- Australia

- /

- Oil and Gas

- /

- ASX:ERA

Energy Resources of Australia (ASX:ERA) shareholders are still up 121% over 3 years despite pulling back 7.5% in the past week

Energy Resources of Australia Ltd (ASX:ERA) shareholders might be concerned after seeing the share price drop 16% in the last quarter. But don't let that distract from the very nice return generated over three years. In the last three years the share price is up, 61%: better than the market.

Since the long term performance has been good but there's been a recent pullback of 7.5%, let's check if the fundamentals match the share price.

View our latest analysis for Energy Resources of Australia

Energy Resources of Australia wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Energy Resources of Australia actually saw its revenue drop by 5.9% per year over three years. The revenue growth might be lacking but the share price has gained 17% each year in that time. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

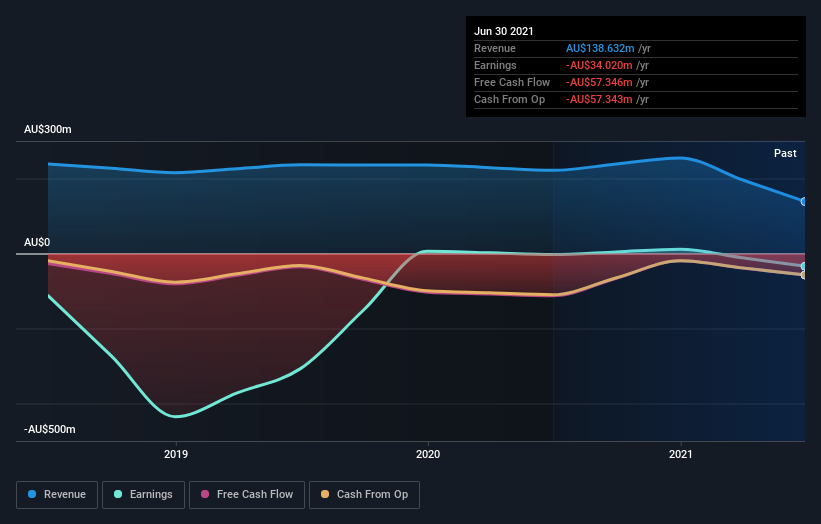

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Energy Resources of Australia's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Energy Resources of Australia's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Energy Resources of Australia's TSR of 121% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Energy Resources of Australia shareholders have received a total shareholder return of 37% over the last year. That certainly beats the loss of about 5% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Energy Resources of Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ERA

Energy Resources of Australia

Engages in mine rehabilitation in Australia.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives