- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

How Zip Co’s New Social Impact Partnership (ASX:ZIP) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this month, Zip Co Limited announced a new partnership with Opportunity Knocks to give its customers nationwide access to digital financial guidance tools and a national casting call where selected participants, including one Zip customer, could receive up to A$20,000 in targeted financial support.

- This collaboration broadens Zip’s social impact by connecting customers to resources for housing, job training, and legal aid, in line with growing industry trends towards personalized financial well-being solutions.

- We'll examine how this initiative to provide personalized financial guidance and targeted support might influence Zip Co's long-term investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Zip Co Investment Narrative Recap

To be a Zip Co shareholder, you have to believe in the ongoing expansion of digital payments and Zip’s ability to build lasting customer engagement through innovative financial solutions. While the new partnership with Opportunity Knocks extends Zip’s social footprint and aligns with industry trends around consumer well-being, it does not materially affect the short-term catalyst of international BNPL adoption or change the immediate risk of regulatory scrutiny in its core markets like Australia and the US.

Among Zip’s recent announcements, the integration with Google Pay in August stands out as highly relevant. This expansion increases Zip’s presence at US checkout and directly supports its main catalyst, higher transaction volumes through e-commerce partnerships. Each of these digital collaborations ties back to Zip’s broader strategy of scaling customer adoption globally.

However, against this backdrop of growth initiatives, investors should also be aware of the heightened risk that comes if...

Read the full narrative on Zip Co (it's free!)

Zip Co's narrative projects A$1.7 billion in revenue and A$216.9 million in earnings by 2028. This requires 17.4% yearly revenue growth and a A$137 million earnings increase from A$79.9 million today.

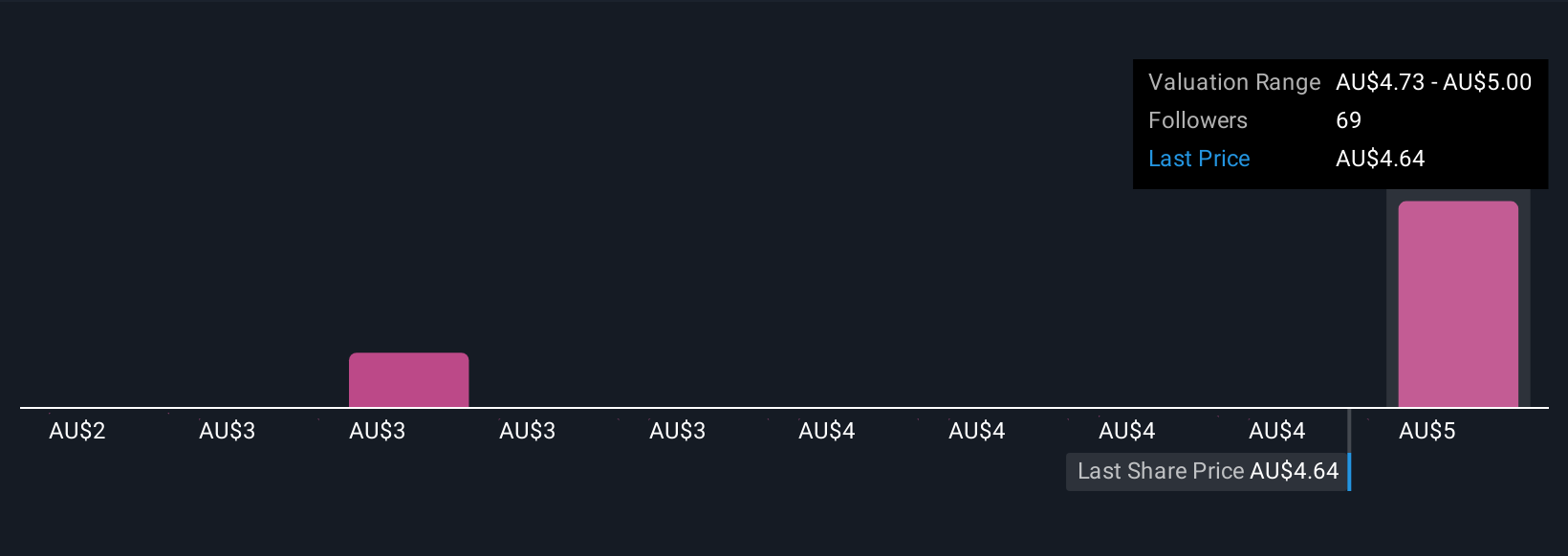

Uncover how Zip Co's forecasts yield a A$5.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community range from A$2.27 to A$5.00 per share. As many market participants debate Zip's outlook, regulatory scrutiny in key jurisdictions remains a key factor with the potential to influence future results, consider reviewing multiple viewpoints here.

Explore 7 other fair value estimates on Zip Co - why the stock might be worth less than half the current price!

Build Your Own Zip Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zip Co research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zip Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zip Co's overall financial health at a glance.

No Opportunity In Zip Co?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives