- Australia

- /

- Metals and Mining

- /

- ASX:ADT

Adriatic Metals And Two Additional ASX Stocks Considered Below Estimated Market Value

Reviewed by Simply Wall St

The Australian stock market has shown a steady performance, rising 8.9% over the past year with a forecast for earnings to grow by 14% annually. In this context, identifying stocks that are considered below their estimated market value could offer potential opportunities for investors looking to capitalize on current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$0.485 | A$0.96 | 49.2% |

| COSOL (ASX:COS) | A$1.24 | A$2.43 | 49% |

| Charter Hall Group (ASX:CHC) | A$11.69 | A$22.35 | 47.7% |

| Count (ASX:CUP) | A$0.555 | A$1.10 | 49.7% |

| ReadyTech Holdings (ASX:RDY) | A$3.24 | A$5.97 | 45.7% |

| hipages Group Holdings (ASX:HPG) | A$1.08 | A$1.94 | 44.5% |

| Regal Partners (ASX:RPL) | A$3.21 | A$6.19 | 48.1% |

| IPH (ASX:IPH) | A$6.30 | A$11.40 | 44.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Treasury Wine Estates (ASX:TWE) | A$12.48 | A$21.87 | 42.9% |

Let's take a closer look at a couple of our picks from the screened companies

Adriatic Metals (ASX:ADT)

Overview: Adriatic Metals PLC operates in the exploration and development of precious and base metals, with a market capitalization of approximately A$1.28 billion.

Operations: The company focuses on the exploration and development of precious and base metals.

Estimated Discount To Fair Value: 29.4%

Adriatic Metals, currently priced at A$3.95, is considered undervalued with a fair value estimate of A$5.59 based on discounted cash flow analysis, reflecting a significant discount of 29.4%. Despite making less than US$1m in revenue, the company's future looks promising with expected annual revenue growth at 36.6% and profit forecasts indicating profitability within three years, significantly outpacing average market expectations. However, recent shareholder dilution and executive turnover could pose challenges to achieving these financial targets.

- In light of our recent growth report, it seems possible that Adriatic Metals' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Adriatic Metals stock in this financial health report.

Lotus Resources (ASX:LOT)

Overview: Lotus Resources Limited focuses on the exploration, evaluation, and development of uranium properties in Australia and Africa, with a market capitalization of approximately A$595.15 million.

Operations: The firm primarily generates its revenue from the exploration, evaluation, and development of uranium properties across Australia and Africa.

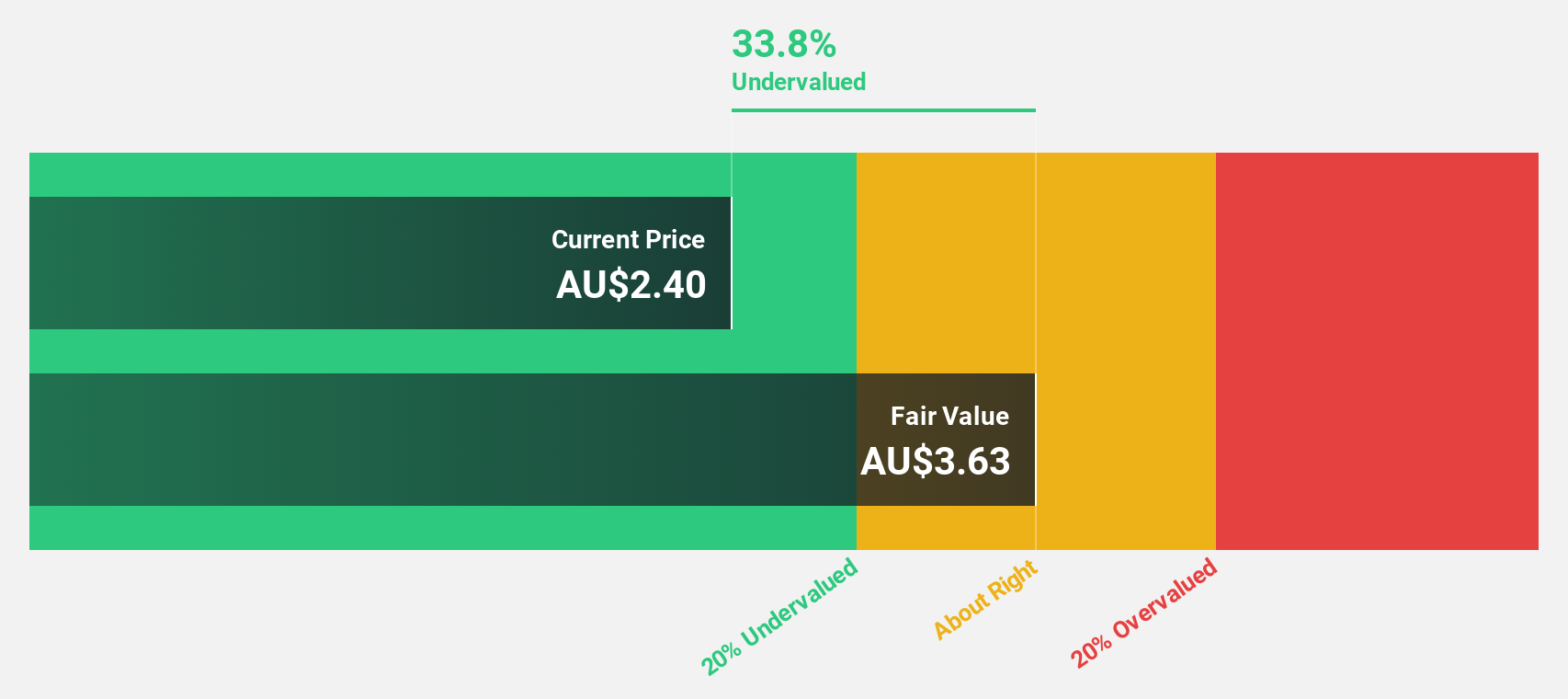

Estimated Discount To Fair Value: 26.8%

Lotus Resources, trading at A$0.33, is perceived as undervalued with a fair value estimate of A$0.44, marking a substantial discount. Despite minimal current revenue (A$102K), the company is poised for significant financial improvements, with profitability expected within three years and an anticipated return on equity forecast to be very high. However, challenges such as recent shareholder dilution and no projected revenue next year could impact growth prospects.

- Our growth report here indicates Lotus Resources may be poised for an improving outlook.

- Dive into the specifics of Lotus Resources here with our thorough financial health report.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited, operating as a privately owned hedge fund sponsor, has a market capitalization of approximately A$818.05 million.

Operations: The company generates revenue primarily through the provision of investment management services, totaling approximately A$105.28 million.

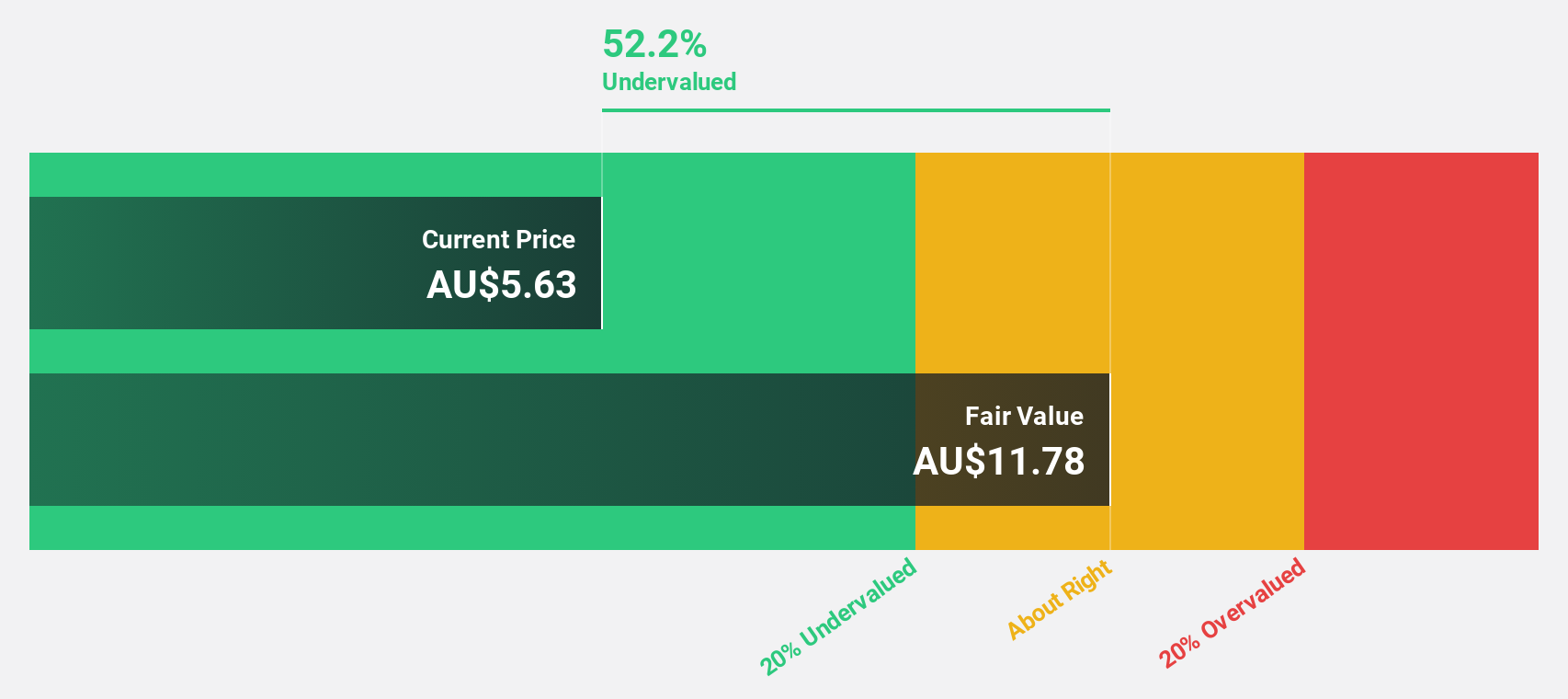

Estimated Discount To Fair Value: 48.1%

Regal Partners Limited, currently priced at A$3.21, is significantly undervalued with an estimated fair value of A$6.19. Analysts forecast a potential price increase of 43%, supported by expected annual earnings growth of 32.93% and revenue growth outpacing the Australian market at 21.6% per year. Recent strategic moves include seeking acquisitions to enhance scale and expertise, alongside auditor changes to KPMG for fresh insights. However, its current dividend coverage by earnings and cash flows is weak, and profit margins have declined from the previous year.

- According our earnings growth report, there's an indication that Regal Partners might be ready to expand.

- Get an in-depth perspective on Regal Partners' balance sheet by reading our health report here.

Where To Now?

- Explore the 47 names from our Undervalued ASX Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ADT

Adriatic Metals

Through its subsidiaries, engages in the exploration and development of precious and base metals.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives