- Australia

- /

- Oil and Gas

- /

- ASX:PCL

ASX Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The Australian market has experienced a challenging day, with the ASX200 closing down 0.9% at 7,890 points, driven by significant declines in the IT and Industrials sectors. Despite these broader market struggles, penny stocks continue to capture investor interest as they offer potential growth opportunities at lower price points. Often representing smaller or newer companies, these stocks can be appealing when backed by strong financial health and fundamentals, making them an intriguing area for investors seeking hidden gems in a volatile market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.59 | A$75.01M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.24 | A$153.74M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.56 | A$109.97M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$2.83 | A$949.17M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.22 | A$343.85M | ★★★★★☆ |

| CTI Logistics (ASX:CLX) | A$1.68 | A$131.06M | ★★★★☆☆ |

| West African Resources (ASX:WAF) | A$2.10 | A$2.39B | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.245 | A$1.16B | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$241.6M | ★★★★★★ |

| Accent Group (ASX:AX1) | A$1.82 | A$1.03B | ★★★★☆☆ |

Click here to see the full list of 1,007 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Comet Ridge (ASX:COI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Comet Ridge Limited is an Australian company involved in the exploration, appraisal, and development of oil and gas resources with a market cap of A$137.59 million.

Operations: Comet Ridge Limited does not report specific revenue segments.

Market Cap: A$137.59M

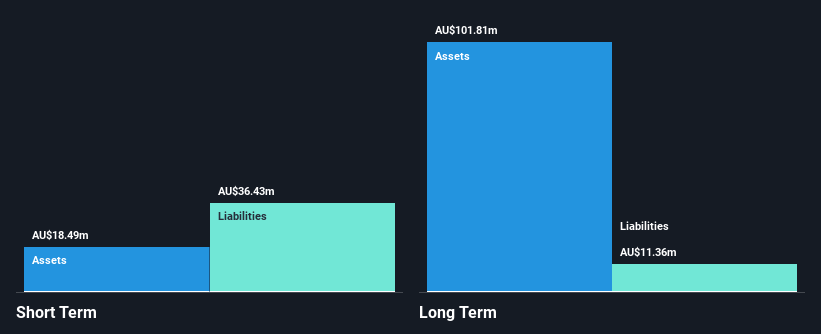

Comet Ridge Limited, with a market cap of A$137.59 million, is a pre-revenue company focused on oil and gas exploration. Despite being unprofitable and not expected to achieve profitability in the next three years, it has managed to secure sufficient cash runway for over a year through recent capital raising efforts, including a follow-on equity offering of A$12.03 million. The company's seasoned board and management team bring extensive experience to its operations. However, challenges remain as short-term liabilities exceed short-term assets by A$17.9 million, and the debt-to-equity ratio has increased modestly over five years.

- Jump into the full analysis health report here for a deeper understanding of Comet Ridge.

- Understand Comet Ridge's earnings outlook by examining our growth report.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL focuses on the exploration of oil and gas properties in Namibia and Australia, with a market cap of A$130.19 million.

Operations: Pancontinental Energy NL has not reported any revenue segments.

Market Cap: A$130.19M

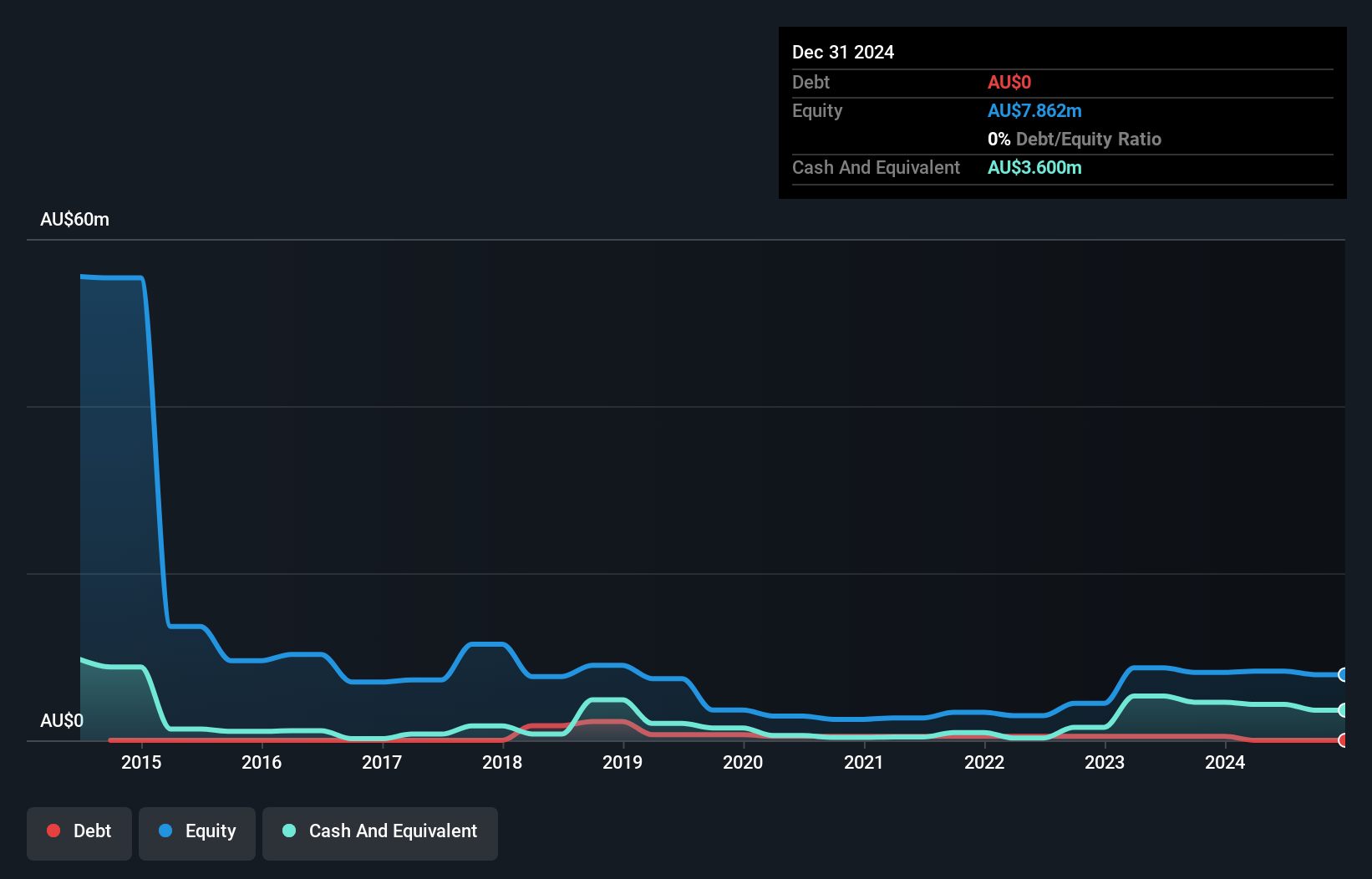

Pancontinental Energy NL, with a market cap of A$130.19 million, is a pre-revenue company engaged in oil and gas exploration in Namibia and Australia. Despite its unprofitability, the company benefits from a seasoned board with an average tenure of 16.2 years and has no debt on its balance sheet. Pancontinental's short-term assets of A$4.4 million comfortably cover both its short-term liabilities (A$810.5K) and long-term liabilities (A$12.8K). The firm has sufficient cash runway for over two years if it continues to grow free cash flow at historical rates, though share price volatility remains high compared to peers.

- Dive into the specifics of Pancontinental Energy here with our thorough balance sheet health report.

- Gain insights into Pancontinental Energy's historical outcomes by reviewing our past performance report.

Pacific Smiles Group (ASX:PSQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pacific Smiles Group Limited operates dental centers in Australia under the Pacific Smiles Dental Centres and Nib Dental Care Centres brands, with a market cap of A$320.02 million.

Operations: The company generates revenue of A$189.30 million from its operations in the dental sector.

Market Cap: A$320.02M

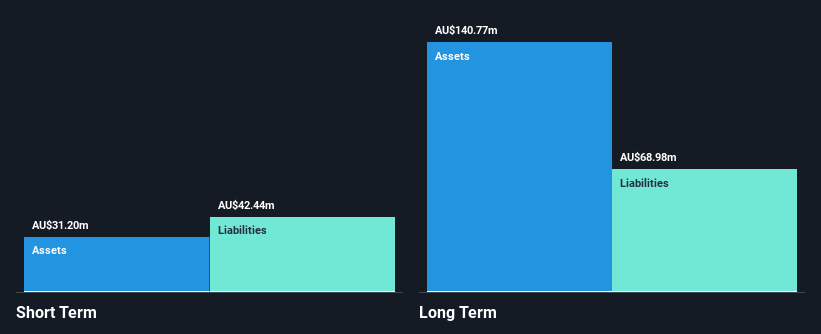

Pacific Smiles Group, with a market cap of A$320.02 million, shows promising growth in the dental sector, reporting sales of A$99 million for the half-year ending December 2024, up from A$90 million the previous year. Earnings have surged by 56.5% over the past year, outpacing industry averages and reflecting improved net profit margins from 3.8% to 5.5%. The company remains debt-free and its short-term assets exceed liabilities. However, recent index exclusions and an inexperienced board could pose challenges despite its undervaluation at nearly 70% below fair value estimates.

- Click here to discover the nuances of Pacific Smiles Group with our detailed analytical financial health report.

- Examine Pacific Smiles Group's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Take a closer look at our ASX Penny Stocks list of 1,007 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PCL

Pancontinental Energy

Engages in the exploration of oil and gas properties in Namibia and Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives