- Australia

- /

- Hospitality

- /

- ASX:HLO

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Australian stock market wraps up 2024, traders are witnessing a modest decline on the last trading day, with the ASX 200 futures indicating a dip amid global market weakness. Despite this end-of-year volatility, the local index has experienced an overall gain of 8.8% throughout the year. For investors interested in smaller or newer companies, penny stocks—though an outdated term—remain relevant as they can offer unique growth opportunities when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$237.13M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$319.37M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.745 | A$855.19M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.8975 | A$106.44M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company operating in Australia, New Zealand, and internationally, with a market cap of A$318.31 million.

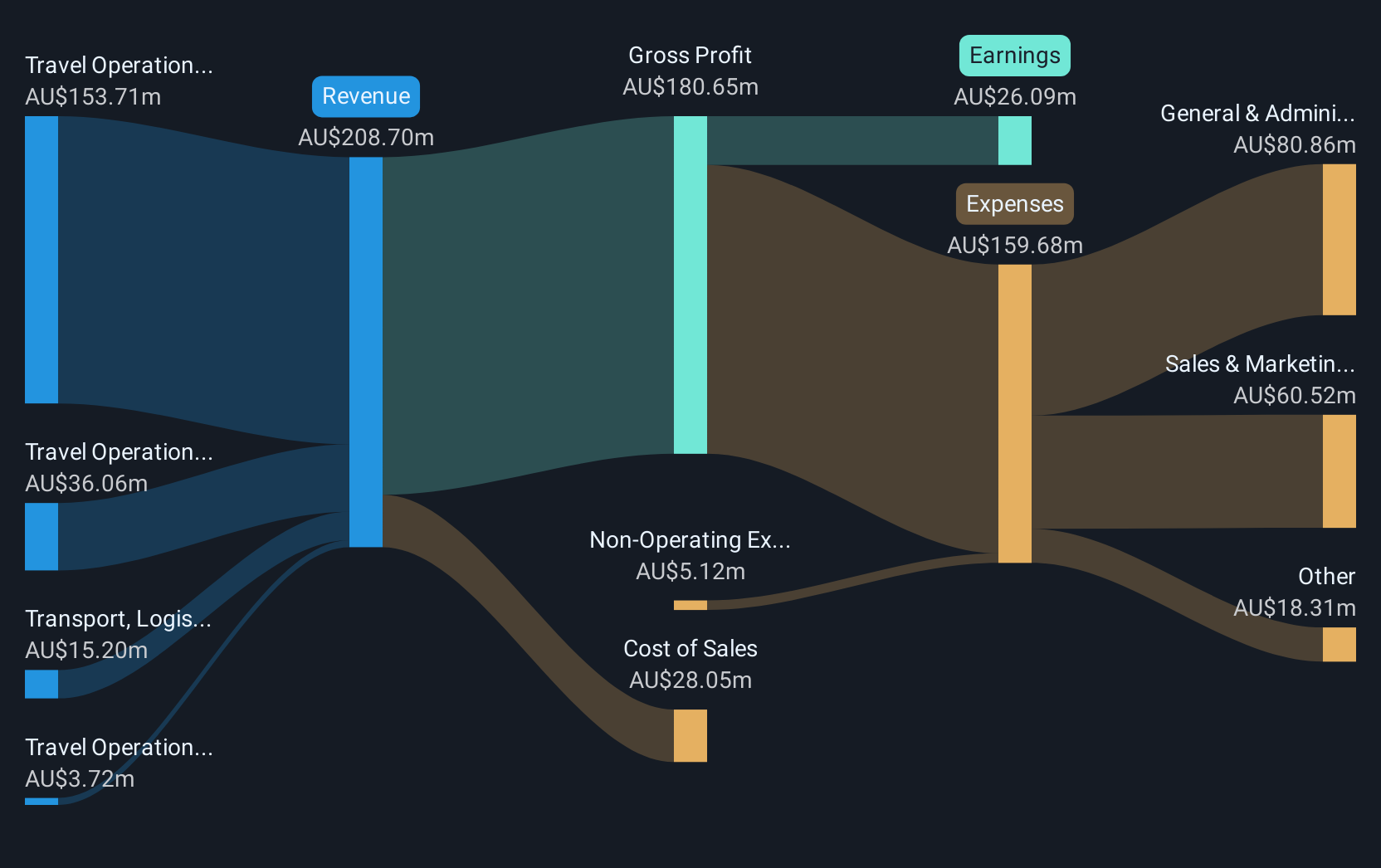

Operations: The company's revenue is derived from Travel Operations in Australia (A$158.66 million), New Zealand (A$37.71 million), and the Rest of World (A$3.74 million), along with Transport, Logistics, and Warehousing services contributing A$16.74 million.

Market Cap: A$318.31M

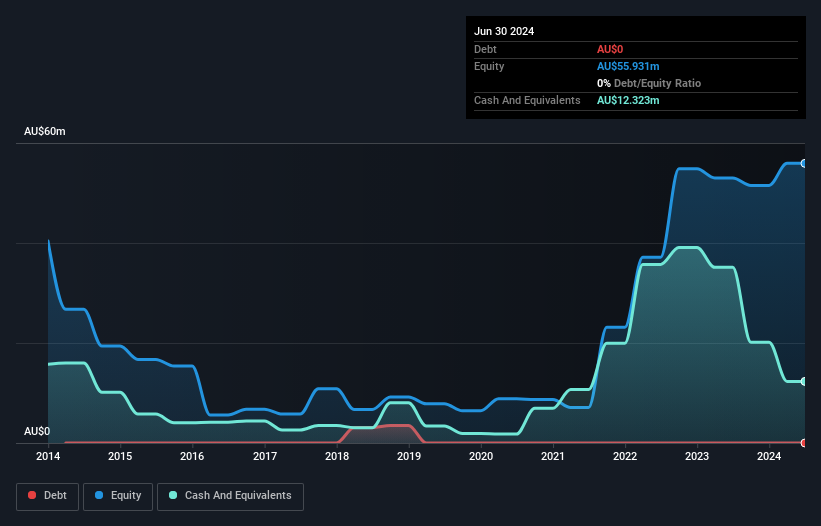

Helloworld Travel Limited presents an intriguing opportunity in the penny stock landscape, with a market cap of A$318.31 million and operations spanning Australia, New Zealand, and internationally. The company is debt-free and has demonstrated strong earnings growth, with a significant 59.4% increase over the past year, surpassing industry averages. Despite shareholder dilution in the past year and low return on equity at 9.4%, Helloworld's financial position remains robust as short-term assets exceed liabilities. Analysts anticipate further price appreciation by nearly 48%, indicating potential value relative to peers despite its unstable dividend history.

- Take a closer look at Helloworld Travel's potential here in our financial health report.

- Gain insights into Helloworld Travel's future direction by reviewing our growth report.

Melbana Energy (ASX:MAY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Melbana Energy Limited is involved in oil and gas exploration in Cuba and Australia, with a market cap of A$94.37 million.

Operations: Melbana Energy Limited does not report specific revenue segments.

Market Cap: A$94.37M

Melbana Energy Limited, with a market cap of A$94.37 million, operates in oil and gas exploration across Cuba and Australia. The company is pre-revenue but has recently become profitable, showing significant earnings growth over the past five years at 25.3% annually. It maintains a strong financial position with no debt and sufficient short-term assets (A$51.3M) to cover liabilities (A$40.4M). Despite its low return on equity at 5.8%, Melbana's experienced management team and board support its operations without shareholder dilution in the past year, making it an intriguing prospect within the penny stock sector.

- Jump into the full analysis health report here for a deeper understanding of Melbana Energy.

- Learn about Melbana Energy's historical performance here.

PointsBet Holdings (ASX:PBH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PointsBet Holdings Limited operates a cloud-based technology platform offering sports, racing, and iGaming betting products and services in Australia with a market cap of A$341.28 million.

Operations: The company generates revenue from its operations in Australian Trading (A$211.54 million), Canada Trading (A$33.95 million), and Technology services (A$21.37 million).

