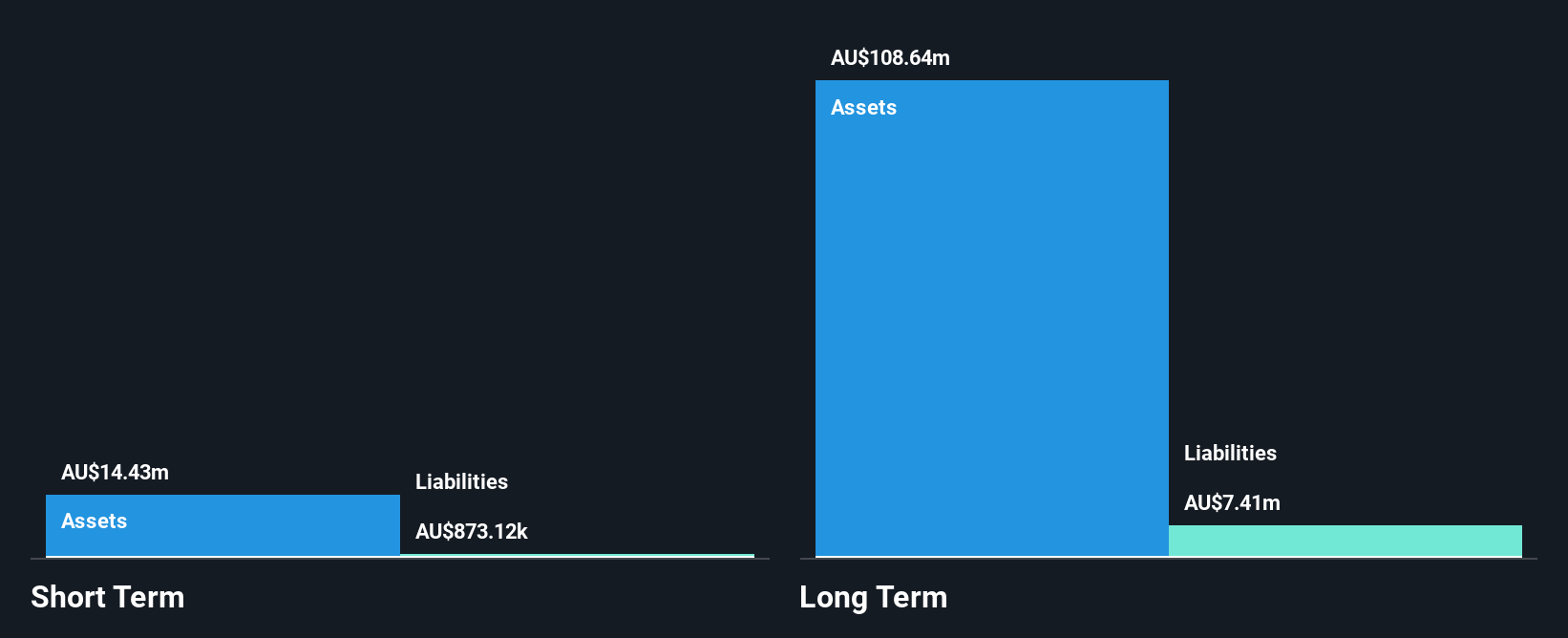

Strickland Metals Limited, with a market cap of A$452.47 million, has become profitable over the past year but remains pre-revenue, indicating potential volatility typical of penny stocks. The company is debt-free and maintains strong short-term assets (A$67.5M) compared to its liabilities. However, earnings are forecasted to decline significantly in the coming years. Recent executive changes include the appointment of James Dent as Senior Exploration Geologist, bringing valuable expertise to their exploration endeavors following asset sales like the Yandal Project. Despite stable weekly volatility and no significant shareholder dilution recently, insider selling could be a concern for investors.

- Take a closer look at Strickland Metals' potential here in our financial health report.

- Explore Strickland Metals' analyst forecasts in our growth report.

Where To Now?

- Jump into our full catalog of 422 ASX Penny Stocks here.

- Ready For A Different Approach? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STK

Strickland Metals

Engages in the exploration of mineral resources in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives