- Australia

- /

- Oil and Gas

- /

- ASX:BKY

Berkeley Energia (ASX:BKY) Is In A Strong Position To Grow Its Business

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Berkeley Energia (ASX:BKY) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Berkeley Energia

How Long Is Berkeley Energia's Cash Runway?

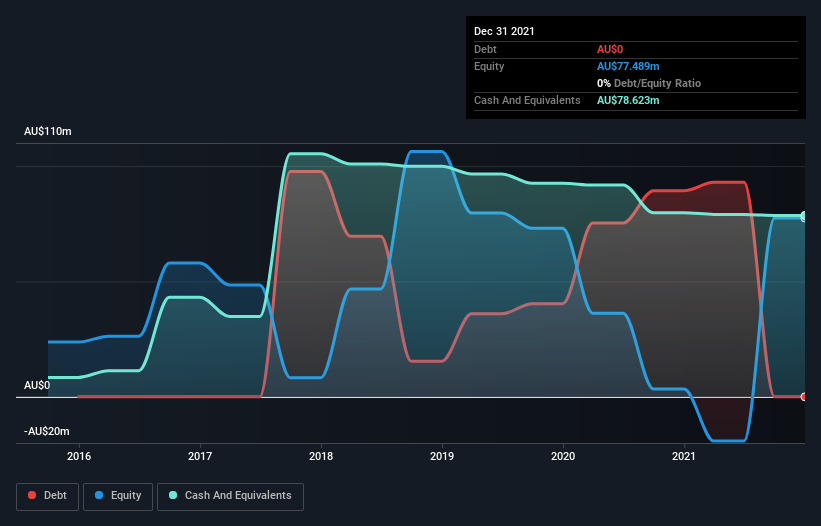

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at December 2021, Berkeley Energia had cash of AU$79m and no debt. Looking at the last year, the company burnt through AU$5.4m. So it had a very long cash runway of many years from December 2021. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How Is Berkeley Energia's Cash Burn Changing Over Time?

Because Berkeley Energia isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. With cash burn dropping by 11% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Admittedly, we're a bit cautious of Berkeley Energia due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Berkeley Energia Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Berkeley Energia to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Berkeley Energia has a market capitalisation of AU$174m and burnt through AU$5.4m last year, which is 3.1% of the company's market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Berkeley Energia's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Berkeley Energia's cash burn. For example, we think its cash runway suggests that the company is on a good path. On this analysis its cash burn reduction was its weakest feature, but we are not concerned about it. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 3 warning signs for Berkeley Energia that potential shareholders should take into account before putting money into a stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if Berkeley Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BKY

Berkeley Energia

Engages in the exploration and development of mineral properties in Spain.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026