- Australia

- /

- Capital Markets

- /

- ASX:AUI

3 Top ASX Dividend Stocks To Consider

Reviewed by Simply Wall St

As the ASX200 edges up by 0.21% to 8,345 points, with sectors like Discretionary and Utilities leading the charge, investors are keenly observing dividend stocks as a potential source of steady income amidst these market dynamics. In this environment, identifying strong dividend stocks involves looking for companies with a solid track record of payouts and stability in performance across fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.40% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.80% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.36% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.01% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 5.00% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.72% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.91% | ★★★★☆☆ |

| Santos (ASX:STO) | 6.82% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 9.76% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.52% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

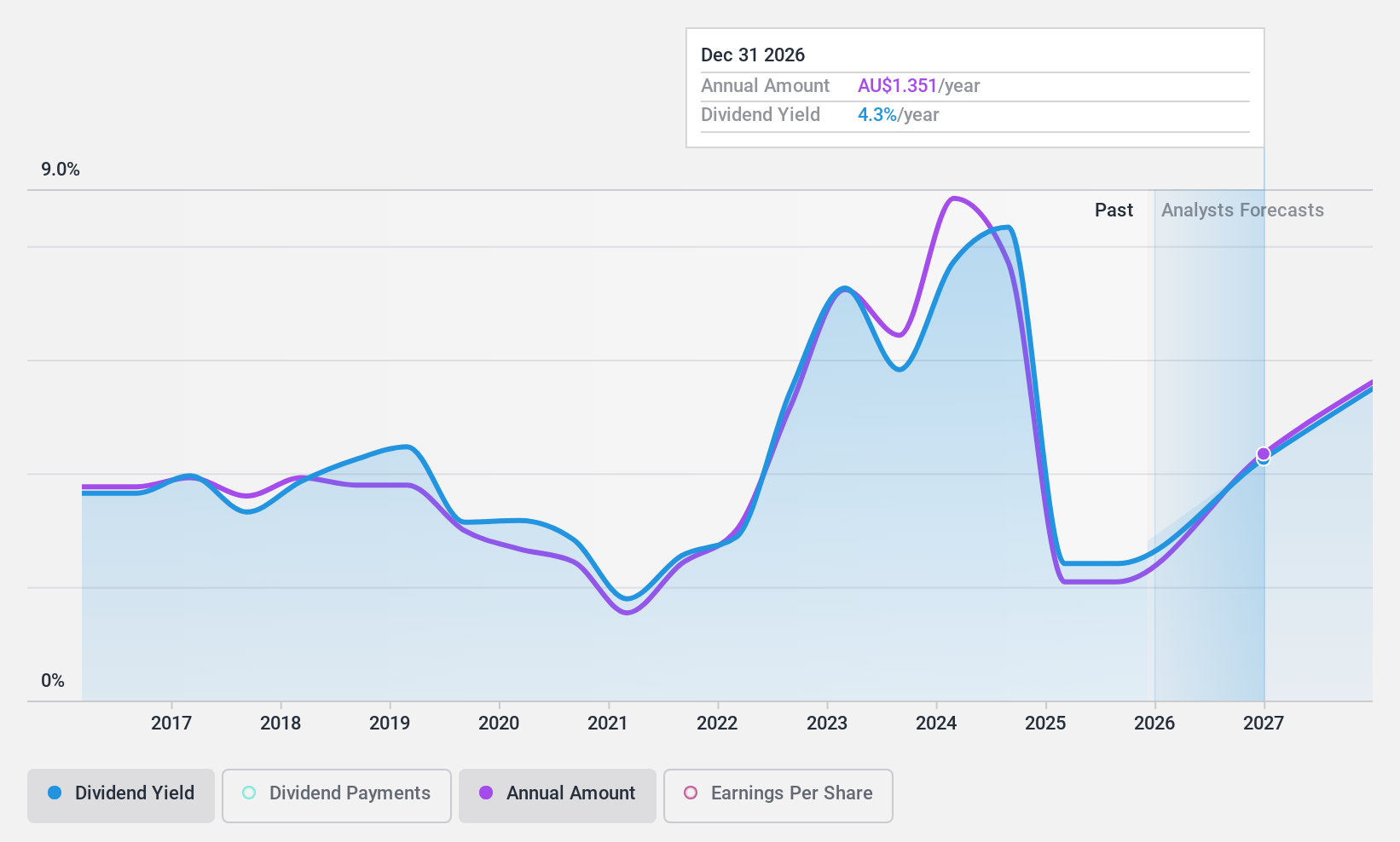

Ampol (ASX:ALD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited is involved in the purchase, refining, distribution, and marketing of petroleum products across Australia, New Zealand, Singapore, and the United States with a market cap of A$7.11 billion.

Operations: Ampol Limited generates its revenue through segments including New Zealand (A$5.49 billion), Convenience Retail (A$5.97 billion), and Fuels and Infrastructure (A$34.46 billion).

Dividend Yield: 8.1%

Ampol's dividend yield of 8.08% ranks in the top 25% of Australian dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 115.2%, indicating dividends aren't well covered by free cash flows. Despite recent earnings growth and trading at a significant discount to fair value, Ampol's dividends have been volatile over the past decade. The appointment of Guy Templeton as an Independent Non-Executive Director may influence future strategic decisions impacting dividends.

- Take a closer look at Ampol's potential here in our dividend report.

- Our valuation report here indicates Ampol may be undervalued.

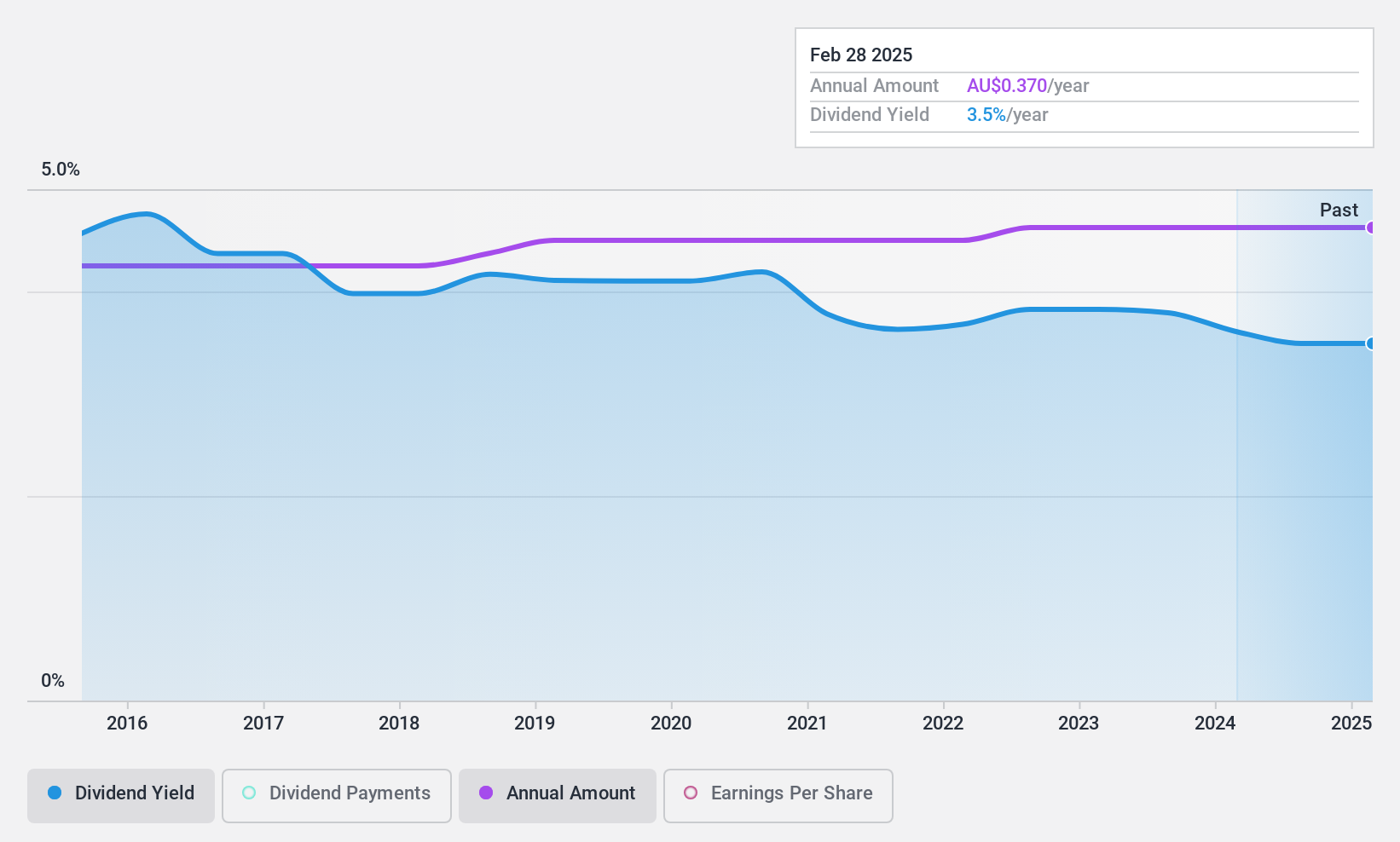

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited is a publicly owned investment manager with a market cap of A$1.30 billion.

Operations: Australian United Investment Company Limited generates its revenue primarily from its investment segment, totaling A$57.76 million.

Dividend Yield: 3.5%

Australian United Investment offers a stable dividend history with consistent growth over the past decade, though its 3.52% yield is below the top tier in Australia. The company's dividends are reliable but not well covered by earnings, indicated by a high payout ratio of 95%. However, they are supported by cash flows with an 89.7% cash payout ratio. Investors should weigh the stability against coverage concerns when considering AUI for dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Australian United Investment.

- The valuation report we've compiled suggests that Australian United Investment's current price could be inflated.

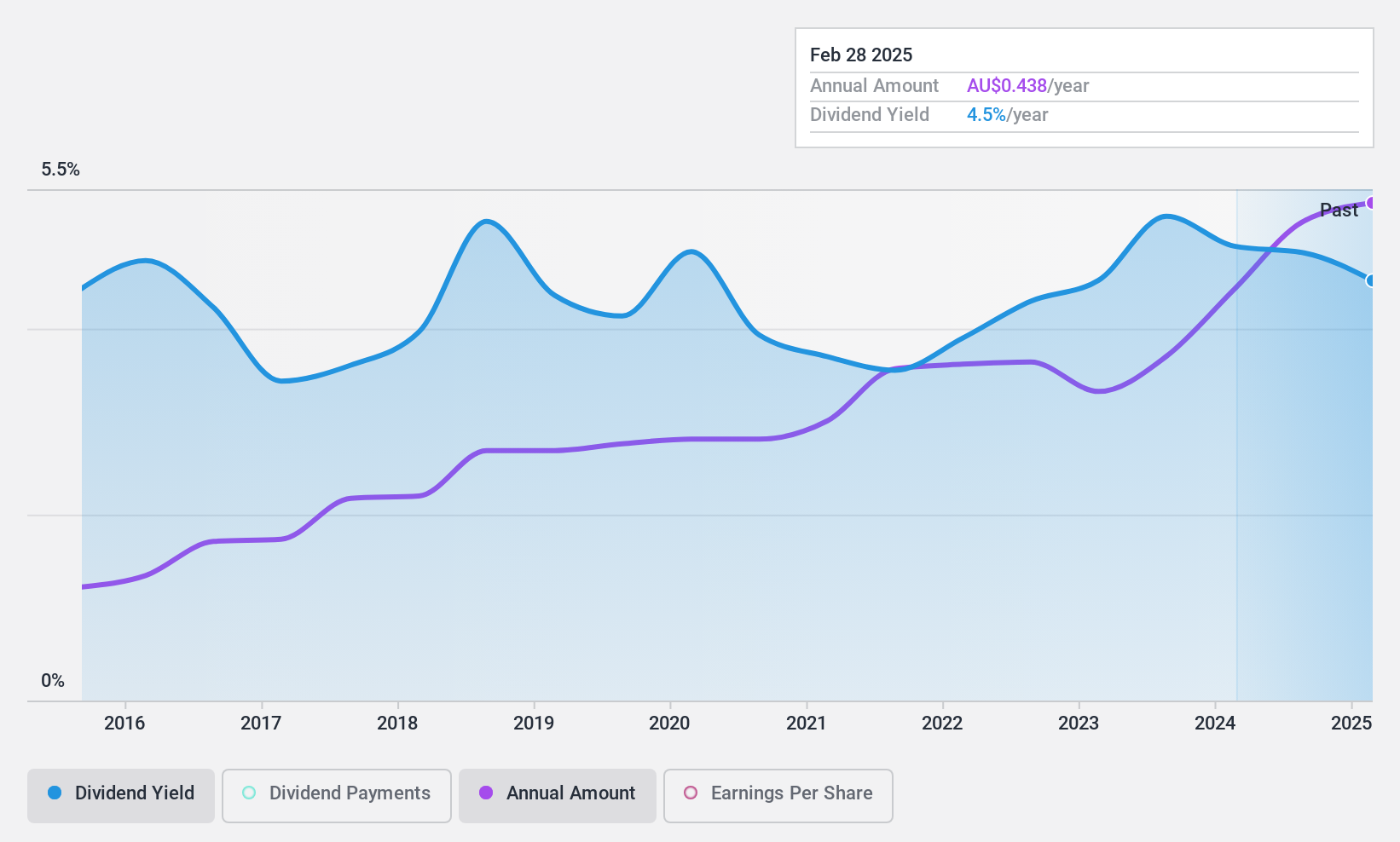

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd, with a market cap of A$277.32 million, operates in Australia through its subsidiaries offering financial services.

Operations: Fiducian Group Ltd generates its revenue from four main segments: Funds Management (A$22.08 million), Corporate Services (A$15.06 million), Financial Planning (A$27.69 million), and Platform Administration (A$15.97 million).

Dividend Yield: 4.4%

Fiducian Group has delivered consistent dividend growth over the past decade, with stable payments and a current yield of 4.36%, which is below Australia's top-tier payers. The dividends are well-supported by earnings and cash flows, with payout ratios of 82.3% and 63.8%, respectively, indicating sustainability despite recent significant insider selling. Its Price-To-Earnings ratio of 18.9x suggests it is reasonably valued compared to the broader market average of 19.1x.

- Navigate through the intricacies of Fiducian Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Fiducian Group is priced higher than what may be justified by its financials.

Key Takeaways

- Take a closer look at our Top ASX Dividend Stocks list of 30 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AUI

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives