- Australia

- /

- Capital Markets

- /

- ASX:SNC

3 ASX Penny Stocks With Market Caps Under A$200M To Consider

Reviewed by Simply Wall St

The Australian stock market has seen mixed performance, with the ASX200 slightly down and sectors like Energy and Information Technology showing resilience amid a tight labor market. In such conditions, identifying promising investments can be challenging, but penny stocks—smaller or newer companies often overlooked—offer unique opportunities for growth when backed by robust financials. This article highlights three such penny stocks that stand out for their potential to deliver value and growth in today's economic landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.99 | A$324.01M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$234.64M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.715 | A$94.87M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.605 | A$786.58M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.92 | A$107.69M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.92 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,048 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Besra Gold (ASX:BEZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Besra Gold Inc. is a gold mining company focused on the exploration and development of gold properties in Malaysia, with a market cap of A$29.69 million.

Operations: There are no reported revenue segments for Besra Gold Inc.

Market Cap: A$29.69M

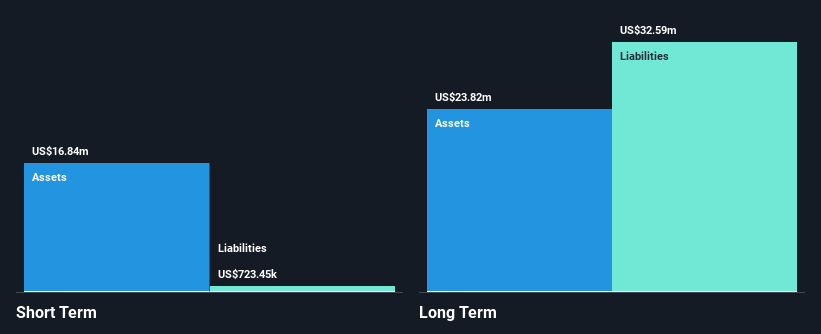

Besra Gold Inc., with a market cap of A$29.69 million, is pre-revenue and faces significant challenges despite having a cash runway for nearly two years. The company recently reported increased net losses, raising concerns about its financial health, especially as auditors have expressed doubts about its ability to continue as a going concern. Besra's management and board are relatively inexperienced, which could impact strategic decision-making. However, the planned drilling program at the Jugan Project represents potential future growth opportunities if successful. Legal proceedings in Canada add further complexity to its investment profile.

- Navigate through the intricacies of Besra Gold with our comprehensive balance sheet health report here.

- Gain insights into Besra Gold's past trends and performance with our report on the company's historical track record.

Salter Brothers Emerging Companies (ASX:SB2)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Salter Brothers Emerging Companies Limited is an investment company that focuses on a portfolio of investment opportunities in Australian listed and unlisted securities, with a market cap of A$69.98 million.

Operations: The company's revenue is derived entirely from its securities segment, amounting to A$7.99 million.

Market Cap: A$69.98M

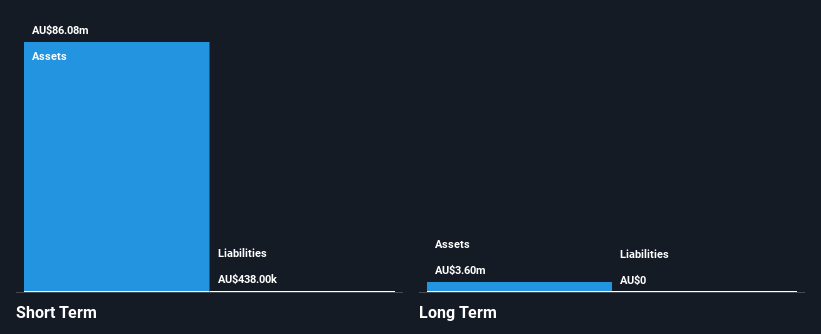

Salter Brothers Emerging Companies Limited, with a market cap of A$69.98 million, has recently become profitable and maintains a stable financial position with no long-term liabilities or debt. The company is advancing plans to list a hospitality vehicle by 2026, aiming to expand its hotel portfolio significantly. Its price-to-earnings ratio of 16.6x suggests it may be undervalued compared to the broader Australian market. Despite having low return on equity at 4.7%, Salter Brothers benefits from experienced board members and strong short-term asset coverage over liabilities, positioning it well for future growth initiatives in the hospitality sector.

- Click here to discover the nuances of Salter Brothers Emerging Companies with our detailed analytical financial health report.

- Assess Salter Brothers Emerging Companies' previous results with our detailed historical performance reports.

Sandon Capital Investments (ASX:SNC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sandon Capital Investments Limited is a publicly owned investment manager with a market cap of A$110.31 million.

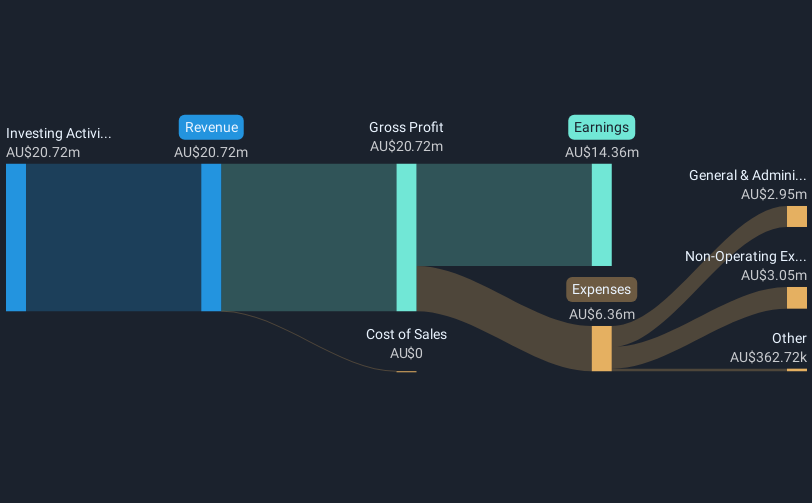

Operations: The company generates revenue primarily from its investing activities, amounting to A$20.72 million.

Market Cap: A$110.31M

Sandon Capital Investments, with a market cap of A$110.31 million, shows strong financial health with short-term assets of A$146.1 million exceeding both short-term and long-term liabilities. The company's earnings growth over the past year is very large at 657.1%, significantly outpacing the industry average, although shareholders have faced dilution with an increase in shares outstanding by 2.3%. Its net profit margins have improved to 69.3% from last year's 37.4%, and its debt is well covered by operating cash flow at 57.1%. Despite an unstable dividend track record, Sandon maintains high-quality earnings and experienced board oversight.

- Get an in-depth perspective on Sandon Capital Investments' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Sandon Capital Investments' track record.

Taking Advantage

- Take a closer look at our ASX Penny Stocks list of 1,048 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SNC

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives