- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Here's Why We're Not Too Worried About Boss Energy's (ASX:BOE) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Boss Energy (ASX:BOE) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Boss Energy

Does Boss Energy Have A Long Cash Runway?

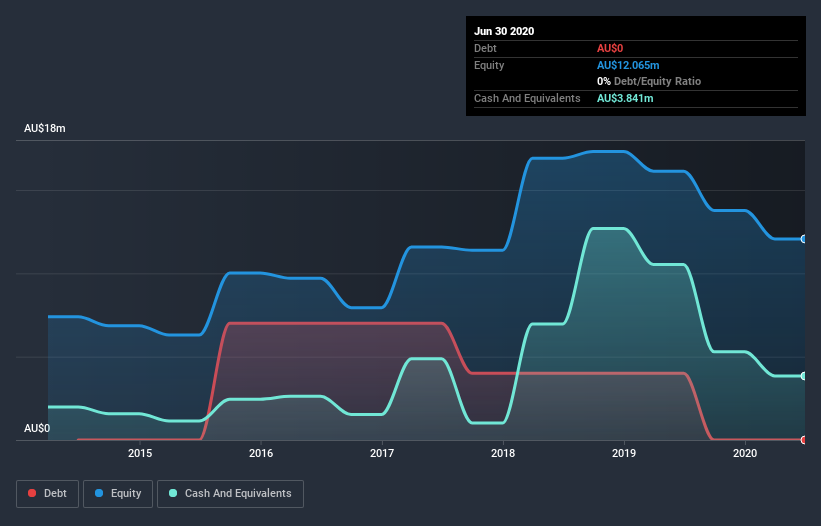

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Boss Energy last reported its balance sheet in June 2020, it had zero debt and cash worth AU$3.8m. In the last year, its cash burn was AU$2.8m. So it had a cash runway of approximately 17 months from June 2020. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

How Is Boss Energy's Cash Burn Changing Over Time?

Whilst it's great to see that Boss Energy has already begun generating revenue from operations, last year it only produced AU$383k, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. Notably, its cash burn was actually down by 57% in the last year, which is a real positive in terms of resilience, but uninspiring when it comes to investment for growth. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Boss Energy Raise Cash?

There's no doubt Boss Energy's rapidly reducing cash burn brings comfort, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund further growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Boss Energy has a market capitalisation of AU$170m and burnt through AU$2.8m last year, which is 1.6% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Boss Energy's Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Boss Energy is burning through its cash. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. On this analysis its cash runway was its weakest feature, but we are not concerned about it. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking a deeper dive, we've spotted 6 warning signs for Boss Energy you should be aware of, and 3 of them are a bit unpleasant.

Of course Boss Energy may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Boss Energy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives