- Australia

- /

- Metals and Mining

- /

- ASX:DEV

ASX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

The Australian stock market has been relatively flat, with the S&P/ASX 200 Index struggling to break past 8,600 points. Despite this lack of momentum, the materials sector remains a bright spot, driven by strong performances in metals like copper and gold. For investors interested in exploring beyond established names, penny stocks can offer surprising value; these smaller or newer companies might evoke earlier market trends but still hold potential for growth when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$110.34M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.55 | A$73.12M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.80 | A$49.81M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.86 | A$439.55M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.29 | A$243.01M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.071 | A$37.4M | ✅ 3 ⚠️ 2 View Analysis > |

| Steadfast Group (ASX:SDF) | A$5.00 | A$5.54B | ✅ 5 ⚠️ 3 View Analysis > |

| West African Resources (ASX:WAF) | A$2.76 | A$3.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.47 | A$647.83M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 414 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Aura Energy (ASX:AEE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aura Energy Limited, along with its subsidiaries, is engaged in the exploration and evaluation of mineral properties in Mauritania and Sweden, with a market capitalization of A$165.37 million.

Operations: Currently, Aura Energy Limited does not report any revenue segments.

Market Cap: A$165.37M

Aura Energy, with a market cap of A$165.37 million, remains pre-revenue and unprofitable, highlighting its speculative nature as a penny stock. The company is debt-free and has not significantly diluted shareholders recently but faces liquidity challenges with less than a year of cash runway. Recent developments include the Swedish parliament's decision to lift the uranium mining ban effective January 2026, potentially enhancing Aura's Häggån project prospects. Management changes are underway following CEO Andrew Grove’s resignation, with Executive Chair Philip Mitchell stepping in to ensure operational continuity amidst ongoing funding discussions and strategic partnerships exploration.

- Click here to discover the nuances of Aura Energy with our detailed analytical financial health report.

- Understand Aura Energy's earnings outlook by examining our growth report.

DevEx Resources (ASX:DEV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DevEx Resources Limited, with a market cap of A$86.13 million, is involved in the exploration and evaluation of mineral properties in Australia.

Operations: The company generates revenue of A$0.36 million from its exploration and evaluation activities in Australia.

Market Cap: A$86.13M

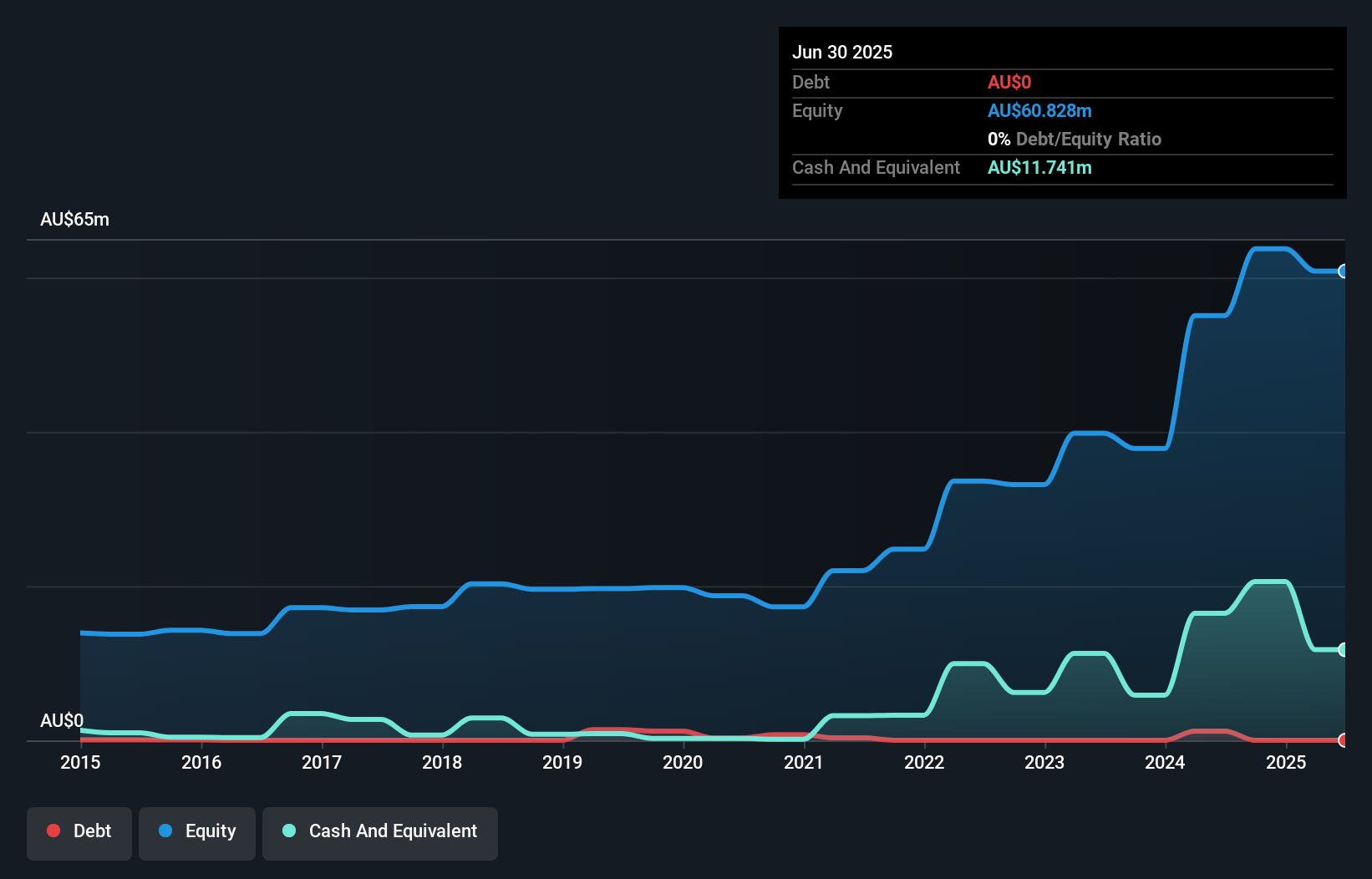

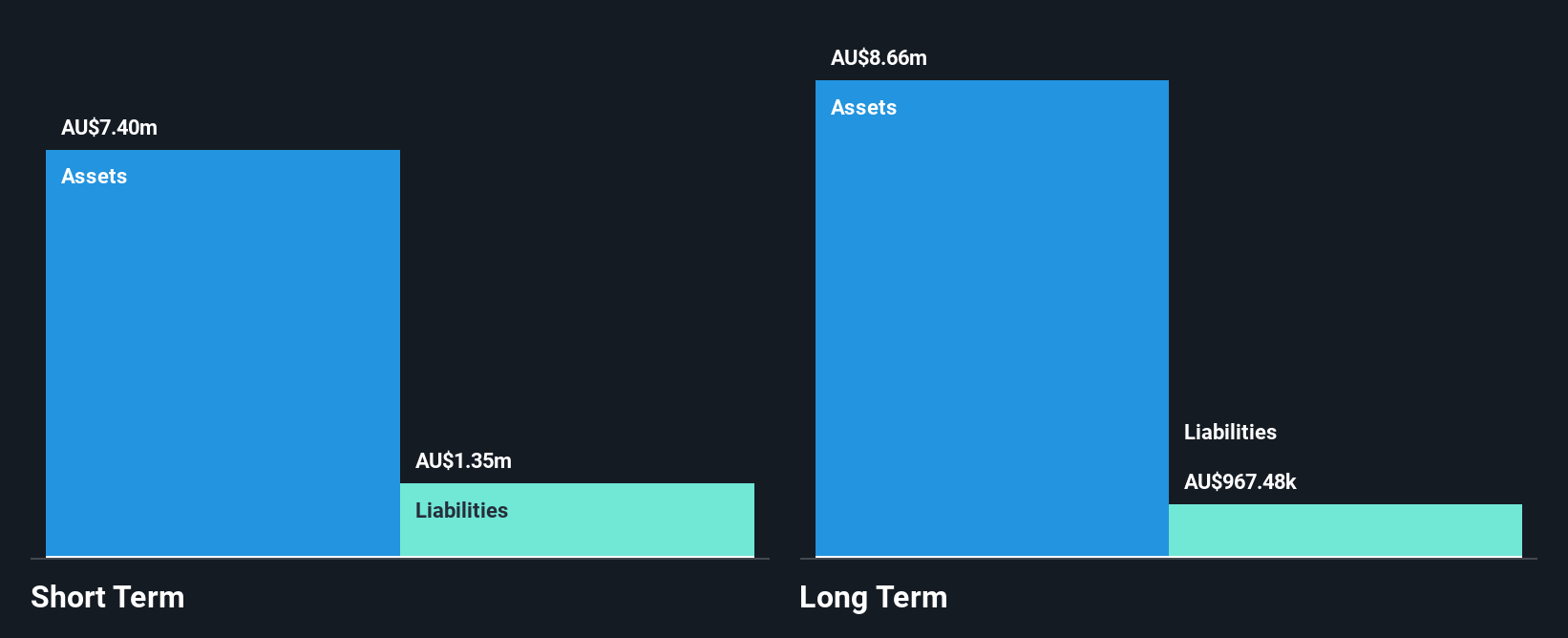

DevEx Resources, with a market cap of A$86.13 million, remains pre-revenue and unprofitable, reflecting its speculative nature. The company is debt-free and has not significantly diluted shareholders recently but faces liquidity challenges with a cash runway of around 9 months. Recent developments include raising A$35 million through follow-on equity offerings to bolster financial stability. The board has been strengthened by appointing Matthew Yates as a non-executive director, enhancing the company's exploration expertise as it seeks growth opportunities amidst ongoing financial constraints and high share price volatility.

- Navigate through the intricacies of DevEx Resources with our comprehensive balance sheet health report here.

- Gain insights into DevEx Resources' historical outcomes by reviewing our past performance report.

Sovereign Metals (ASX:SVM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sovereign Metals Limited, along with its subsidiaries, focuses on the exploration and development of mineral resource projects in Malawi and has a market capitalization of A$342.88 million.

Operations: No revenue segments have been reported for this company.

Market Cap: A$342.88M

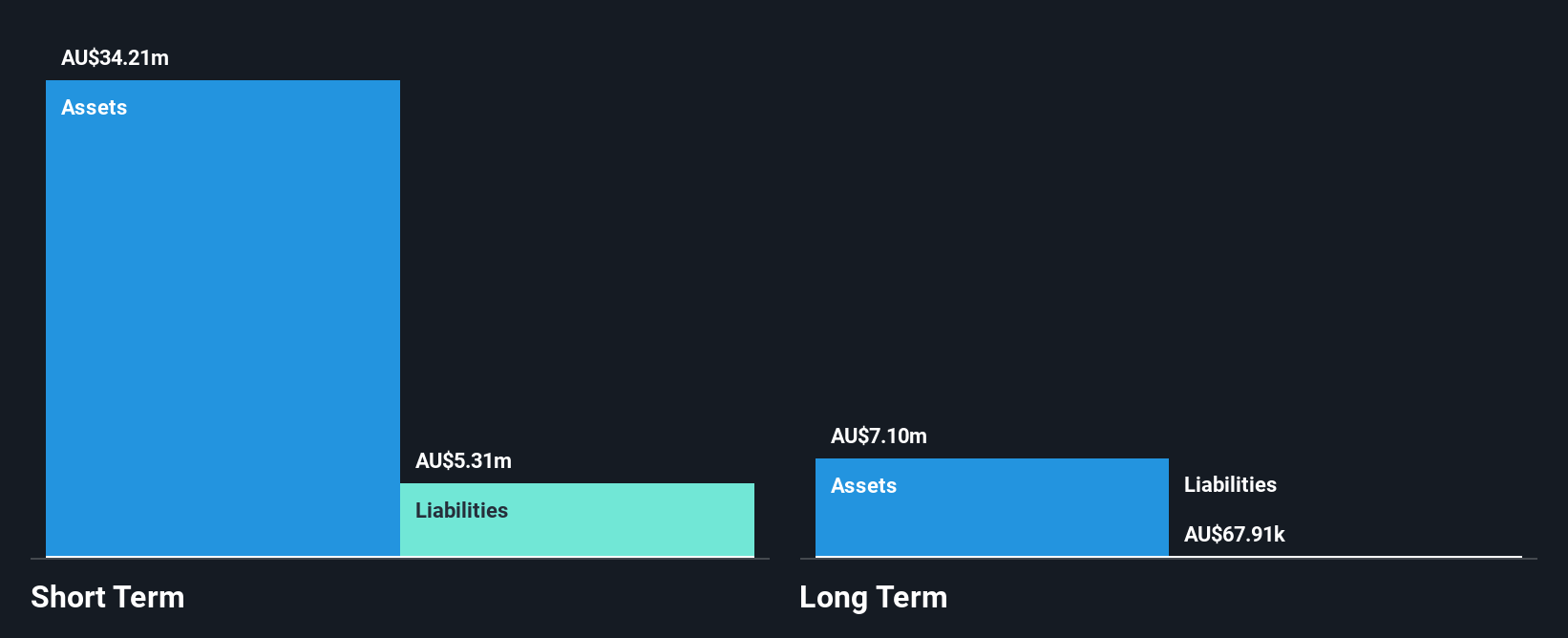

Sovereign Metals Limited, with a market cap of A$342.88 million, is pre-revenue and currently unprofitable, indicating its speculative nature in the mining sector. The company is debt-free and has not experienced significant shareholder dilution recently. Despite reporting a net loss of A$40.44 million for the year ending June 2025, Sovereign's short-term assets significantly exceed both its short- and long-term liabilities, suggesting strong liquidity management. However, it faces challenges with less than a year of cash runway if current cash flow trends persist. The management team is relatively experienced with an average tenure of 2.2 years.

- Jump into the full analysis health report here for a deeper understanding of Sovereign Metals.

- Gain insights into Sovereign Metals' outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Click this link to deep-dive into the 414 companies within our ASX Penny Stocks screener.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DEV

DevEx Resources

Engages in the exploration and evaluation of mineral properties in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026