Market Cap: A$341.28M

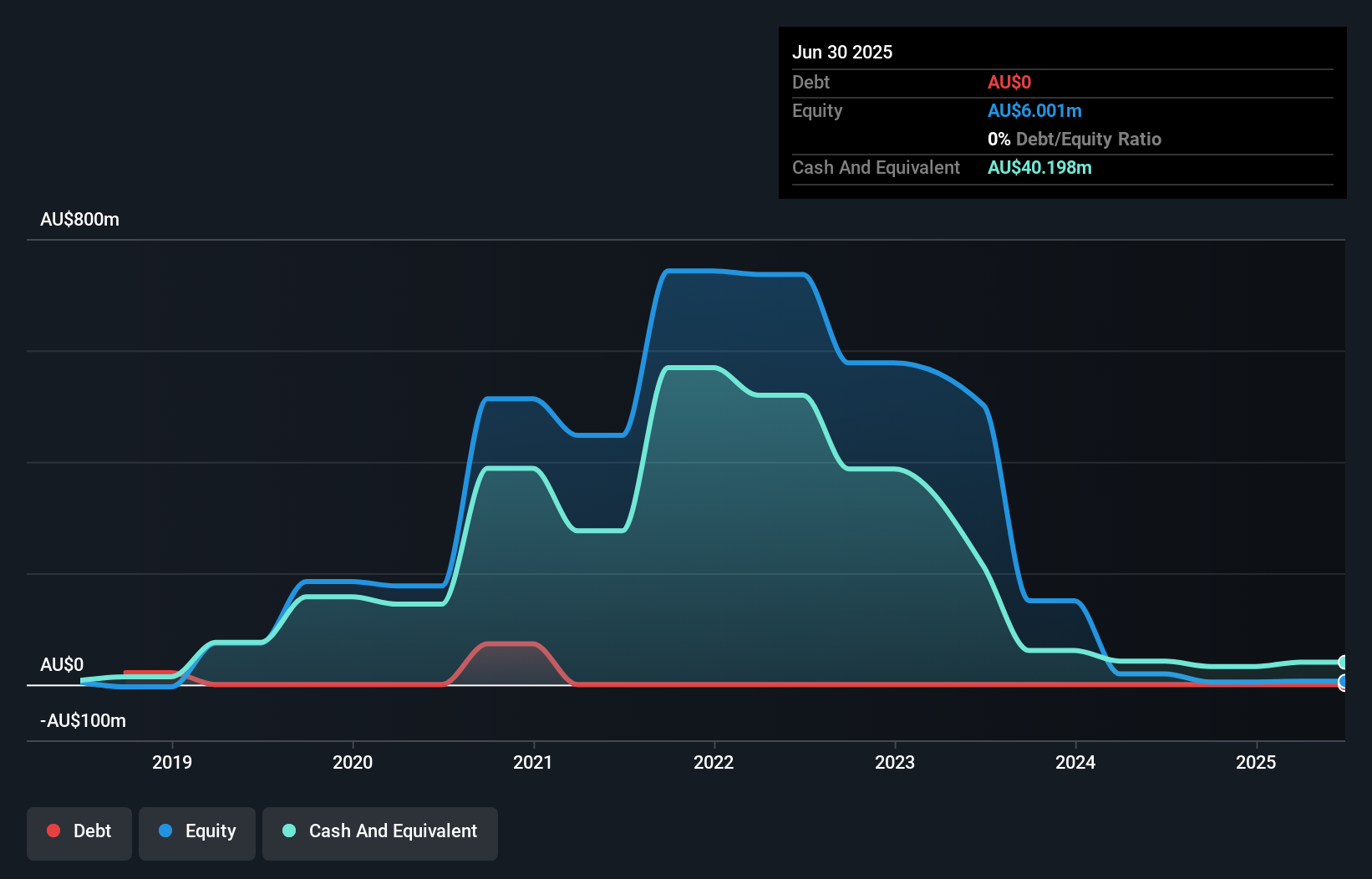

PointsBet Holdings Limited, with a market cap of A$341.28 million, operates without debt and has a cash runway exceeding three years. Despite being unprofitable with negative return on equity, it has reduced losses over five years by 7.9% annually and is trading significantly below its estimated fair value. The company recently experienced shareholder dilution of 4.8%. Recent merger discussions suggest potential takeover interest from an overseas suitor at over $300 million, reflecting a premium on its current market valuation and driving share price increases since September 2024.

- Get an in-depth perspective on PointsBet Holdings' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into PointsBet Holdings' future.

Where To Now?

- Click here to access our complete index of 1,053 ASX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helloworld Travel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLO

Helloworld Travel

Operates as a travel distribution company in Australia, New Zealand, and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives