- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

Zip Co (ASX:ZIP) Jumps 54% Over Last Month

Reviewed by Simply Wall St

Zip Co (ASX:ZIP) recently experienced a price move of 54% over the last month. While there were no significant overall market shifts—remaining flat over the past week—the company’s substantial gain stands out against the broader 12-month market growth of 8%. With no major external market-driven forces influencing this uptick, attention shifts to internal events as potential catalysts. Even though additional market-specific news like anticipated earnings growth across sectors was present, it neither strongly aligned with nor opposed Zip's noteworthy performance, suggesting the company's unique internal developments played a key role in its recent valuation increase.

You should learn about the 2 warning signs we've spotted with Zip Co.

The recent surge in Zip Co's share price might signify investor optimism surrounding the company's strategic shifts and internal developments, such as expanding its U.S. market presence and partnerships like those with Stripe. Considering the share price surged 88.38% over the last three years, this suggests a strong long-term performance compared to the Australian Consumer Finance industry's 13.2% growth over the past year. Such a large return over three years sets a promising precedent for potential future gains.

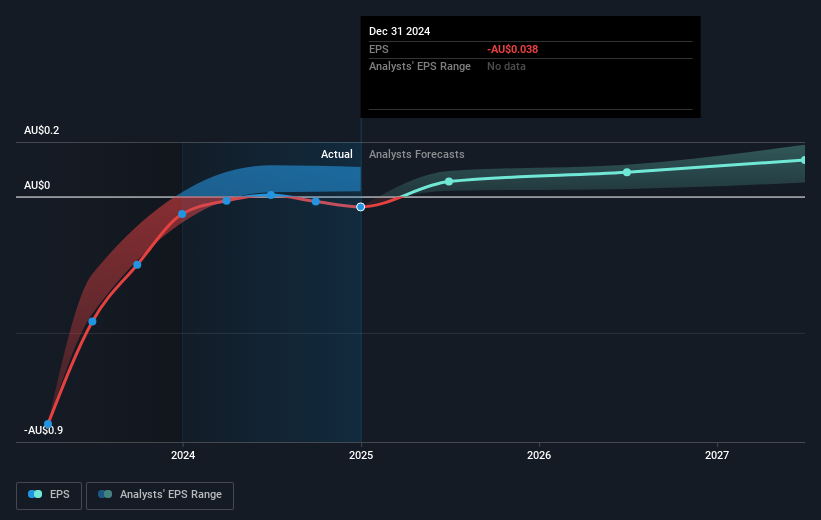

This optimistic outlook likely impacts revenue and earnings forecasts, as analysts project an annual revenue growth rate of 18.1% over the next few years. Forecasted profit margins are expected to turn from the current 4.6% decline to a positive 12.0% in three years. Such predictions hinge on the successful execution of strategic partnerships and product innovations, paving the way for A$187.9 million in future earnings. However, market conditions inherently carry risks that could impact these forecasts.

In the current context, the price movement positions Zip Co's shares significantly below the consensus analyst price target of A$3.33. Given today's share price of A$1.73, this suggests potential upside based on analyst projections. Overall, these elements reflect the complex interplay between market perceptions, company strategies, and financial forecasts that continually shape Zip Co's market valuation. As always, individual due diligence remains crucial for investors assessing the company's potential.

Learn about Zip Co's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zip Co, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance and payments solutions to consumers, and small and medium sized merchants (SMEs) in Australia, New Zealand, Canada, and the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives