- Australia

- /

- Metals and Mining

- /

- ASX:SFR

ASX Value Stocks Trading Below Estimated Worth In August 2025

Reviewed by Simply Wall St

As the Australian market faces a mixed outlook with futures looking red on the last day of earnings, investors are keenly watching how local stocks might react to the recent surge in U.S. indices, driven by robust economic growth. In such a climate, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst fluctuating market conditions, as these stocks may offer potential value when trading below their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trajan Group Holdings (ASX:TRJ) | A$0.92 | A$1.72 | 46.6% |

| Resimac Group (ASX:RMC) | A$1.04 | A$1.99 | 47.7% |

| PointsBet Holdings (ASX:PBH) | A$1.26 | A$2.05 | 38.5% |

| Kogan.com (ASX:KGN) | A$4.03 | A$7.77 | 48.1% |

| Kinatico (ASX:KYP) | A$0.275 | A$0.46 | 39.9% |

| Elders (ASX:ELD) | A$7.44 | A$14.04 | 47% |

| Credit Clear (ASX:CCR) | A$0.245 | A$0.47 | 47.8% |

| Collins Foods (ASX:CKF) | A$9.72 | A$16.15 | 39.8% |

| Advanced Braking Technology (ASX:ABV) | A$0.10 | A$0.16 | 38.8% |

| Adore Beauty Group (ASX:ABY) | A$1.03 | A$1.61 | 36.2% |

Here's a peek at a few of the choices from the screener.

Resimac Group (ASX:RMC)

Overview: Resimac Group Limited operates in Australia and New Zealand, offering residential mortgage and asset finance lending products, with a market cap of A$411.56 million.

Operations: The company's revenue segments consist of Home Loan Lending at A$132.63 million, New Zealand Lending at A$3.03 million, and Asset Finance Lending at A$27.93 million.

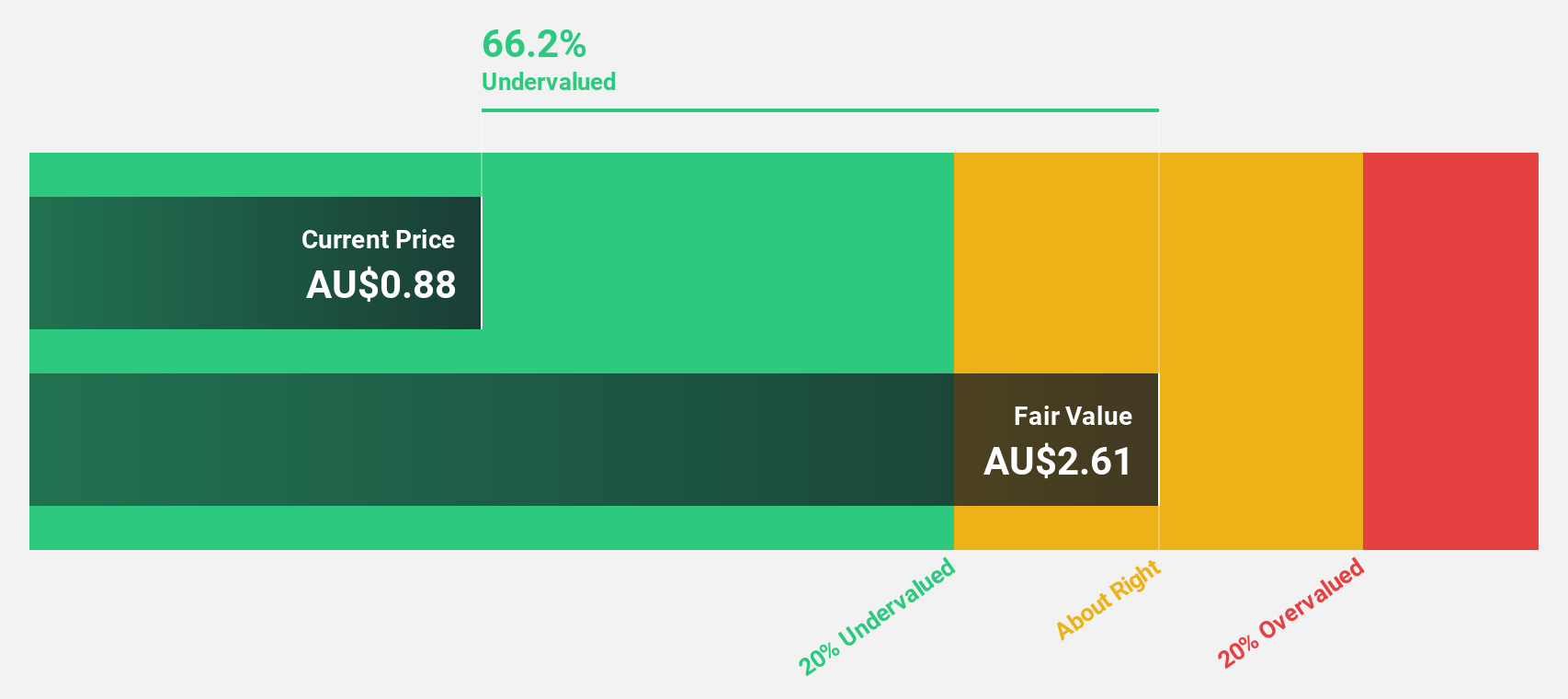

Estimated Discount To Fair Value: 47.7%

Resimac Group is trading at A$1.04, significantly below its estimated fair value of A$1.99, indicating potential undervaluation based on discounted cash flow analysis. Despite a dividend yield of 6.73% not being well-covered by earnings or free cash flows, the company shows strong revenue growth forecasts at 60.5% per year, outpacing the market's 5.4%. Recent buybacks and stable net income further support its financial position amidst modest earnings growth projections.

- The growth report we've compiled suggests that Resimac Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Resimac Group stock in this financial health report.

Sandfire Resources (ASX:SFR)

Overview: Sandfire Resources Limited is a mining company focused on exploring, evaluating, and developing mineral tenements and projects, with a market cap of A$5.75 billion.

Operations: The company's revenue is primarily derived from the MATSA Copper Operations at $636.69 million and the Motheo Copper Project at $528.47 million, with a minor negative contribution from Degrussa Copper Operations at -$0.39 million.

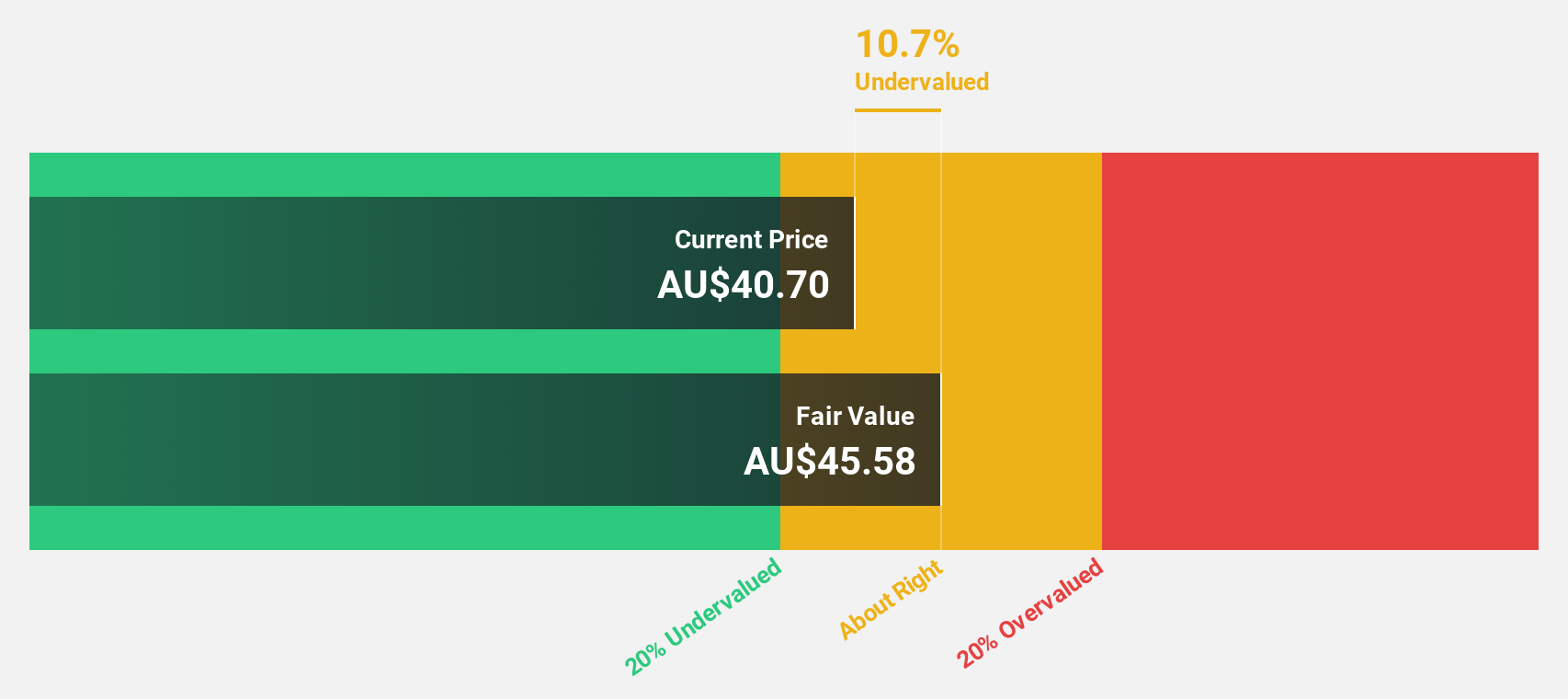

Estimated Discount To Fair Value: 14.8%

Sandfire Resources is trading at A$12.52, below its fair value estimate of A$14.69, suggesting potential undervaluation based on cash flows. The company reported a strong turnaround with net income of US$93.25 million for the year ending June 2025, up from a loss last year, alongside revenue growth to US$1.18 billion from US$935 million. Earnings are forecast to grow significantly at 25% annually over the next three years, outpacing market expectations despite low projected return on equity.

- Our earnings growth report unveils the potential for significant increases in Sandfire Resources' future results.

- Dive into the specifics of Sandfire Resources here with our thorough financial health report.

Technology One (ASX:TNE)

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$13.08 billion.

Operations: Technology One's revenue segments consist of Software generating A$378.25 million, Corporate contributing A$90.55 million, and Consulting adding A$82.87 million.

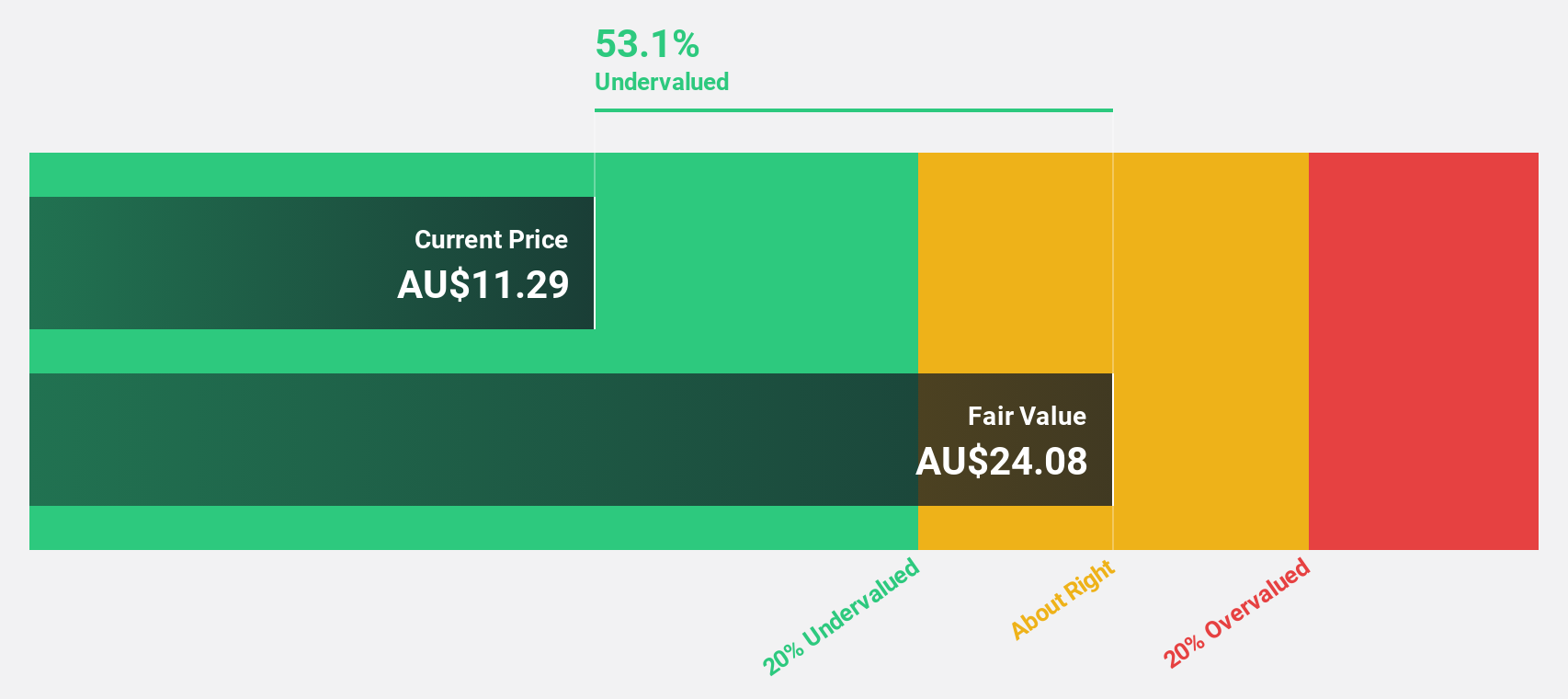

Estimated Discount To Fair Value: 25%

Technology One is trading at A$39.97, below its fair value estimate of A$53.31, highlighting potential undervaluation based on cash flows. The company forecasts revenue growth of 13.2% annually, outpacing the broader Australian market's 5.3%. Although earnings are expected to grow at 16.7% per year—faster than the market average—they remain under the significant growth threshold of 20%. Recent executive changes could enhance governance and strategic direction.

- Insights from our recent growth report point to a promising forecast for Technology One's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Technology One.

Taking Advantage

- Get an in-depth perspective on all 28 Undervalued ASX Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SFR

Sandfire Resources

A mining company, explores for, evaluates, and develops mineral tenements and projects.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives