- Australia

- /

- Oil and Gas

- /

- ASX:HHR

Hartshead Resources And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian stock market has shown resilience, with the ASX200 closing up 0.48% at 8,231 points, driven by gains in the Materials sector and a lift in iron ore prices. For investors looking beyond established giants, penny stocks offer intriguing possibilities despite being an older term for smaller or newer companies. These stocks can present unique opportunities for growth when supported by strong financials and fundamentals, making them worthy of attention as potential hidden gems in the investment landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$239.61M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.89 | A$108.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.96 | A$317.49M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$235.35M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.285 | A$108M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.54 | A$747.37M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.93 | A$482.47M | ★★★★☆☆ |

Click here to see the full list of 1,024 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Hartshead Resources (ASX:HHR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hartshead Resources NL is involved in the exploration and development of oil and gas properties in the United Kingdom, Gabon, and Madagascar, with a market cap of A$16.89 million.

Operations: The company generates revenue of A$4.68 million from its oil and gas development and exploration activities.

Market Cap: A$16.89M

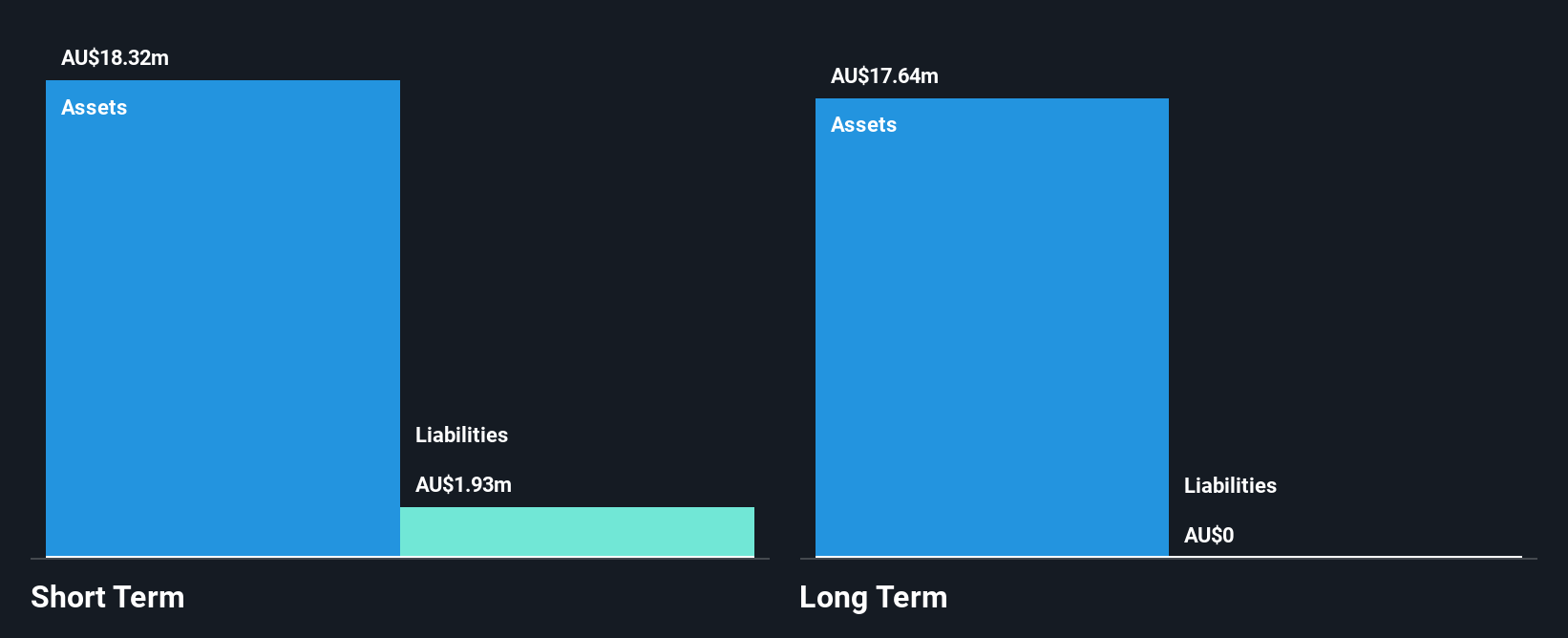

Hartshead Resources NL, with a market cap of A$16.89 million, is pre-revenue and currently unprofitable, yet it has reduced losses over the past five years by 44.5% annually. The company benefits from an experienced management team and board, with average tenures of 3.9 and 6.7 years respectively. Hartshead is debt-free and its short-term assets of A$24.5 million comfortably cover its short-term liabilities of A$3 million, providing a cash runway exceeding three years if cash flow trends persist. However, the stock experiences high volatility compared to most Australian stocks and lacks meaningful revenue streams at present.

- Dive into the specifics of Hartshead Resources here with our thorough balance sheet health report.

- Gain insights into Hartshead Resources' historical outcomes by reviewing our past performance report.

Immuron (ASX:IMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Immuron Limited is a biopharmaceutical company focused on the research, development, and commercialization of polyclonal antibodies in Australia, the United States, and Canada with a market cap of A$19.71 million.

Operations: The company's revenue is derived from its Hyperimmune Products segment, totaling A$4.90 million.

Market Cap: A$19.71M

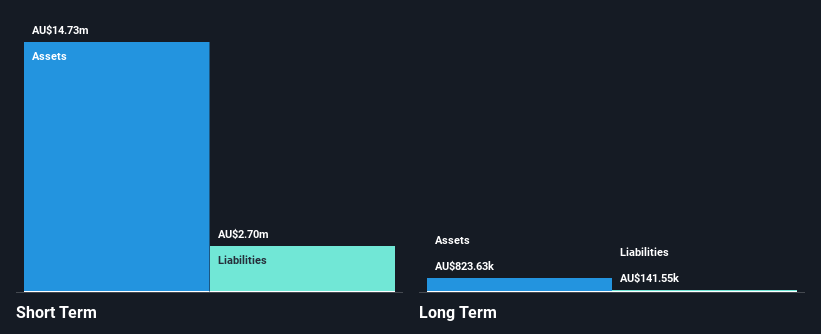

Immuron Limited, with a market cap of A$19.71 million, is currently pre-revenue and unprofitable but has reduced its losses over the past five years. The company benefits from a seasoned management team and board, boasting average tenures of 6 and 5.3 years respectively. Immuron's short-term assets (A$14.7M) exceed both its short-term liabilities (A$2.7M) and long-term liabilities (A$141.5K), ensuring financial stability without debt concerns. Recent follow-on equity offerings raised A$0.23 million, reflecting ongoing efforts to bolster capital amid revenue forecasts predicting significant growth of 59.66% annually despite current volatility challenges decreasing from previous levels.

- Click here and access our complete financial health analysis report to understand the dynamics of Immuron.

- Gain insights into Immuron's outlook and expected performance with our report on the company's earnings estimates.

Platina Resources (ASX:PGM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Platina Resources Limited engages in the acquisition, exploration, and development of precious metals and other mineral deposits in Australia, with a market capitalization of A$12.46 million.

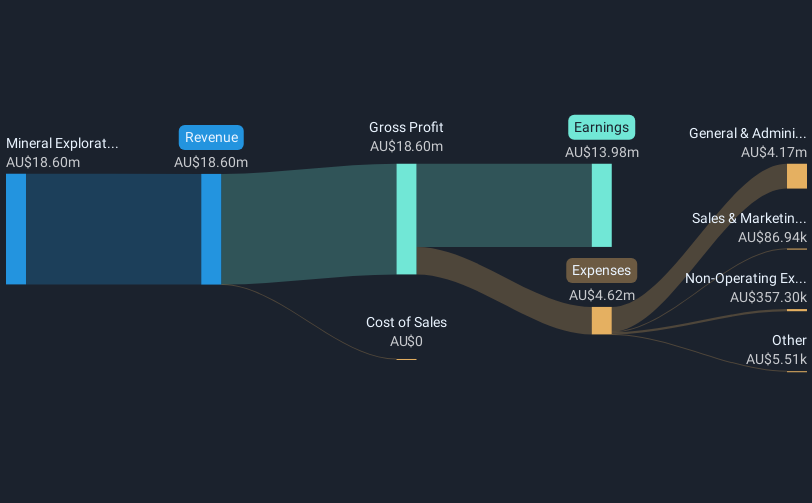

Operations: The company's revenue is derived entirely from its mineral exploration activities, amounting to A$18.60 million.

Market Cap: A$12.46M

Platina Resources Limited, with a market cap of A$12.46 million, is pre-revenue and boasts an outstanding return on equity of 74%. The company is debt-free, with short-term assets (A$14.3M) comfortably covering both short-term (A$1.3M) and long-term liabilities (A$21.4K). Its seasoned management team averages 6.4 years in tenure, contributing to strategic stability despite recent share price volatility. Platina's profitability achieved over the past year marks a significant milestone after five years of earnings growth challenges, although the high level of non-cash earnings warrants consideration for investors evaluating its financial health and future potential at current valuations.

- Click to explore a detailed breakdown of our findings in Platina Resources' financial health report.

- Assess Platina Resources' previous results with our detailed historical performance reports.

Taking Advantage

- Reveal the 1,024 hidden gems among our ASX Penny Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hartshead Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HHR

Hartshead Resources

Engages in the exploration and development of oil and gas properties in the United Kingdom, Gabon, and Madagascar.

Flawless balance sheet slight.