- Australia

- /

- Diversified Financial

- /

- ASX:SOL

WHSP (ASX:SOL) Valuation Spotlight: How Sales Growth and Lower Profits Shape the Investment Case

Reviewed by Kshitija Bhandaru

WHSP Holdings (ASX:SOL) just released its full-year earnings, revealing higher sales but a drop in net income and earnings per share. This mix of growth and lower profits is prompting fresh discussion among investors.

See our latest analysis for WHSP Holdings.

WHSP Holdings’ latest results come after a strong run earlier this year. However, recent weeks saw its share price drop over 13% in the past month as investors reacted to the earnings mix. Despite short-term volatility, the company’s total shareholder return stands at an impressive 15.6% for the past year and over 73% for the past five years. This reflects substantial long-term value creation even as near-term sentiment cools.

If you’re interested in broadening your search beyond the headlines, now’s an ideal moment to discover fast growing stocks with high insider ownership

With sales up but profits down and shares now trading just below analyst targets, the key question remains: is WHSP Holdings attractively undervalued at these levels, or is the market already factoring in future gains?

Most Popular Narrative: Fairly Valued

At A$38.73, the share price sits just under the narrative’s fair value of A$39.08, highlighting how close market perception and projected fundamentals are right now.

The market's high valuations and Soul Pattinson's deliberate strategy to prioritize investments in private assets over listed portfolios suggest a potential for lower returns from listed investments if they fail to capitalize on market momentum. This might impact revenue growth.

What is the secret behind this tight valuation? It is built upon detailed forecasts for profits and revenue, intriguing assumptions for future profit margins, and an earnings multiple that even major industry players rarely command. Want to know how bold these projections really are? Unpack the full story to understand exactly what drives this near parity with the current price.

Result: Fair Value of $39.08 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong cash flow generation and a resilient balance sheet could challenge this outlook. These factors may support continued dividends and offer potential upside for shareholders.

Find out about the key risks to this WHSP Holdings narrative.

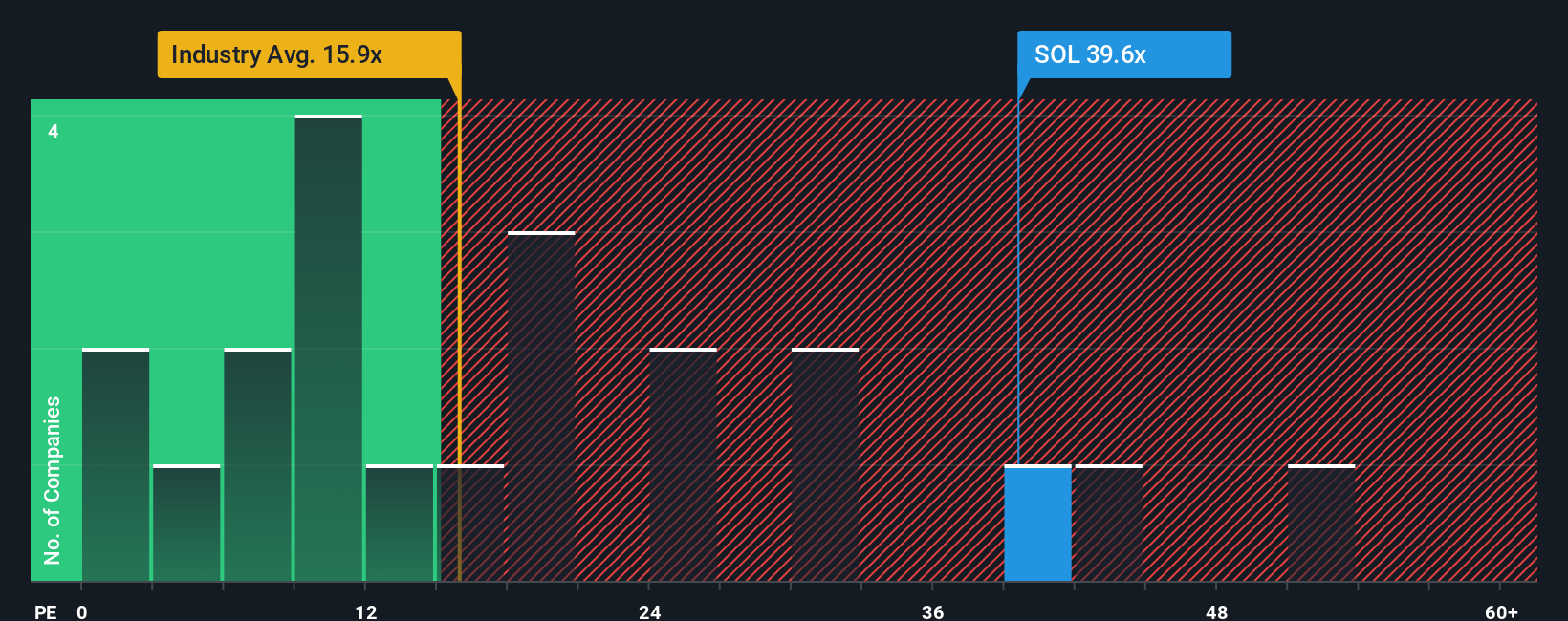

Another View: Focus on Price-to-Earnings

While the earlier fair value estimate puts WHSP Holdings almost in line with analyst expectations, looking at its price-to-earnings ratio tells a different story. The company trades at 40.4 times earnings, which is richly valued compared to both peers and the broader industry. Peers average 26.8x and the broader industry averages 16x. The fair ratio is estimated to be 18.2x. This significant difference suggests investors are paying a premium that may not be justified by fundamentals. Could this pricing signal heightened risk if growth fails to materialize, or are strong investor convictions set to be rewarded?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WHSP Holdings Narrative

If you feel a different story is emerging from the numbers, why not explore the data yourself and put together your own narrative in just a few minutes? Do it your way

A great starting point for your WHSP Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by while others seize the next wave. Use the powerful Simply Wall Street Screener to uncover hidden value and accelerate your stock-picking journey today.

- Unlock the potential of steady income streams and get ahead with these 19 dividend stocks with yields > 3%, which offers market-beating dividend yields.

- Tap into game-changing breakthroughs and follow these 26 quantum computing stocks, as it is poised to transform technology at lightning speed.

- Capture tomorrow’s success stories by targeting value opportunities using these 898 undervalued stocks based on cash flows, which is based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WHSP Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SOL

WHSP Holdings

An investment company, engages in investing various industries and asset classes in Australia.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives