- Australia

- /

- Oil and Gas

- /

- ASX:BKY

The Berkeley Energia (ASX:BKY) Share Price Has Gained 259%, So Why Not Pay It Some Attention?

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example Berkeley Energia Limited (ASX:BKY). Its share price is already up an impressive 259% in the last twelve months. It's also good to see the share price up 56% over the last quarter. Zooming out, the stock is actually down 20% in the last three years.

View our latest analysis for Berkeley Energia

With just AU$2,340,000 worth of revenue in twelve months, we don't think the market considers Berkeley Energia to have proven its business plan. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Berkeley Energia will discover or develop fossil fuel before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Berkeley Energia has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

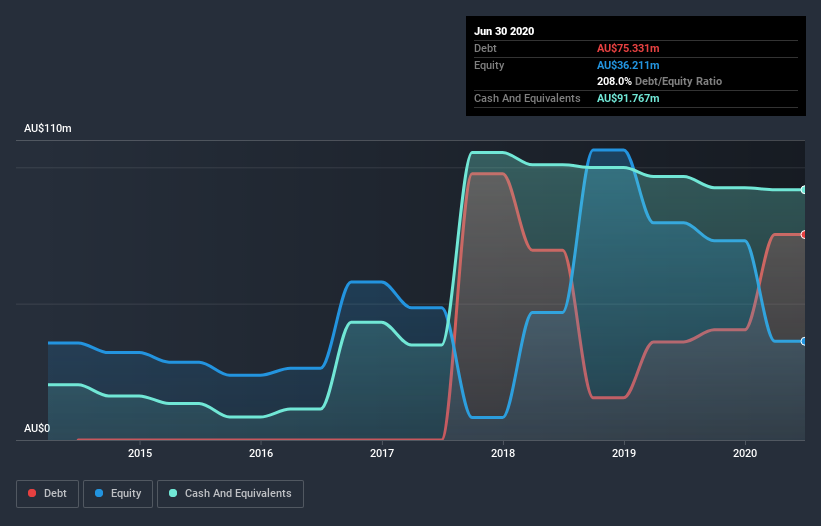

Berkeley Energia had cash in excess of all liabilities of AU$13m when it last reported (June 2020). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price up 64% in the last year , the market is seems hopeful about the potential, despite the cash burn. The image below shows how Berkeley Energia's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

A Different Perspective

It's good to see that Berkeley Energia has rewarded shareholders with a total shareholder return of 259% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 9% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Berkeley Energia better, we need to consider many other factors. For example, we've discovered 2 warning signs for Berkeley Energia that you should be aware of before investing here.

We will like Berkeley Energia better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Berkeley Energia, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Berkeley Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BKY

Berkeley Energia

Engages in the exploration and development of mineral properties in Spain.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026