- Australia

- /

- Energy Services

- /

- ASX:MCE

How Does Matrix Composites & Engineering's (ASX:MCE) CEO Pay Compare With Company Performance?

Aaron Begley has been the CEO of Matrix Composites & Engineering Ltd (ASX:MCE) since 2009, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Matrix Composites & Engineering.

View our latest analysis for Matrix Composites & Engineering

Comparing Matrix Composites & Engineering Ltd's CEO Compensation With the industry

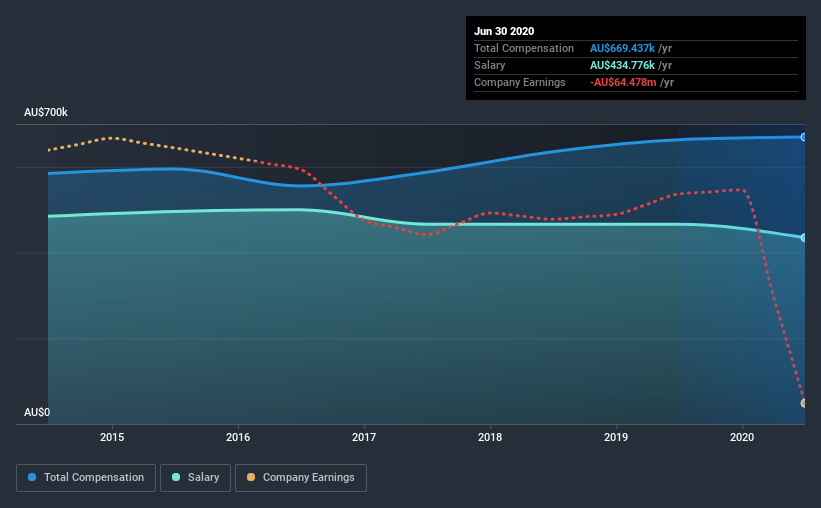

According to our data, Matrix Composites & Engineering Ltd has a market capitalization of AU$15m, and paid its CEO total annual compensation worth AU$669k over the year to June 2020. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is AU$434.8k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under AU$259m, the reported median total CEO compensation was AU$648k. So it looks like Matrix Composites & Engineering compensates Aaron Begley in line with the median for the industry. Moreover, Aaron Begley also holds AU$1.6m worth of Matrix Composites & Engineering stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$435k | AU$466k | 65% |

| Other | AU$235k | AU$197k | 35% |

| Total Compensation | AU$669k | AU$663k | 100% |

Speaking on an industry level, nearly 66% of total compensation represents salary, while the remainder of 34% is other remuneration. Although there is a difference in how total compensation is set, Matrix Composites & Engineering more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Matrix Composites & Engineering Ltd's Growth Numbers

Matrix Composites & Engineering Ltd has reduced its earnings per share by 33% a year over the last three years. It saw its revenue drop 28% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Matrix Composites & Engineering Ltd Been A Good Investment?

Since shareholders would have lost about 75% over three years, some Matrix Composites & Engineering Ltd investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we touched on above, Matrix Composites & Engineering Ltd is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for Matrix Composites & Engineering (1 is concerning!) that you should be aware of before investing here.

Switching gears from Matrix Composites & Engineering, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Matrix Composites & Engineering, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MCE

Matrix Composites & Engineering

Engages in the design, manufacture, and supply of engineered composite products in Australia, Brazil, the United States, the United Kingdom, Japan, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026