The Australian stock market has been showing resilience, with the ASX200 up 1% at 8405 points, nearing record highs thanks to positive influences from Wall Street. In this context, penny stocks—often smaller or newer companies—continue to attract attention for their potential to offer growth opportunities. Despite being considered a niche area now, these stocks can provide significant returns when backed by solid financials and strategic positioning.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.00 | A$325.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.89 | A$104.55M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.65 | A$808.63M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.4475 | A$87.7M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.80 | A$473.59M | ★★★★☆☆ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Aurora Energy Metals (ASX:1AE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aurora Energy Metals Limited is involved in mineral exploration activities in the United States and has a market cap of A$10.92 million.

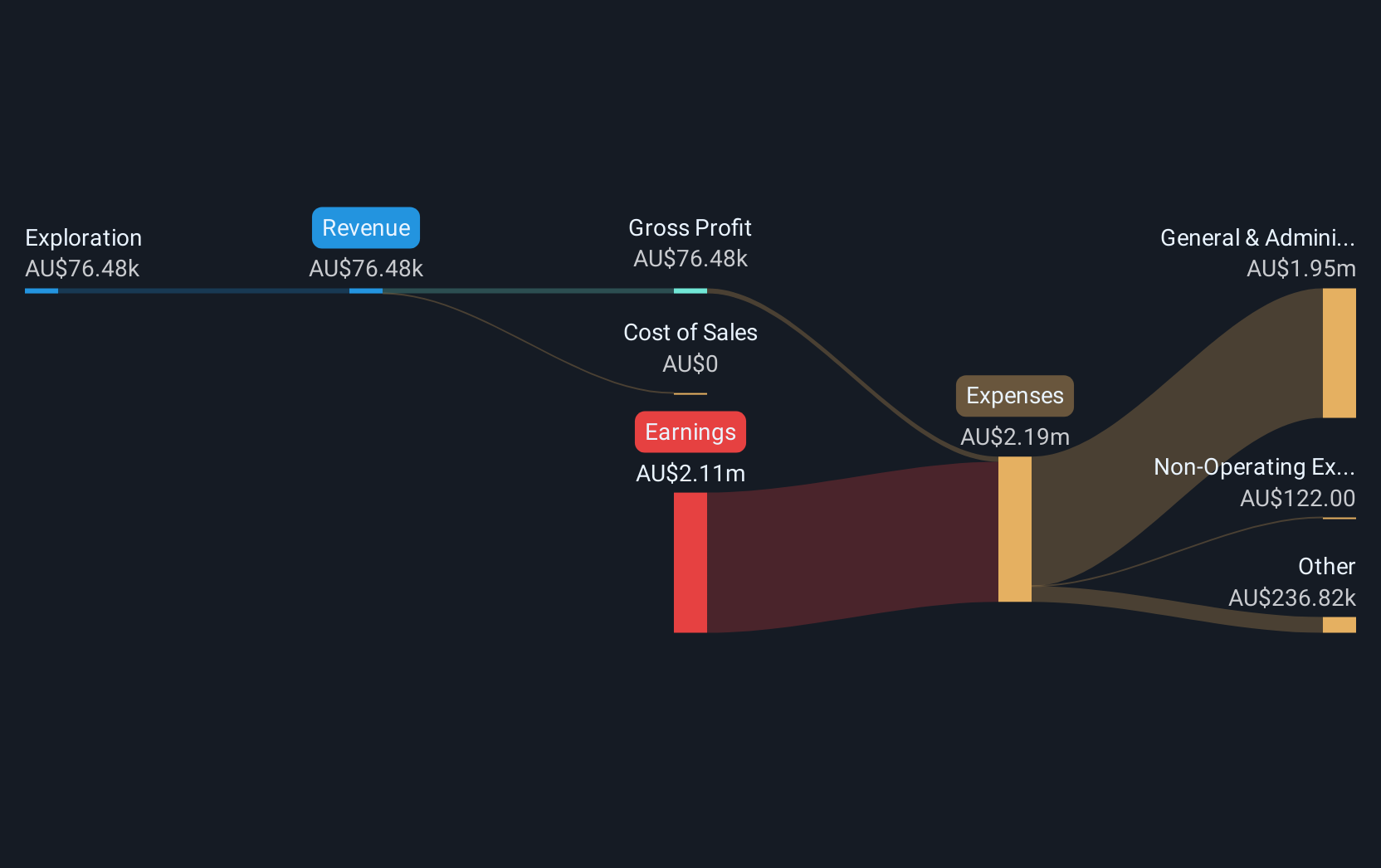

Operations: The company generates revenue from its exploration activities, amounting to A$0.11 million.

Market Cap: A$10.92M

Aurora Energy Metals Limited, with a market cap of A$10.92 million, is a pre-revenue company engaged in mineral exploration in the United States. Despite being debt-free and having no long-term liabilities, it faces financial challenges with less than one year of cash runway and increasing losses over the past five years at 38.8% annually. The company's share price has been highly volatile recently, reflecting its elevated weekly volatility from 18% to 26%. Recent earnings announcements showed a reduced net loss of A$2.36 million for the year ended June 2024 compared to A$5.66 million previously, indicating some improvement despite ongoing unprofitability.

- Take a closer look at Aurora Energy Metals' potential here in our financial health report.

- Understand Aurora Energy Metals' track record by examining our performance history report.

Energy Metals (ASX:EME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Energy Metals Limited is a uranium exploration company based in Australia with a market cap of A$22.02 million.

Operations: The company's revenue is derived from Uranium Exploration, amounting to A$0.02 million.

Market Cap: A$22.02M

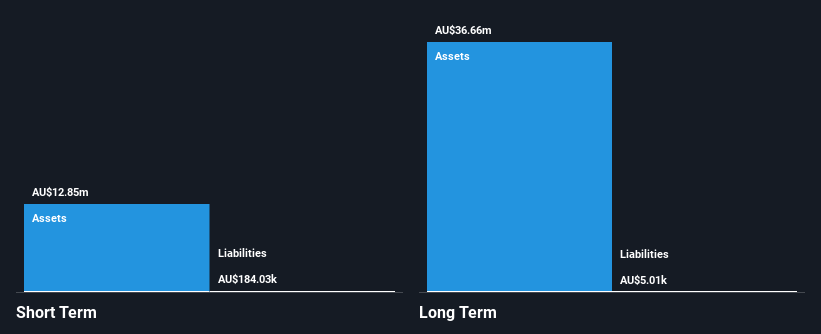

Energy Metals Limited, with a market cap of A$22.02 million, is a pre-revenue uranium exploration company in Australia. It remains debt-free and boasts sufficient cash runway for over three years, supported by short-term assets of A$12.9 million exceeding both long-term and short-term liabilities. Despite its unprofitability, the company has reduced losses over five years at 2.2% annually and maintained stable weekly volatility compared to most Australian stocks. Recent earnings showed an increase in sales to A$0.02 million for the half year ended June 2024 but also reported a higher net loss of A$0.29 million year-on-year, reflecting ongoing financial challenges amidst share price volatility.

- Click to explore a detailed breakdown of our findings in Energy Metals' financial health report.

- Gain insights into Energy Metals' past trends and performance with our report on the company's historical track record.

ReadyTech Holdings (ASX:RDY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia, with a market cap of A$358.22 million.

Operations: The company generates its revenue from three main segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million).

Market Cap: A$358.22M

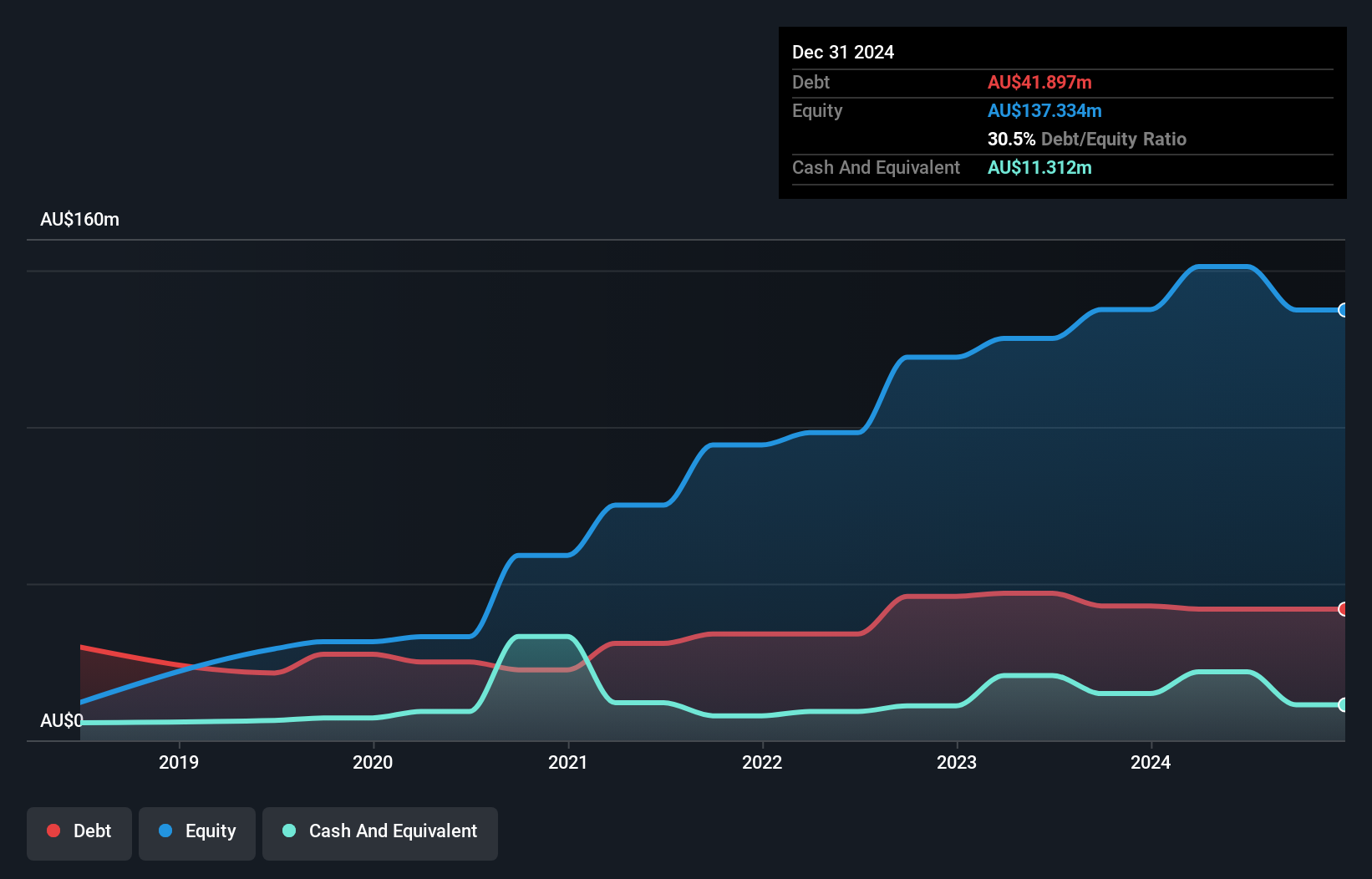

ReadyTech Holdings Limited, with a market cap of A$358.22 million, has demonstrated consistent revenue growth across its segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million). The company reported full-year sales of A$113.8 million, up from A$103.31 million the previous year, with net income rising to A$5.46 million from A$4.98 million. Despite shareholder dilution by 2.9% last year, ReadyTech's debt management is strong; operating cash flow covers 75% of its debt while interest payments are well-covered by EBIT at 3 times coverage, reflecting financial stability amidst industry challenges.

- Unlock comprehensive insights into our analysis of ReadyTech Holdings stock in this financial health report.

- Evaluate ReadyTech Holdings' prospects by accessing our earnings growth report.

Next Steps

- Dive into all 1,046 of the ASX Penny Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ReadyTech Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDY

Undervalued with reasonable growth potential.