- Australia

- /

- Oil and Gas

- /

- ASX:KAR

Will Karoon Energy's (ASX:KAR) Sizable Share Buyback Redefine Its Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

- Karoon Energy Ltd (ASX:KAR) recently announced a new share repurchase program, authorizing up to A$25 million in buybacks through May 2026 and disclosed progress with 20.8 million shares already repurchased since March 2025 for A$22 million, reducing outstanding shares to around 731 million as of late September.

- This program reflects management's commitment to capital optimization and signals confidence in the company’s outlook, which is often regarded as a positive indicator for shareholder value.

- With management actively returning capital to shareholders through this sizable buyback, we’ll examine how it impacts Karoon Energy’s investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Karoon Energy Investment Narrative Recap

To be a Karoon Energy shareholder, you need to believe in the company’s ability to keep production reliable and costs low at its Brazilian operations, while actively managing technical risks and project execution. The recent share buyback announcement supports management’s focus on returns, but has limited direct influence on the near-term catalysts, such as operational progress at Baúna, and does not materially change the biggest risk: persistent technical issues or cost overruns that could erode profits.

Among recent announcements, the August 2025 earnings report stands out, revealing a drop in sales but an increase in net income and earnings per share, likely reflecting a one-off gain and cost discipline. This context is important given the buyback, since supporting per-share metrics may not address the underlying operational risks or the need for sustained production outperformance to deliver lasting value for investors.

By contrast, investors should also be aware that recurring technical issues or rising costs at Baúna could suddenly...

Read the full narrative on Karoon Energy (it's free!)

Karoon Energy's narrative projects $612.7 million revenue and $123.8 million earnings by 2028. This implies a 3.2% yearly revenue decline and a $12.9 million decrease in earnings from the current $136.7 million.

Uncover how Karoon Energy's forecasts yield a A$2.20 fair value, a 42% upside to its current price.

Exploring Other Perspectives

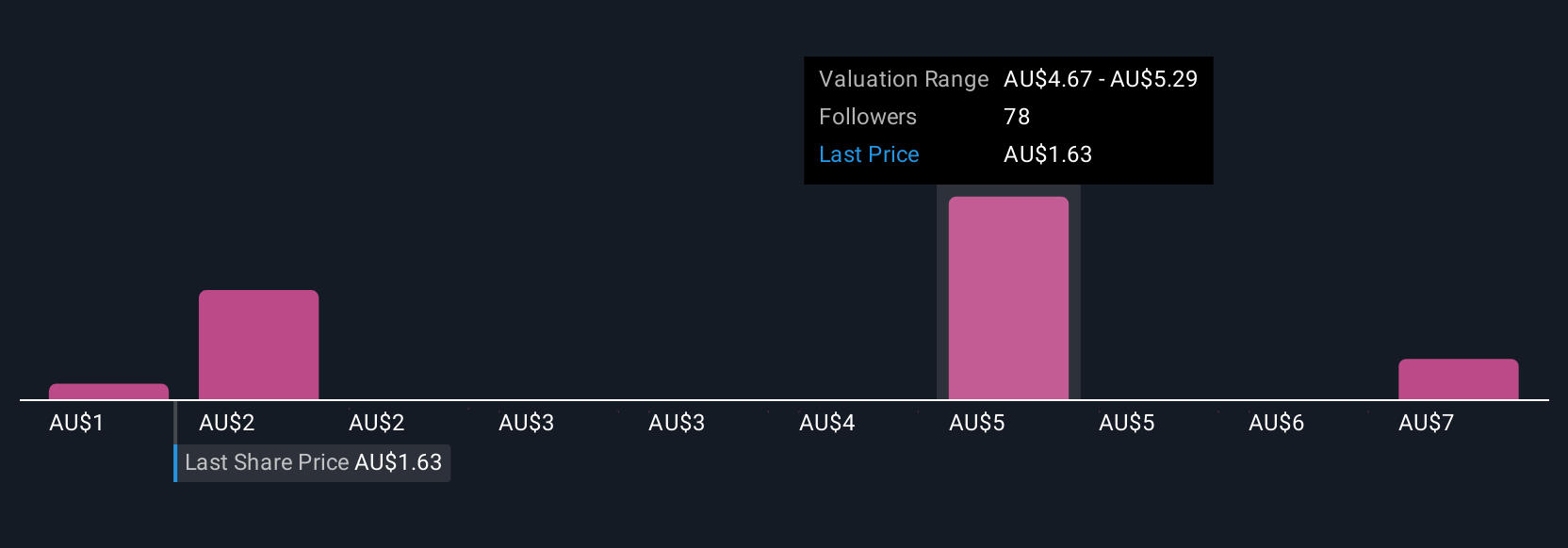

The Simply Wall St Community offered 12 fair value estimates for Karoon Energy, ranging from A$1.01 up to A$39.64 per share. While opinions differ widely, the company’s reliance on continued production stability remains central to its outlook and may shape future profitability more than recent capital management decisions.

Explore 12 other fair value estimates on Karoon Energy - why the stock might be a potential multi-bagger!

Build Your Own Karoon Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Karoon Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Karoon Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Karoon Energy's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karoon Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KAR

Karoon Energy

Operates as an oil and gas exploration and production company in Brazil, the United States, and Australia.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives