- Australia

- /

- Diversified Financial

- /

- ASX:SOL

Here's Why Washington H. Soul Pattinson and Company Limited's (ASX:SOL) CEO Might See A Pay Rise Soon

Key Insights

- Washington H. Soul Pattinson's Annual General Meeting to take place on 22nd of November

- Total pay for CEO Todd Barlow includes AU$1.64m salary

- Total compensation is 35% below industry average

- Over the past three years, Washington H. Soul Pattinson's EPS grew by 9.0% and over the past three years, the total shareholder return was 20%

Shareholders will probably not be disappointed by the robust results at Washington H. Soul Pattinson and Company Limited (ASX:SOL) recently and they will be keeping this in mind as they go into the AGM on 22nd of November. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for Washington H. Soul Pattinson

Comparing Washington H. Soul Pattinson and Company Limited's CEO Compensation With The Industry

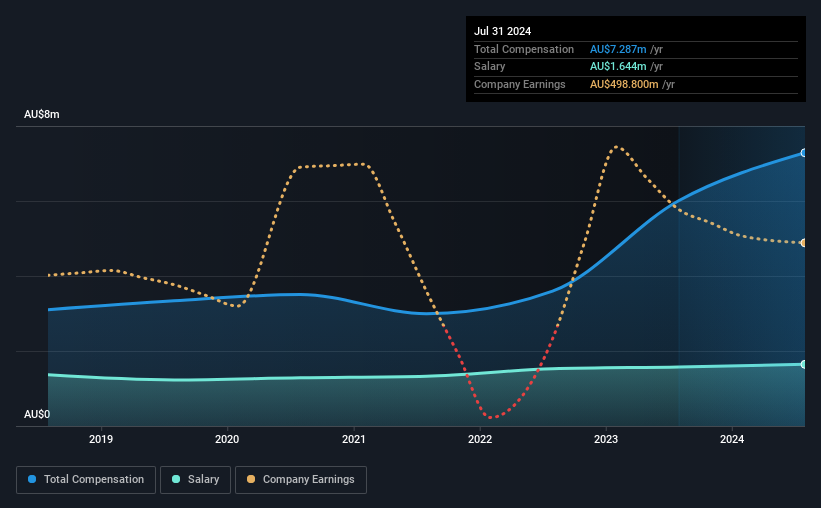

At the time of writing, our data shows that Washington H. Soul Pattinson and Company Limited has a market capitalization of AU$13b, and reported total annual CEO compensation of AU$7.3m for the year to July 2024. That's a notable increase of 21% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$1.6m.

On examining similar-sized companies in the Australian Diversified Financial industry with market capitalizations between AU$6.2b and AU$19b, we discovered that the median CEO total compensation of that group was AU$11m. Accordingly, Washington H. Soul Pattinson pays its CEO under the industry median. What's more, Todd Barlow holds AU$14m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$1.6m | AU$1.6m | 23% |

| Other | AU$5.6m | AU$4.4m | 77% |

| Total Compensation | AU$7.3m | AU$6.0m | 100% |

Speaking on an industry level, nearly 67% of total compensation represents salary, while the remainder of 33% is other remuneration. Washington H. Soul Pattinson sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Washington H. Soul Pattinson and Company Limited's Growth Numbers

Washington H. Soul Pattinson and Company Limited's earnings per share (EPS) grew 9.0% per year over the last three years. It saw its revenue drop 4.4% over the last year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Washington H. Soul Pattinson and Company Limited Been A Good Investment?

Washington H. Soul Pattinson and Company Limited has served shareholders reasonably well, with a total return of 20% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Washington H. Soul Pattinson you should be aware of, and 1 of them is a bit concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Washington H. Soul Pattinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SOL

Washington H. Soul Pattinson

An investment company, engages in investing various industries and asset classes in Australia.

Flawless balance sheet average dividend payer.